Third Quarter 2022 Earnings Conference Call

Asset quality

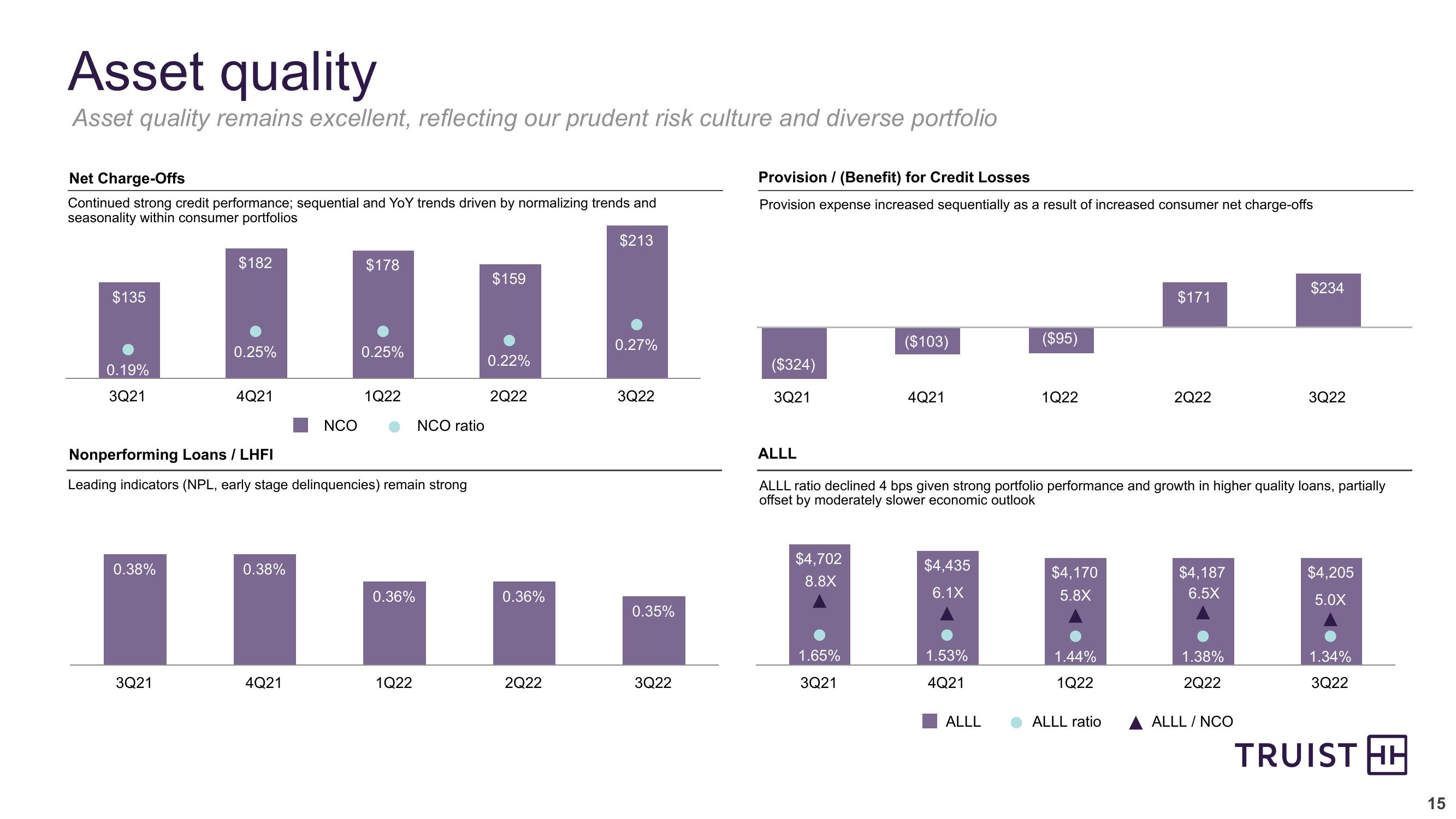

Asset quality remains excellent, reflecting our prudent risk culture and diverse portfolio

Net Charge-Offs

Continued strong credit performance; sequential and YoY trends driven by normalizing trends and

seasonality within consumer portfolios

$213

$182

$178

$159

Provision / (Benefit) for Credit Losses

Provision expense increased sequentially as a result of increased consumer net charge-offs

$234

$135

$171

0.27%

($103)

($95)

0.25%

0.25%

0.22%

0.19%

3Q21

4Q21

1Q22

2Q22

3Q22

($324)

3Q21

4Q21

1Q22

2Q22

3Q22

NCO

NCO ratio

Nonperforming Loans / LHFI

Leading indicators (NPL, early stage delinquencies) remain strong

ALLL

ALLL ratio declined 4 bps given strong portfolio performance and growth in higher quality loans, partially

offset by moderately slower economic outlook

0.38%

0.38%

$4,702

8.8X

$4,435

6.1X

0.36%

0.36%

$4,170

5.8X

$4,187

6.5X

$4,205

5.0X

0.35%

1.65%

1.53%

1.44%

1.38%

1.34%

3Q21

4Q21

1Q22

2Q22

3Q22

3Q21

4Q21

1Q22

2Q22

3Q22

ALLL

ALLL ratio

ALLL/NCO

TRUIST HH

15View entire presentation