Bank of America Investment Banking Pitch Book

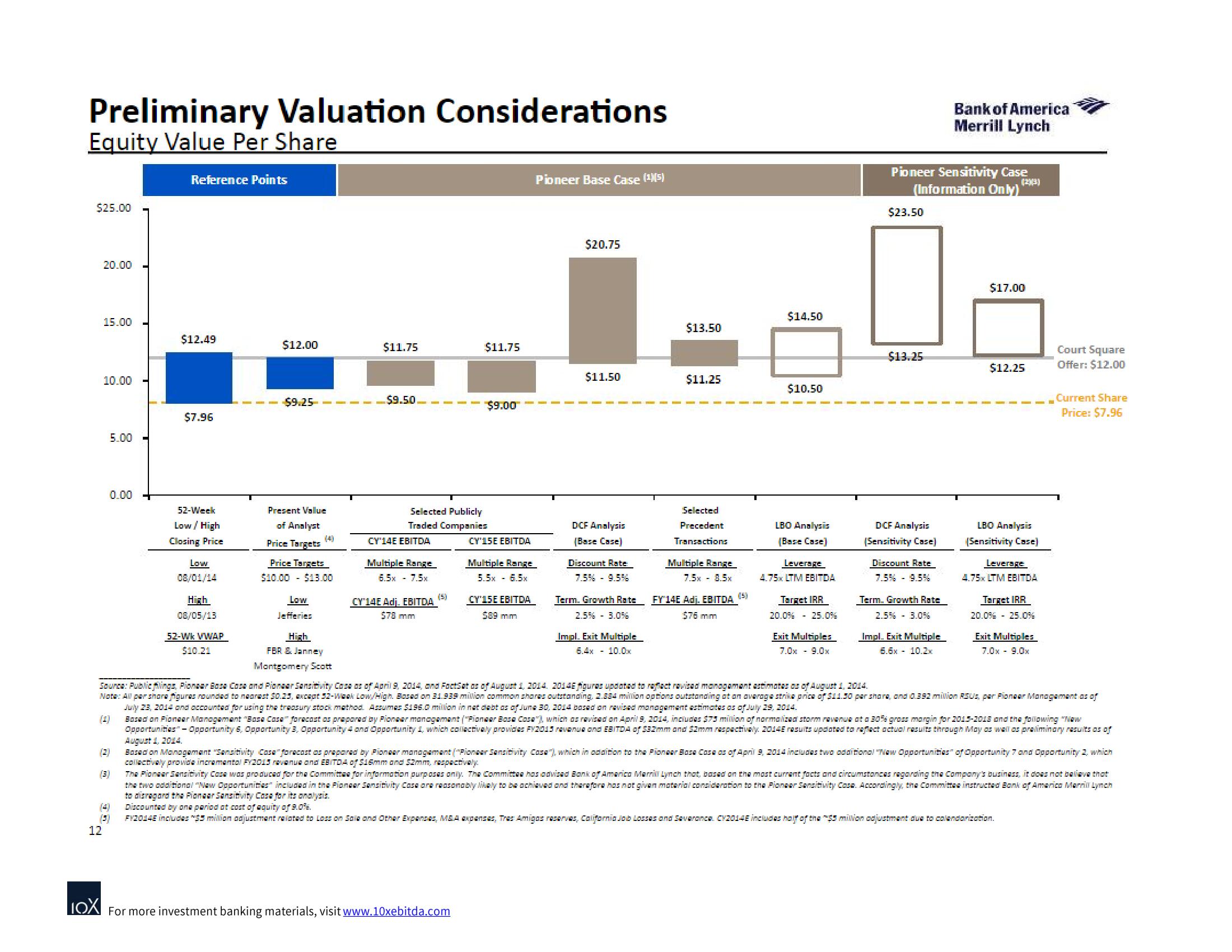

Preliminary Valuation Considerations

Equity Value Per Share

$25.00

20.00

15.00

10.00

5.00

12

0.00

(2)

(3)

(5)

