flyExclusive SPAC Presentation Deck

REVENUE AND ADJUSTED EBITDA SUMMARY

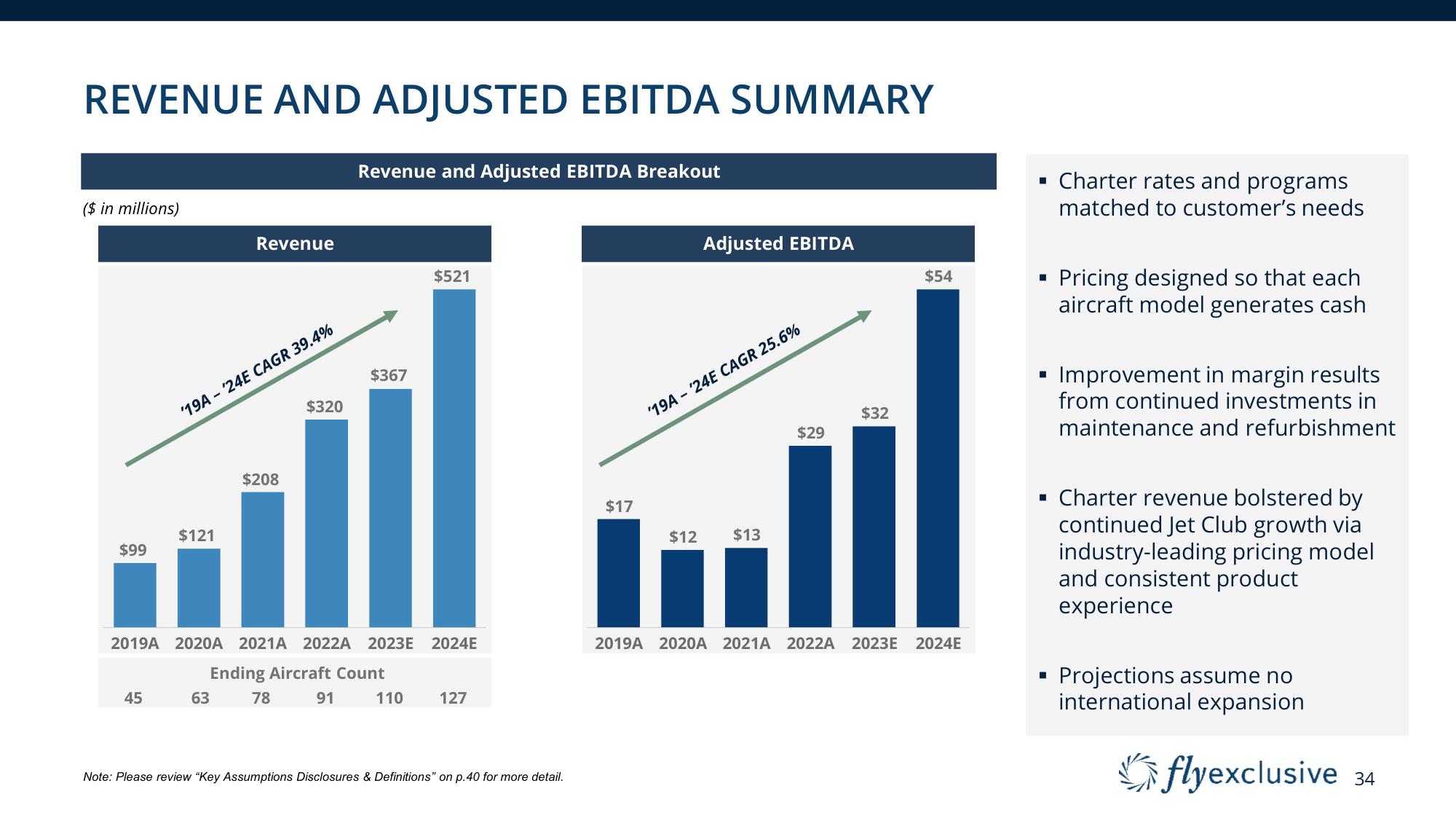

($ in millions)

$99

45

$121

Revenue

'19A - '24E CAGR 39.4%

$320

$208

63

Revenue and Adjusted EBITDA Breakout

$367

2019A 2020A 2021A 2022A 2023E 2024E

Ending Aircraft Count

78

91

$521

110 127

Note: Please review "Key Assumptions Disclosures & Definitions" on p.40 for more detail.

$17

Adjusted EBITDA

'19A - '24E CAGR 25.6%

$12 $13

$29

$32

$54

2019A 2020A 2021A 2022A 2023E 2024E

▪ Charter rates and programs

matched to customer's needs

■

■

■

■

Pricing designed so that each

aircraft model generates cash

Improvement in margin results

from continued investments in

maintenance and refurbishment

Charter revenue bolstered by

continued Jet Club growth via

industry-leading pricing model

and consistent product

experience

Projections assume no

international expansion

flyexclusive 34View entire presentation