Tudor, Pickering, Holt & Co Investment Banking

8/1/18

6/19/13

5/17/18

3/26/18

2/7/18

8/20/17

5/18/17

4/3/17

2/1/17

1/27/17

10/24/16

9/26/16

11/3/15

10/26/15

2/13/15

1/26/15

10/13/14

11/12/14

Announcement

Date

7/24/14

10/10/13

8/27/13

5/6/13

2/23/11

Median

Mean

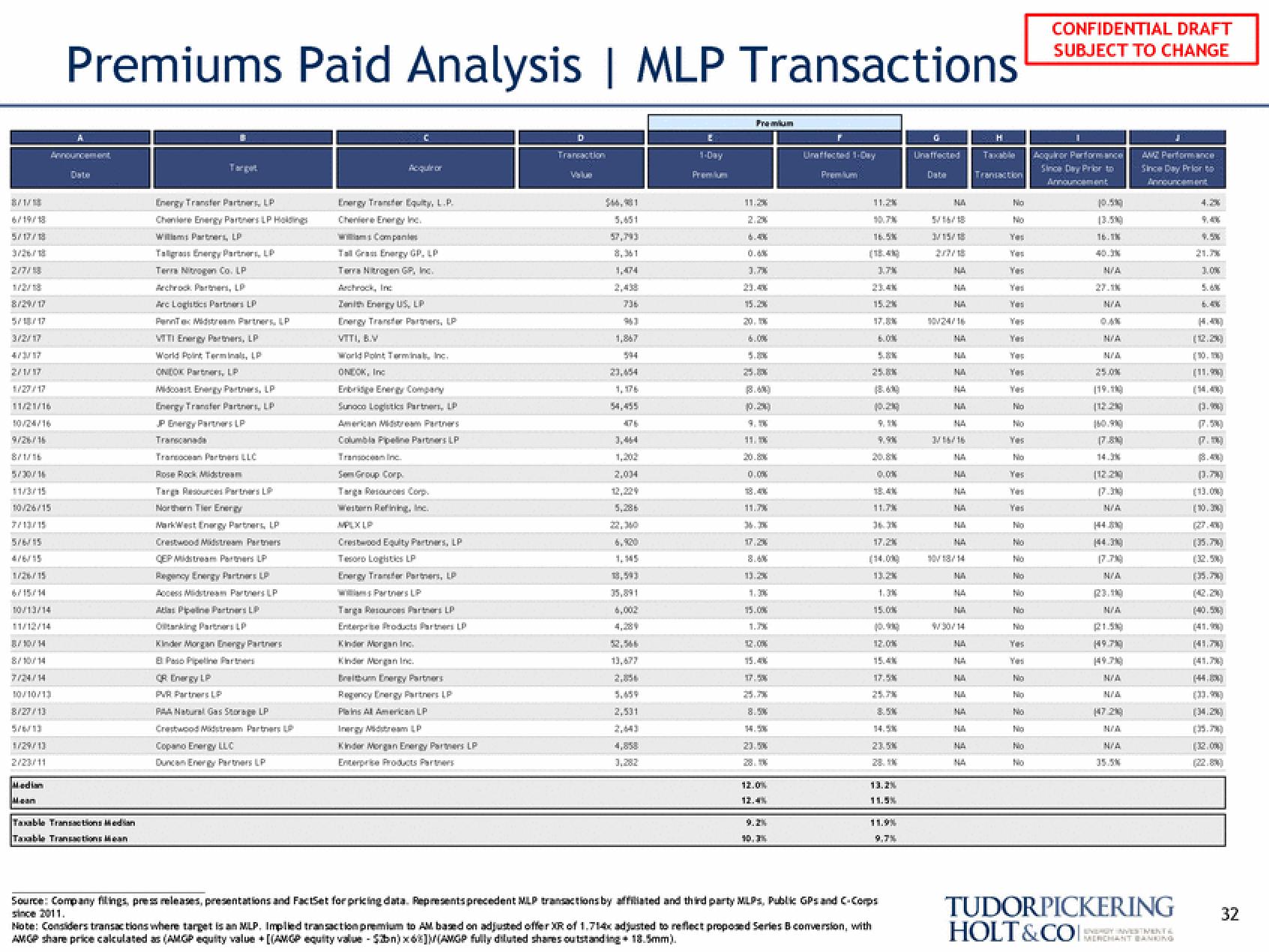

Premiums Paid Analysis | MLP Transactions

Taxable Trans

Taxable Transactions an

Target

Energy Transfer Partners LP

Chenler Energy Partners LP Holdings

Wism Partners, LP

Tags Energy Partners, LP

Terra Nitrogen Co. LP

Archrock Partners, LP

Arc Logistics Partners LP

PeTex Midstream Partners, LP

VITI Energy Partners, LP

World Point Terminals, LP

ONDOX Partners, LP

Midas Energy Partners LP

Energy Transfer Partners, LP

JP Energy Partners LP

Transcanada

Trance Partners LLC

Rose Rock Midstream

Targe Resources Partners LP

Northern Ter Energy

MarkWest Energy Partners, LP

Crestwood Midstream Partners

QEP Midstream Partners LP

Regency Energy Partners LP

Access Midstream Partners LP

Atlas Pipeline Partners LP

Otanking Partners LP

Kinder Morgan Energy Partners

BP Pipeline Partners

QR Energy LP

PVR Partners LP

PAA Natural Gas Storage LP

Crestwood Midstream Partners LP

Copano Energy LLC

Duncan Energy Partners LP

Acquiror

Energy Transfer Equity, L.P.

Cheniere Energy Inc.

wis Companies

TallGras Energy GP, LP

Terra Nitrogen GP, Inc.

Archrock, Inc

Zenith Energy US, LP

Energy Transfer Partners, LP

VITI, B.V

World Point Terminals, Inc.

ONECK, Inc

Enbridge Energy Company

Sunoco Logistics Partners, LP

American Midstream Partners

Columbia Pipeline Partners LP

Transocean Inc.

Sem Group Corp

Tanga Resources Corp.

western Refining, Inc.

MPLX LP

Crestwood Equity Partners, LP

Tesoro Logistics LP

Energy Transfer Partners, LP

WiPartners LP

Tanga Resources Partners LP

Enterprise Products Partners LP

Kinder Morgan Inc.

Kinder Morgan Inc.