[

T

T

Reference Points

$12.49

$7.96

52-Week

Low / High

Closing Price

Low

08/01/14

High

08/05/13

52-Wk VWAP

$12.00

$10.21

$9.25-

Present Value

of Analyst

Price Targets

Price Targets

$10.00 $13.00

Low

Jefferies

$11.75

$9.50

CY'14E EBITDA

Selected Publicly

Traded Companies

Multiple Range

E5x - 75x

CY'14E Adj. EBITDA

578 mm

$11.75

$9.00

CY'15E EBITDA

Multiple Range

E5x - E5x

IOX For more investment banking materials, visit www.10xebitda.com

CY'15E EBITDA

$89 mm

Pioneer Base Case (¹5)

$20.75

$11.50

DCF Analysis

(Base Case)

Discount Rate

7.5% - 9.5%

$13.50

$11.25

Impl. Exit Multiple

6.4x - 10.0x

Selected

Precedent

Transactions

Multiple Range

JEx - BEx

Term. Growth Rate FY 14E Adī. EBITDA

2.5% - 3.056

$76 mm

(5)

$14.50

$10.50

LBO Analysis

[Base Case]

Leverage

4.75x LTM EBITDA

Target IRR

20.0% 25.0%

Exit Multiples

7.0x 9.0x

Pioneer Sensitivity Case

(Information Only)

(23)

$23.50

$13.25

DCF Analysis

[Sensitivity Case)

Discount Rate

7.5% - 9.5%

Term. Growth Rate

2.5% - 3.0%

High

FBR & Janney

Montgomery Scott

Source: Publicfilings, Pioneer Base Case and Pioneer Sensitivity Case as of April 9, 2014, and FactSet as of August 1, 2014. 20146 figuras updated to reflect revised management estimates as of August 1, 2014.

Note: All pershore figures rounded to nearest $0.25, except 52-Wask Low/High. Based on 31.935 million common shares outstanding, 2.584 million options outstanding at an average strive price of $11.30 per share, and 0.352 million RSUS, per Pioneer Management as of

July 23, 2014 and accounted for using the treasury stock method. Assumes $196.0 million in net diebt as of June 30, 2014 based on revised management estimates as of July 29, 2014.

(4)

Bank of America

Merrill Lynch

Impl. Exit Multiple

6.6x - 10.2x

$17.00

$12.25

LBO Analysis

[Sensitivity Case)

Leverage

4.75x LTM EBITDA

Target IRR

20.0% 25.0%

Exit Multiples

7.0x 9.0x

Court Square

Offer: $12.00

Current Share

Price: $7.96

Based on Pioneer Management "Base Case" forecast as prepared by Pioneer management ("Pioneer Bose Cose"), which as revised on April 9, 2014, includes $73 million of normalized storm revenue at a 30% grass margin for 2015-2018 and the following "New

Opportunities - Opportunity 6, Opportunity 3, Opportunity and Opportunity I, which collectively provides FY2013 revenue and EBITDA of $32mm and $2mm respectively 20145 results updated to reflect actual results through May as well as preliminary results as of

August 1, 2014.

Basad on Management Sensitivity Case forecast as prepared by Pioneer management ("Pioneer Sensitivity Casa"), which in addition to the Pioneer Bose Cosa as of April 9, 2014 includes two additional "New Opportunities of Opportunity 7 and Opportunity 2, which

collectively provide incremental FY2013 revanua and EBITDA of $15mm and 52mm, respectively

The Pioneer Sensitivity Cose was produced for the Committee for information purposes only. The Committee has advised Bank of America Marrill Lynch that, based on the most current facts and circumstances regarding the Company's business, it does not believe that

the two additional "New Opportunities included in the Pioneer Sensitivity Casa are reasonably likely to be achieved and therefore has not given material consideration to the Pioneer Sensitivity Cose. Accordingly, the Committee instructed Bank of America Marrill Lynch

to disregard the Pioneer Sensitivity Case for its analysis.

Discounted by one period at cost of aquity of 9.0%.

FY20148 includes "$5 million adjustment related to Loss on Sale and Other Expenses, M&A expenses, Tres Amigas reserves, California Job Losses and Severonce. CY2014E includes half of the "$3 million adjustment due to calendarization.View entire presentation