Paysafe Results Presentation Deck

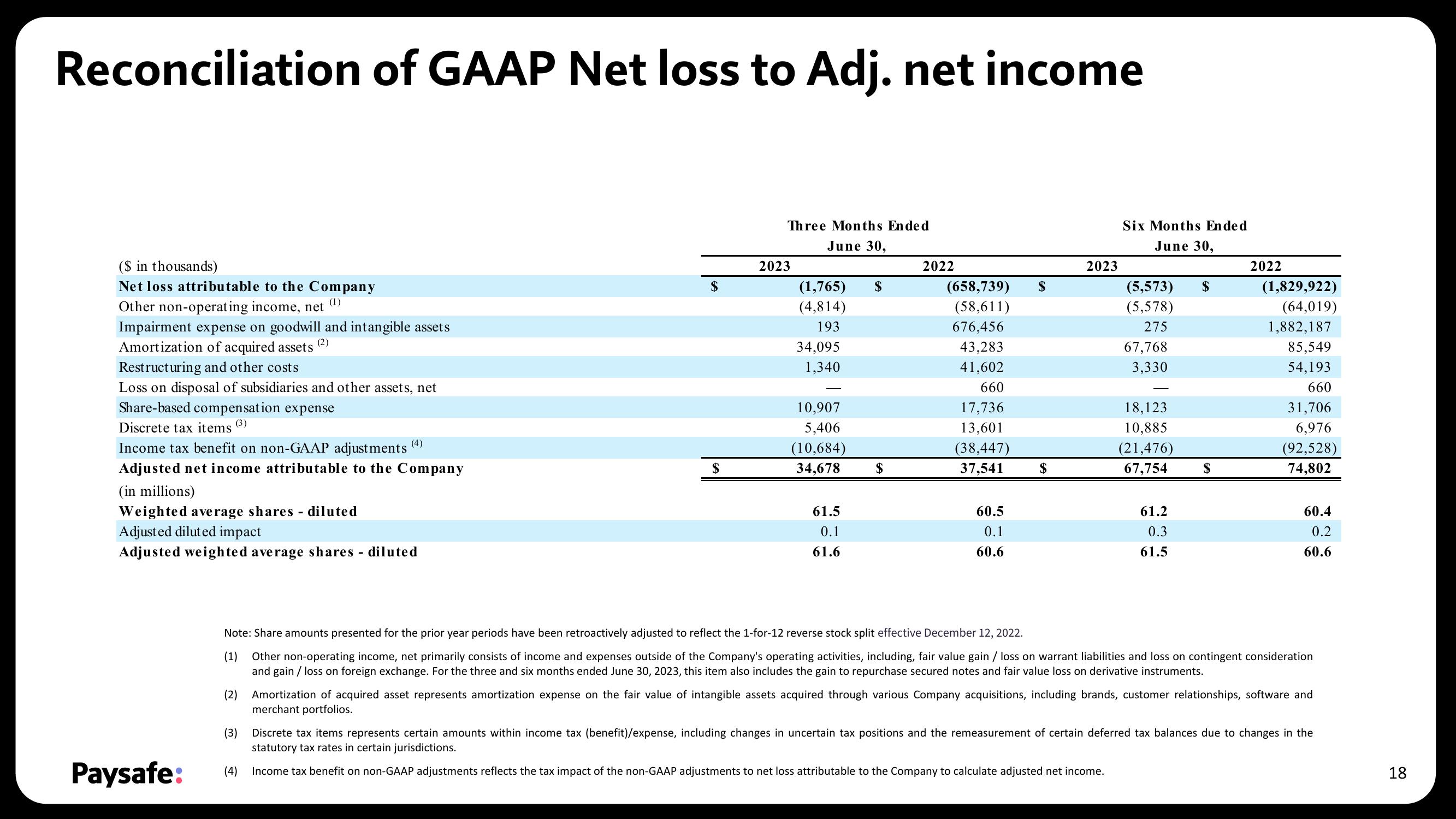

Reconciliation of GAAP Net loss to Adj. net income

($ in thousands)

Net loss attributable to the Company

Other non-operating income, net

(1)

Impairment expense on goodwill and intangible assets

(2)

Amortization of acquired assets

Restructuring and other costs

Loss on disposal of subsidiaries and other assets, net

Share-based compensation expense

Discrete tax items (3)

Income tax benefit on non-GAAP adjustments

Adjusted net income attributable to the Company

(in millions)

Weighted average shares - diluted

Adjusted diluted impact

Adjusted weighted average shares - diluted

Paysafe:

(2)

(4)

(3)

(4)

$

Three Months Ended

June 30,

2023

(1,765)

(4,814)

193

34,095

1,340

10,907

5,406

(10,684)

34,678

61.5

0.1

61.6

$

$

2022

(658,739)

(58,611)

676,456

43,283

41,602

660

17,736

13,601

(38,447)

37,541

60.5

0.1

60.6

$

$

2023

Six Months Ended

June 30,

(5,573)

(5,578)

275

67,768

3,330

18,123

10,885

(21,476)

67,754

61.2

0.3

61.5

$

$

2022

Note: Share amounts presented for the prior year periods have been retroactively adjusted to reflect the 1-for-12 reverse stock split effective December 12, 2022.

(1) Other non-operating income, net primarily consists of income and expenses outside of the Company's operating activities, including, fair value gain / loss on warrant liabilities and loss on contingent consideration

and gain / loss on foreign exchange. For the three and six months ended June 30, 2023, this item also includes the gain to repurchase secured notes and fair value loss on derivative instruments.

(1,829,922)

(64,019)

1,882,187

85,549

54,193

660

31,706

6,976

(92,528)

74,802

60.4

0.2

60.6

Amortization of acquired asset represents amortization expense on the fair value of intangible assets acquired through various Company acquisitions, including brands, customer relationships, software and

merchant portfolios.

Discrete tax items represents certain amounts within income tax (benefit)/expense, including changes in uncertain tax positions and the remeasurement of certain deferred tax balances due to changes in the

statutory tax rates in certain jurisdictions.

Income tax benefit on non-GAAP adjustments reflects the tax impact of the non-GAAP adjustments to net loss attributable to the Company to calculate adjusted net income.

18View entire presentation