Spotify Results Presentation Deck

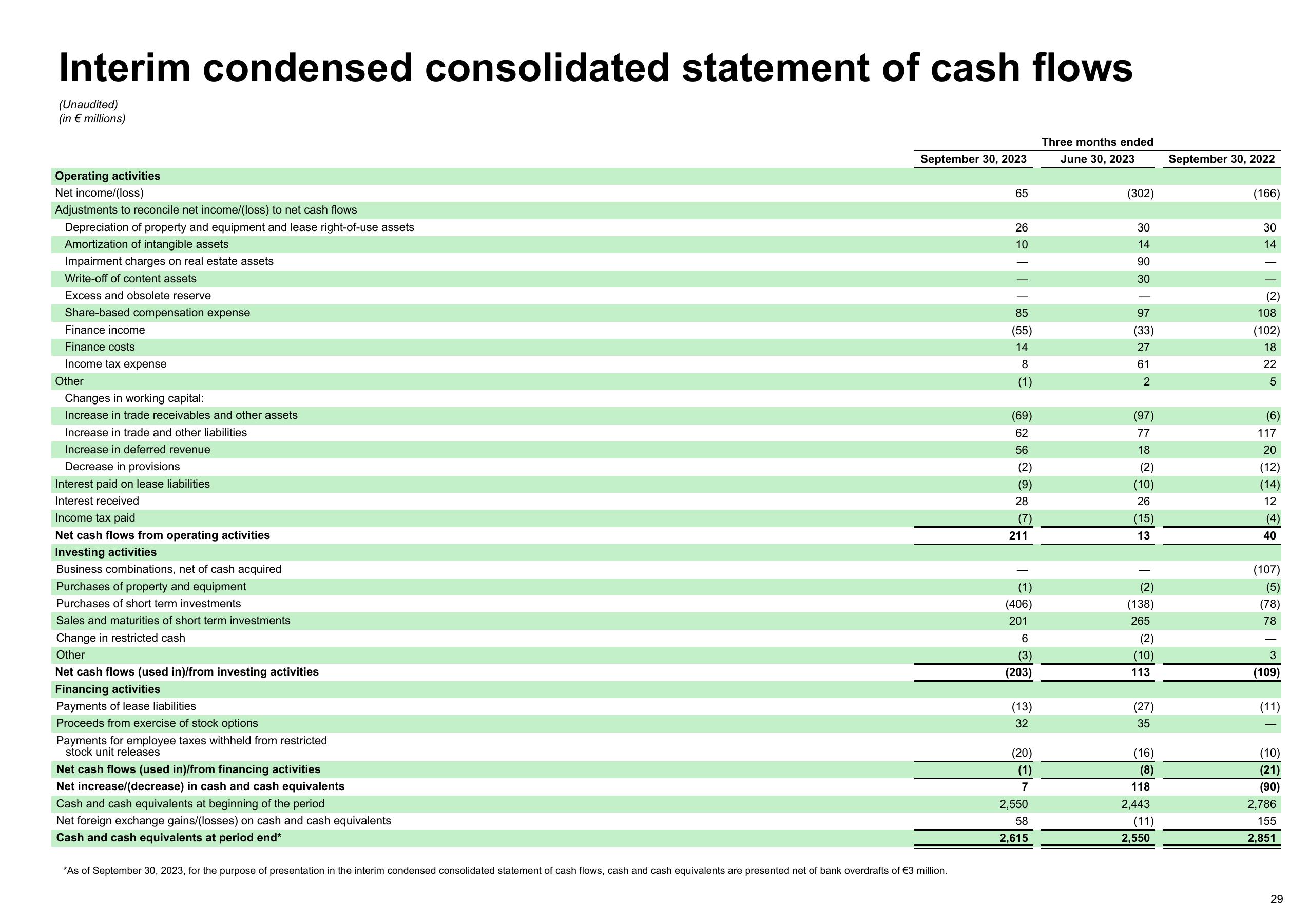

Interim condensed consolidated statement of cash flows

(Unaudited)

(in € millions)

Operating activities

Net income/(loss)

Adjustments to reconcile net income/(loss) to net cash flows

Depreciation of property and equipment and lease right-of-use assets

Amortization of intangible assets

Impairment charges on real estate assets

Write-off of content assets

Excess and obsolete reserve

Share-based compensation expense

Finance income

Finance costs

Income tax expense

Other

Changes in working capital:

Increase in trade receivables and other assets

Increase in trade and other liabilities

Increase in deferred revenue

Decrease in provisions

Interest paid on lease liabilities

Interest received

Income tax paid

Net cash flows from operating activities

Investing activities

Business combinations, net of cash acquired

Purchases of property and equipment

Purchases of short term investments

Sales and maturities of short term investments

Change in restricted cash

Other

Net cash flows (used in)/from investing activities

Financing activities

Payments of lease liabilities

Proceeds from exercise of stock options

Payments for employee taxes withheld from restricted

stock unit releases

Net cash flows (used in)/from financing activities

Net increase/(decrease) in cash and cash equivalents

Cash and cash equivalents at beginning of the period

Net foreign exchange gains/(losses) on cash and cash equivalents

Cash and cash equivalents at period end*

September 30, 2023

*As of September 30, 2023, for the urpo of presentation in the interim condensed consolidated statement of cash flows, cash and cash equivalents are presented net of bank overdrafts of €3 million.

65

26

10

85

(55)

14

8

(1)

(69)

62

56

(2)

(9)

28

(7)

211

(1)

(406)

201

6

(3)

(203)

(13)

32

(20)

(1)

7

2,550

58

2,615

Three months ended

June 30, 2023

(302)

30

14

90

30

97

(33)

27

61

2

(97)

77

18

(2)

(10)

26

(15)

13

(2)

(138)

265

(2)

(10)

113

(27)

35

(16)

(8)

118

2,443

(11)

2,550

September 30, 2022

(166)

30

14

(2)

108

(102)

18

22

5

(6)

117

20

(12)

(14)

12

(4)

40

(107)

(5)

(78)

78

3

(109)

(11)

(10)

(21)

(90)

2,786

155

2,851

29View entire presentation