PJT Partners Investment Banking Pitch Book

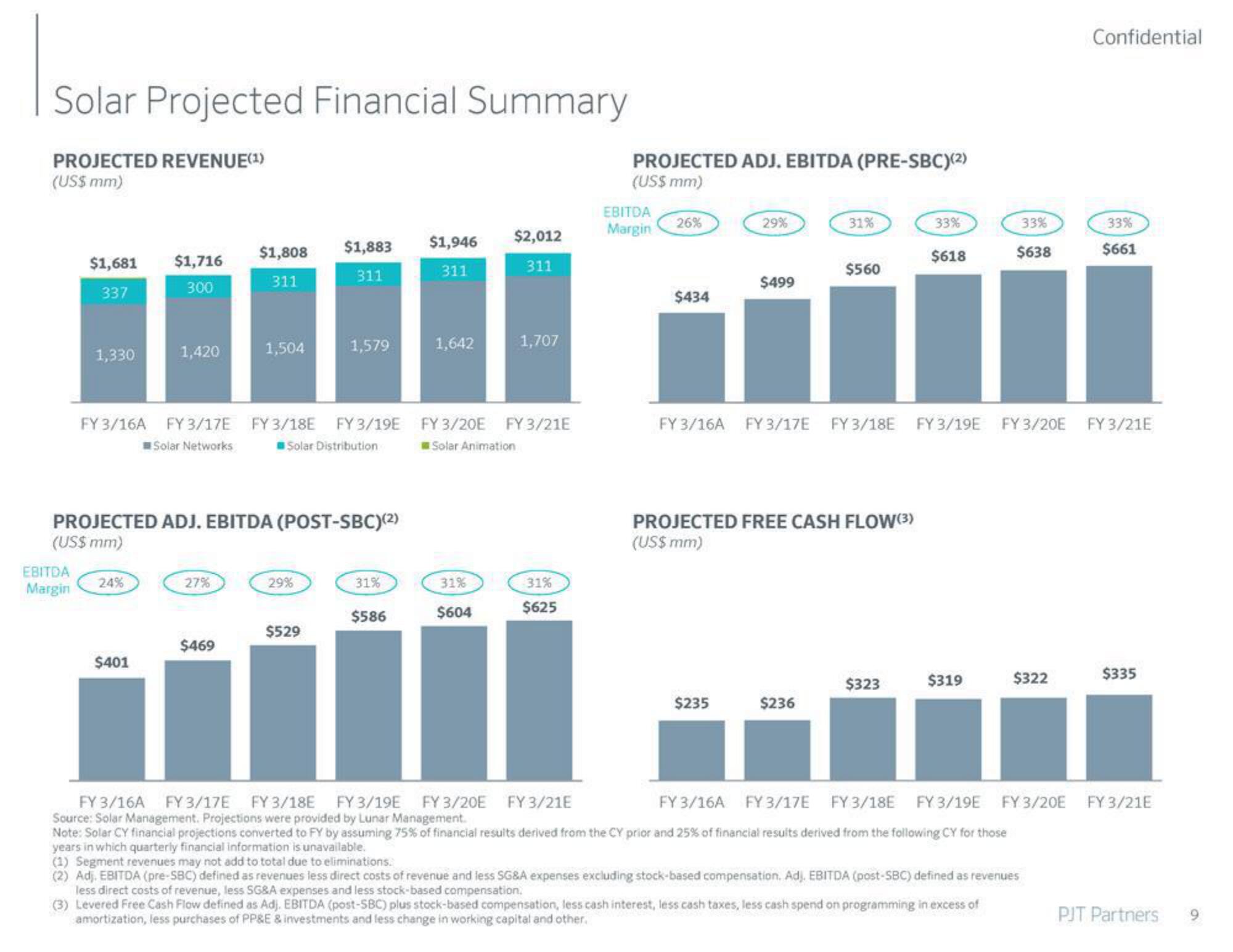

Solar Projected Financial Summary

PROJECTED REVENUE(¹)

(US$ mm)

$1,681

337

EBITDA

Margin

1,330

$1,716

300

24%

1,420

$401

FY 3/16A FY 3/17E FY 3/18E FY 3/19E

Solar Networks

Solar Distribution

PROJECTED ADJ. EBITDA (POST-SBC)(²)

(US$ mm)

$1,808 $1,883

311

311

27%

1,504

$469

1,579

29%

$529

31%

$586

$1,946

311

1,642

$2,012

311

31%

$604

1,707

FY 3/20E FY 3/21E

Solar Animation

31%

$625

PROJECTED ADJ. EBITDA (PRE-SBC)(2)

(US$ mm)

EBITDA

Margin

26%

$434

29%

$499

$235

31%

$560

PROJECTED FREE CASH FLOW(3)

(US$ mm)

$236

33%

$323

$618

FY 3/16A FY 3/17E FY 3/18E FY 3/19E FY 3/20E FY 3/21E

33%

$638

$319

$322

Confidential

FY 3/16A FY 3/17E FY 3/18E FY 3/19E

FY 3/16A FY 3/17E FY 3/18E FY 3/19E FY 3/20E FY 3/21E

Source: Solar Management. Projections were provided by Lunar Management.

Note: Solar CY financial projections converted to FY by assuming 75% of financial results derived from the CY prior and 25% of financial results derived from the following CY for those

years in which quarterly financial information is unavailable.

(1) Segment revenues may not add to total due to eliminations.

(2) Adj. EBITDA (pre-SBC) defined as revenues less direct costs of revenue and less SG&A expenses excluding stock-based compensation. Adj. EBITDA (post-SBC) defined as revenues

less direct costs of revenue, less SG&A expenses and less stock-based compensation.

(3) Levered Free Cash Flow defined as Adj. EBITDA (post-SBC) plus stock-based compensation, less cash interest, less cash taxes, less cash spend on programming in excess of

amortization, less purchases of PP&E & investments and less change in working capital and other.

33%

$661

$335

FY 3/20E FY 3/21E

PJT PartnersView entire presentation