J.P.Morgan Investment Banking

VALUATION SUMMARY

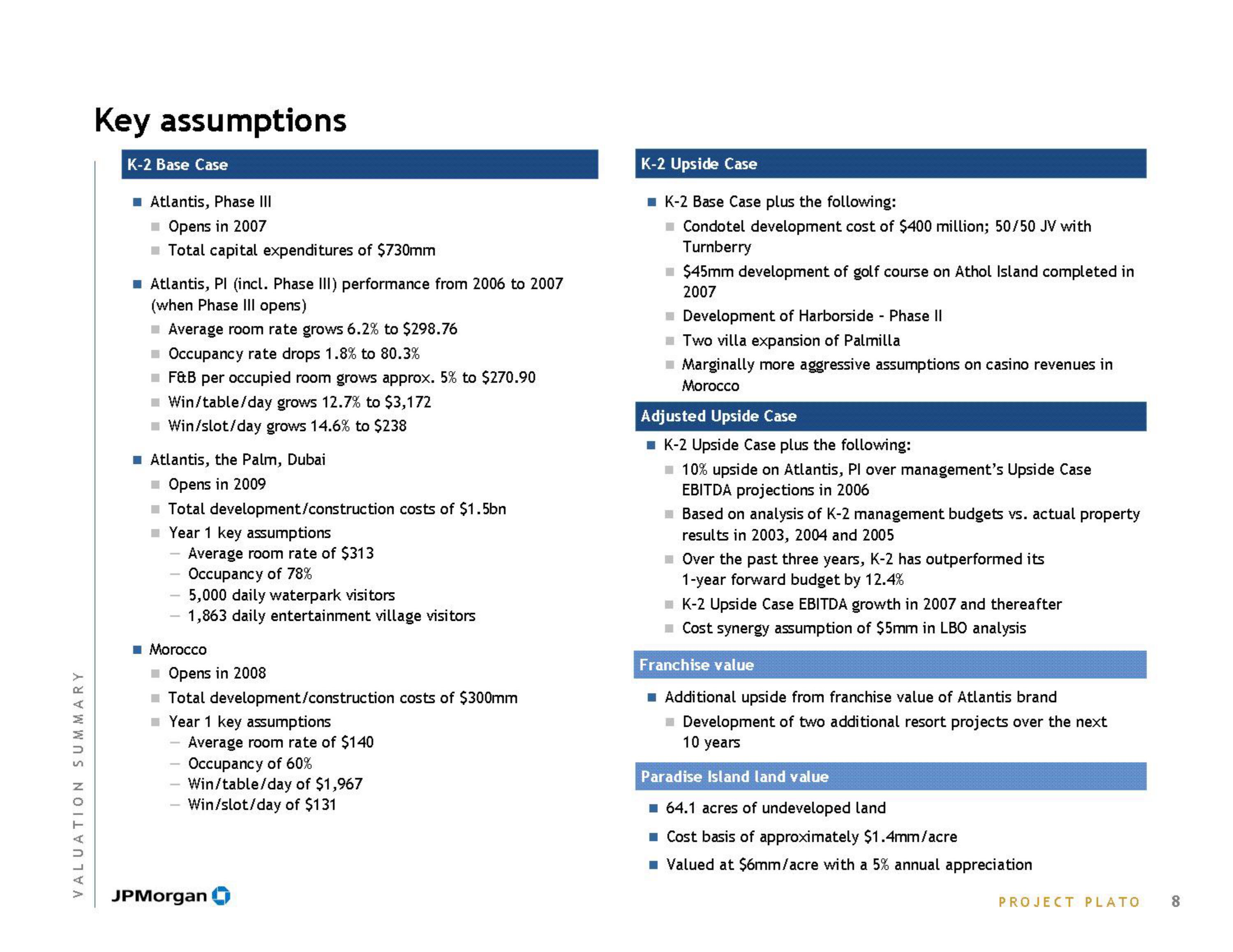

Key assumptions

K-2 Base Case

■ Atlantis, Phase III

■ Opens in 2007

■ Total capital expenditures of $730mm

■ Atlantis, Pl (incl. Phase III) performance from 2006 to 2007

(when Phase III opens)

■ Average room rate grows 6.2% to $298.76

■ Occupancy rate drops 1.8% to 80.3%

■ F&B per occupied room grows approx. 5% to $270.90

■Win/table/day grows 12.7% to $3,172

■Win/slot/day grows 14.6% to $238

■ Atlantis, the Palm, Dubai

■Opens in 2009

■ Total development/construction costs of $1.5bn

■Year 1 key assumptions

Average room rate of $313

Occupancy of 78%

5,000 daily waterpark visitors

1,863 daily entertainment village visitors

■ Morocco

■ Opens in 2008

■ Total development/construction costs of $300mm

■Year 1 key assumptions

Average room rate of $140

Occupancy of 60%

Win/table/day of $1,967

Win/slot/day of $131

JPMorgan

K-2 Upside Case

■ K-2 Base Case plus the following:

■ Condotel development cost of $400 million; 50/50 JV with

Turnberry

■ $45mm development of golf course on Athol Island completed in

2007

Development of Harborside - Phase II

Two villa expansion of Palmilla

■ Marginally more aggressive assumptions on casino revenues in

Morocco

Adjusted Upside Case

K-2 Upside Case plus the following:

■ 10% upside on Atlantis, Pl over management's Upside Case

EBITDA projections in 2006

Based on analysis of K-2 management budgets vs. actual property

results in 2003, 2004 and 2005

Over the past three years, K-2 has outperformed its

1-year forward budget by 12.4%

K-2 Upside Case EBITDA growth in 2007 and thereafter

■ Cost synergy assumption of $5mm in LBO analysis

Franchise value

Additional upside from franchise value of Atlantis brand

■ Development of two additional resort projects over the next

10 years

Paradise Island land value

■ 64.1 acres of undeveloped land

■ Cost basis of approximately $1.4mm/acre

■ Valued at $6mm/acre with a 5% annual appreciation

PROJECT PLATO

8View entire presentation