Adtheorent SPAC Presentation Deck

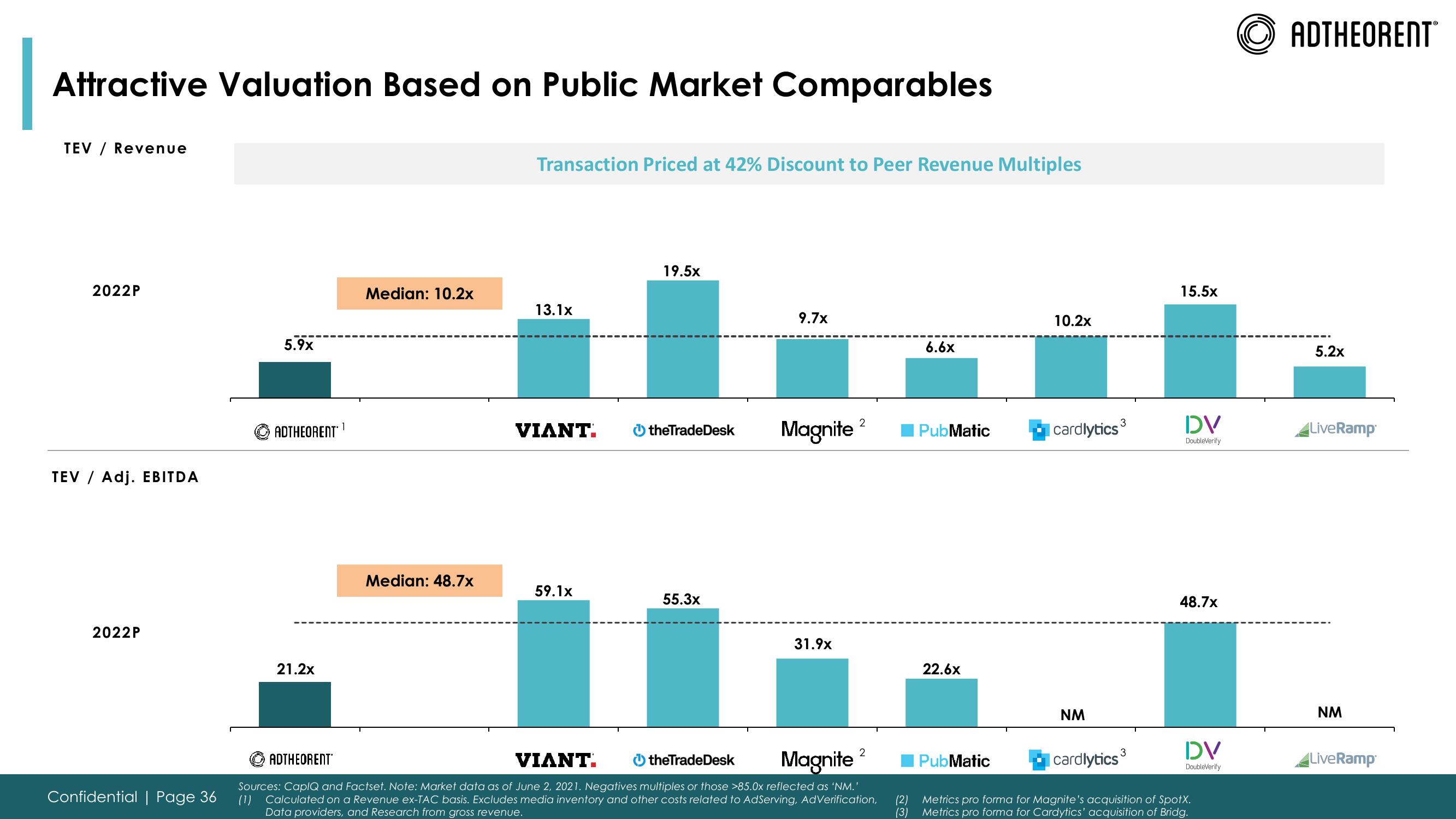

Attractive Valuation Based on Public Market Comparables

TEV/ Revenue

TEV

2022P

Adj. EBITDA

2022P

Confidential | Page 36

5.9x

ⒸADTHEORENT

21.2x

1

Median: 10.2x

Median: 48.7x

Transaction Priced at 42% Discount to Peer Revenue Multiples

13.1x

VIANT.

59.1x

19.5x

9.7x

theTradeDesk Magnite

55.3x

31.9x

2

2

ADTHEORENT

VIANT.

theTradeDesk Magnite

Sources: CapIQ and Factset. Note: Market data as of June 2, 2021. Negatives multiples or those >85.0x reflected as 'NM.'

(1) Calculated on a Revenue ex-TAC basis. Excludes media inventory and other costs related to AdServing, AdVerification,

Data providers, and Research from gross revenue.

6.6x

PubMatic

22.6x

PubMatic

10.2x

cardlytics ³

NM

3

cardlytics ³

15.5x

DV

DoubleVerify

48.7x

DV

DoubleVerify

(2) Metrics pro forma for Magnite's acquisition of SpotX.

(3) Metrics pro forma for Cardytics' acquisition of Bridg.

ADTHEORENTⓇ

5.2x

LiveRamp

NM

LiveRampView entire presentation