J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

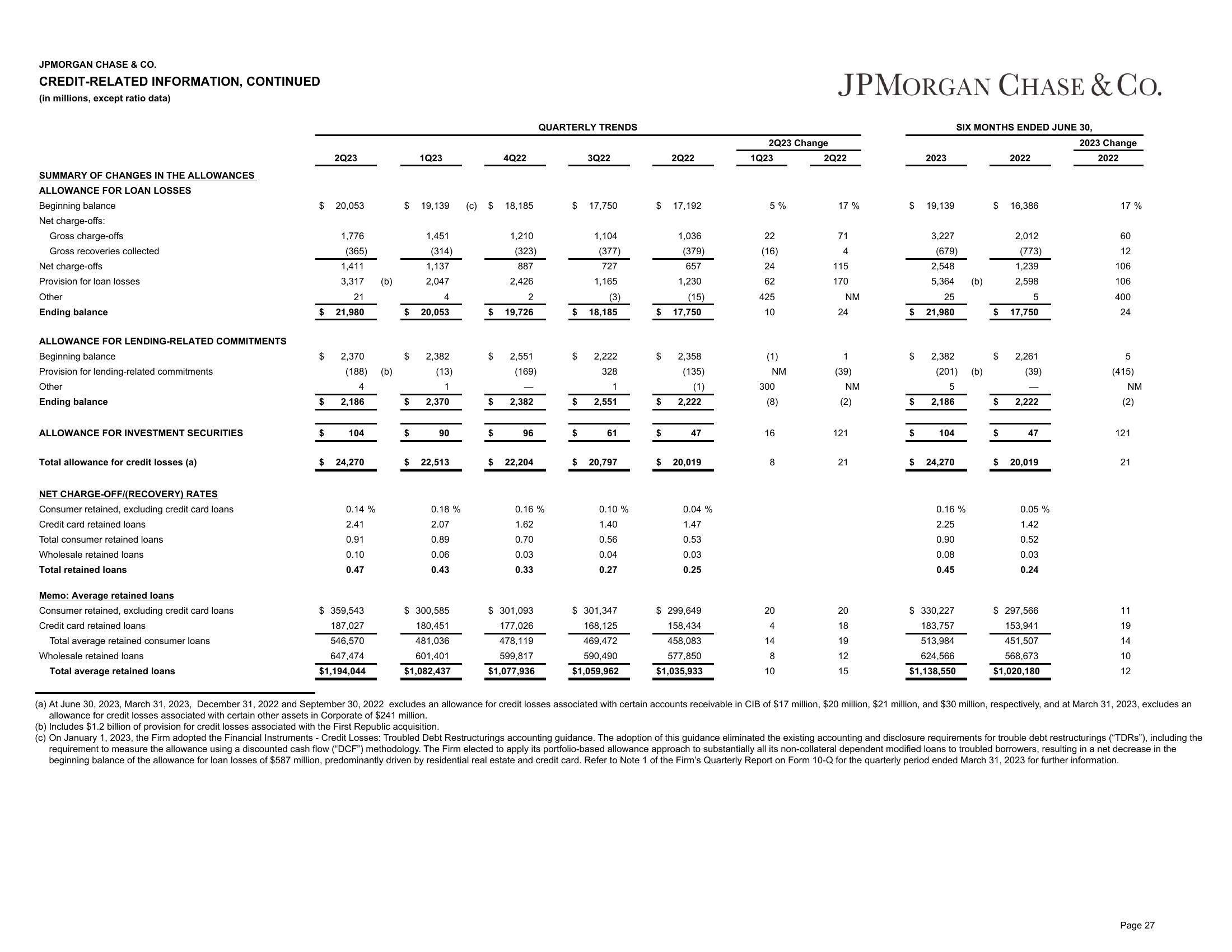

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

SUMMARY OF CHANGES IN THE ALLOWANCES

ALLOWANCE FOR LOAN LOSSES

Beginning balance

Net charge-offs:

