Bank of America Investment Banking Pitch Book

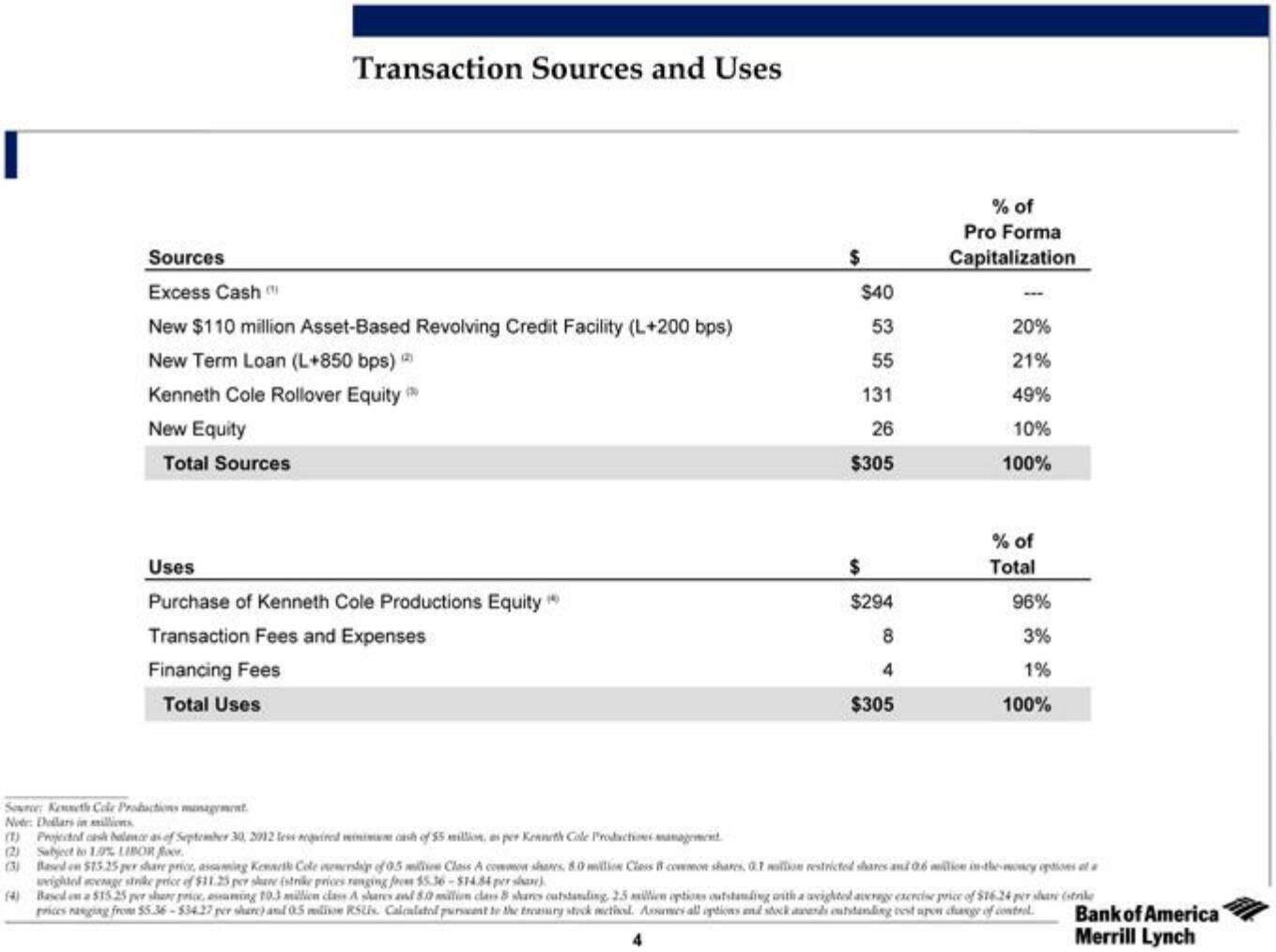

Sources

Excess Cash

New $110 million Asset-Based Revolving Credit Facility (L+200 bps)

New Term Loan (L+850 bps)

Kenneth Cole Rollover Equity

New Equity

Total Sources

Transaction Sources and Uses

Uses

Purchase of Kenneth Cole Productions Equity

Transaction Fees and Expenses

Financing Fees

Total Uses

Source: Kenneth Cole Productions management.

Note: Dollars in millions

(1) Projected cash balance as of September 30, 2012 Tessed

(2) Subject to 10% LIBOR floor

$

$40

53

55

131

26

$305

$

$294

8

4

$305

% of

Pro Forma

Capitalization

20%

21%

49%

10%

100%

% of

Total

96%

3%

1%

100%

cash of $5 million, as per Kenneth Cole Production management

(3) Based on $15.25 per share price, assuming Kenneth Cole nership of 0.5 mln Class A common shares 8.0 million Class 8 common shares 0.7 million restricted shares and 0.6 milion in the money options at a

weightol mege strike price of $11.25 per share (strike prices ranging from $5.36-$14.84 pers

(4)

Based on a $15.25 per share pice, osaming 10.3 million class A shares and 50 million class 8 shares outstanding, 25 millen options outstanding with a weighted average exercise price of $16.24 per share (strike

prices nanging from $5.36-534.27 per share) and 0.5 midio RSUs. Calculated parent to the treasury stock metod. Assumes all options and stock awards outstanding est upon change of control.

Bank of America

Merrill LynchView entire presentation