Brabu Energy Partners

Regency Energy Partners LP

Plain Al American LP

Inergy Midstream LP

Kinder Morgan Energy Partners LP

Enterprise Products Partners

Transaction

Value

$44,981

8,361

1,474

736

%3

1,867

23,454

54,455

476

1,202

2,034

12,229

35,891

4,002

13,677

2.85

5.459

2,531

3,282

1-Day

Premium

11.2%

0.6%

3.7%

23.48

15.2%

25.08

p.20

11.0

20.8%

0.0%

11.7%

13.2%

15.00

1.39%

12.0%

15.4%

8.50

14.5%

23.50

12.0%

12.4%

10.3%

Unaffected 1-Day

Premium

11.2%

1.7%

15.2%

25.8%

9.90

OLON

36.38

13.2%

15.0

10.90

17.58

14.5%

23.5

13.2%

11.9%

9.7%

Source: Company filings, press releases, presentations and FactSet for pricing data. Representsprecedent MLP transactions by affiliated and third party MLPs, Public GPS and C-Corps

since 2011.

Note: Considers transactions where target is an MLP. Implied transaction premium to AM based on adjusted offer XR of 1.714x adjusted to reflect proposed Series B conversion, with

AMGP share price calculated as (AMGP equity value +[(AMGP equity value $bn) x6(AMGP fully diluted shares outstanding 18.5mm).

Unaffected

Date

NA

5/16/18

3/15/18

NA

NA

NA

NA

NA

NA

3/16/16

NA

NA

NA

10/18/14

NA

NA

NA

W30/14

NA

NA

NA

NA

NA

NA

H

Taxable

Transaction

No

No

You

Yo

Yes

Yes

Yes

Yas

Yes

No

No

Yes

No

Yes

Yes

Yes

No

No

No

No

No

No

No

Yes

Yes

No

No

No

No

No

No

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Acquiror Performance

Since Day Prior to

Announcement

10.500

40.3%

N/A

N/A

OAK

N/A

25.0%

(19.10

(12.20

(12.200

144.

(17.710

21.50

149.790

149.790

N/A

N/A

N/A

AMT Performance

Since Day Prior to

Announcement

TUDORPICKERING

HOLT&COI:

ENERGY INVESTIMENTE

MERCHANT BANKING

4.2

9,40

3,0%

14.400

(12.200

(11.990)

33.90

(7.5)

13.7%)

(10.300)

(35.74)

(42.200)

(40.500

(34.20)

(35.790

(32.00)

(22.8%)

32View entire presentation