Gross charge-offs

Gross recoveries collected

Net charge-offs

Provision for loan losses

Other

Ending balance

ALLOWANCE FOR LENDING-RELATED COMMITMENTS

Beginning balance

Provision for lending-related commitments

Other

Ending balance

ALLOWANCE FOR INVESTMENT SECURITIES

Total allowance for credit losses (a)

NET CHARGE-OFF/(RECOVERY) RATES

Consumer retained, excluding credit card loans

Credit card retained loans

Total consumer retained loans

Wholesale retained loans

Total retained loans

Memo: Average retained loans

Consumer retained, excluding credit card loans

Credit card retained loans

Total average retained consumer loans

Wholesale retained loans

Total average retained loans

$ 20,053

$

$

$

2Q23

$

1,776

(365)

1,411

3,317 (b)

21

21,980

2,370

(188) (b)

4

2,186

104

$ 24,270

0.14%

2.41

0.91

0.10

0.47

$ 359,543

187,027

546,570

647,474

$1,194,044

$

$

$

$

$

1Q23

19,139 (c) $

1,451

(314)

1,137

2,047

4

20,053

2,382

(13)

1

2,370

90

$ 22,513

0.18%

2.07

0.89

0.06

0.43

$ 300,585

180,451

481,036

601,401

$1,082,437

$

$

$

$

4Q22

18,185

1,210

(323)

887

2,426

2

19,726

2,551

(169)

2,382

96

$ 22,204

QUARTERLY TRENDS

0.16%

1.62

0.70

0.03

0.33

$ 301,093

177,026

478,119

599,817

$1,077,936

$ 17,750

$

$

$

$

3Q22

$

1,104

(377)

727

1,165

(3)

18,185

2,222

328

1

2,551

61

20,797

0.10 %

1.40

0.56

0.04

0.27

$ 301,347

168,125

469,472

590,490

$1,059,962

$

$

2Q22

$

17,192

1,036

(15)

$ 17,750

(379)

657

1,230

2,358

(135)

(1)

2,222

47

$ 20,019

0.04%

1.47

0.53

0.03

0.25

$ 299,649

158,434

458,083

577,850

$1,035,933

2Q23 Change

1Q23

5%

22

(16)

24

62

425

10

(1)

NM

300

(8)

16

8

20

4

14

8

10

JPMORGAN CHASE & Co.

2Q22

17 %

71

4

115

170

NM

24

1

(39)

NM

(2)

121

21

20

18

19

12

15

$

2023

$

19,139

3,227

(679)

2,548

5,364

25

$ 21,980

$

$ 2,382

(201)

5

2,186

104

SIX MONTHS ENDED JUNE 30,

$ 24,270

0.16%

2.25

0.90

0.08

0.45

$ 330,227

183,757

513,984

624,566

$1,138,550

(b)

(b)

$

$

$

$

$

$

2022

16,386

2,012

(773)

1,239

2,598

5

17,750

2,261

(39)

2,222

47

20,019

0.05%

1.42

0.52

0.03

0.24

$ 297,566

153,941

451,507

568,673

$1,020,180

2023 Change

2022

17%

60

12

106

106

400

24

5

(415)

NM

(2)

121

21

11

19

14

10

12

(a) At June 30, 2023, March 31, 2023, December 31, 2022 and September 30, 2022 excludes an allowance for credit losses associated with certain accounts receivable in CIB of $17 million, $20 million, $21 million, and $30 million, respectively, and at March 31, 2023, excludes an

allowance for credit losses associated with certain other assets in Corporate of $241 million.

(b) Includes $1.2 billion of provision for credit losses associated with the First Republic acquisition.

(c) On January 1, 2023, the Firm adopted the Financial Instruments - Credit Losses: Troubled Debt Restructurings accounting guidance. The adoption of this guidance eliminated the existing accounting and disclosure requirements for trouble debt restructurings ("TDRs"), including the

requirement to measure the allowance using a discounted cash flow ("DCF") methodology. The Firm elected to apply its portfolio-based allowance approach to substantially all its non-collateral dependent modified loans to troubled borrowers, resulting in a net decrease in the

beginning balance of the allowance for loan losses of $587 million, predominantly driven by residential real estate and credit card. Refer to Note 1 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 for further information.

Page 27View entire presentation