First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

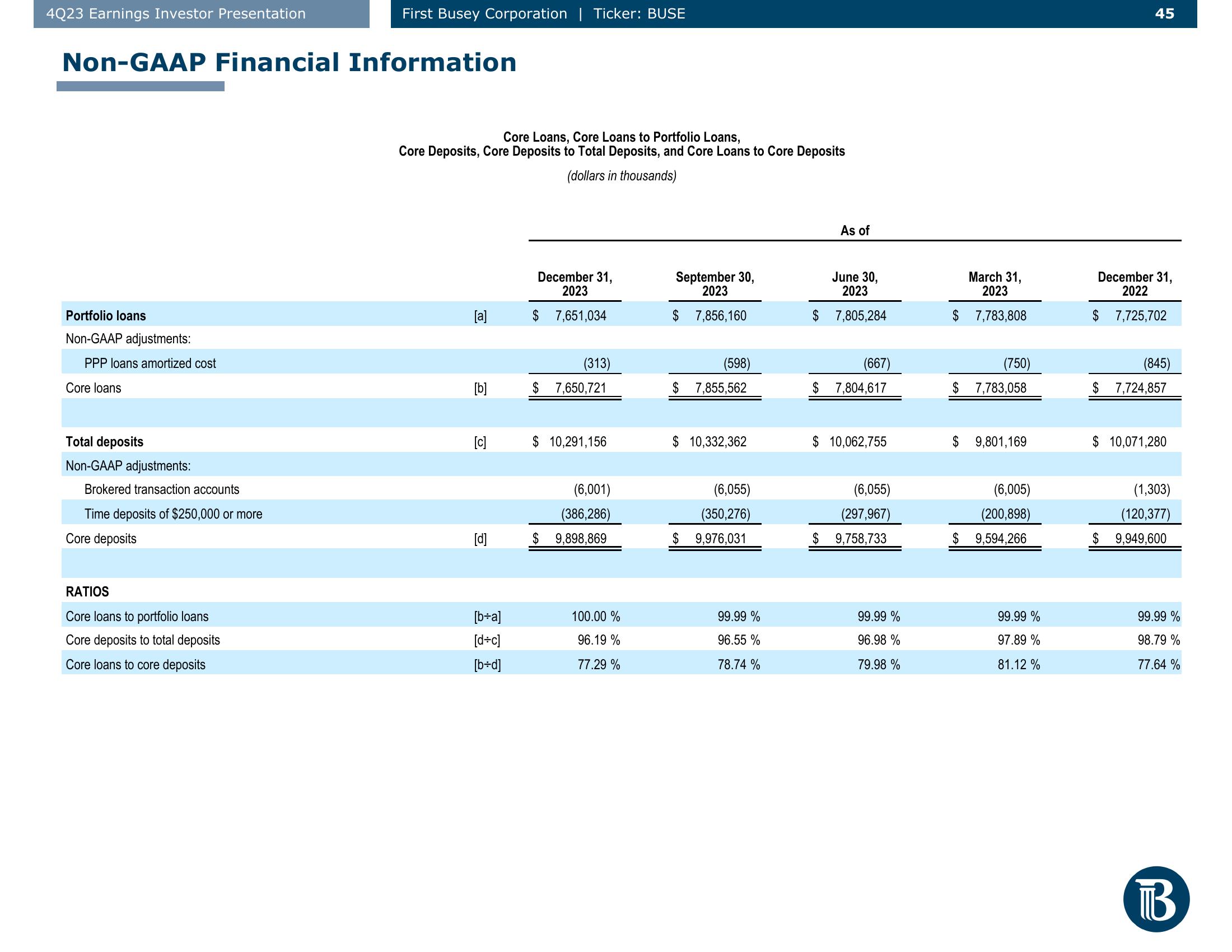

Non-GAAP Financial Information

Portfolio loans

Non-GAAP adjustments:

PPP loans amortized cost

Core loans

Total deposits

Non-GAAP adjustments:

Brokered transaction accounts

Time deposits of $250,000 or more

Core deposits

First Busey Corporation | Ticker: BUSE

RATIOS

Core loans to portfolio loans

Core deposits to total deposits

Core loans to core deposits

Core Loans, Core Loans to Portfolio Loans,

Core Deposits, Core Deposits to Total Deposits, and Core Loans to Core Deposits

(dollars in thousands)

[a]

[b]

[c]

[d]

[b+a]

[d+c]

[b+d]

December 31,

2023

7,651,034

$

(313)

$ 7,650,721

$ 10,291,156

(6,001)

(386,286)

$ 9,898,869

100.00 %

96.19%

77.29%

September 30,

2023

$ 7,856,160

(598)

$ 7,855,562

$ 10,332,362

(6,055)

(350,276)

$ 9,976,031

99.99%

96.55 %

78.74 %

As of

June 30,

2023

$ 7,805,284

(667)

$ 7,804,617

$ 10,062,755

(6,055)

(297,967)

$ 9,758,733

99.99%

96.98 %

79.98 %

March 31,

2023

$ 7,783,808

(750)

$ 7,783,058

$ 9,801,169

(6,005)

(200,898)

$ 9,594,266

99.99%

97.89 %

81.12 %

45

December 31,

2022

$ 7,725,702

(845)

$ 7,724,857

$10,071,280

$

(1,303)

(120,377)

9,949,600

99.99 %

98.79%

77.64 %

BView entire presentation