Skillz Investor Day Presentation Deck

53

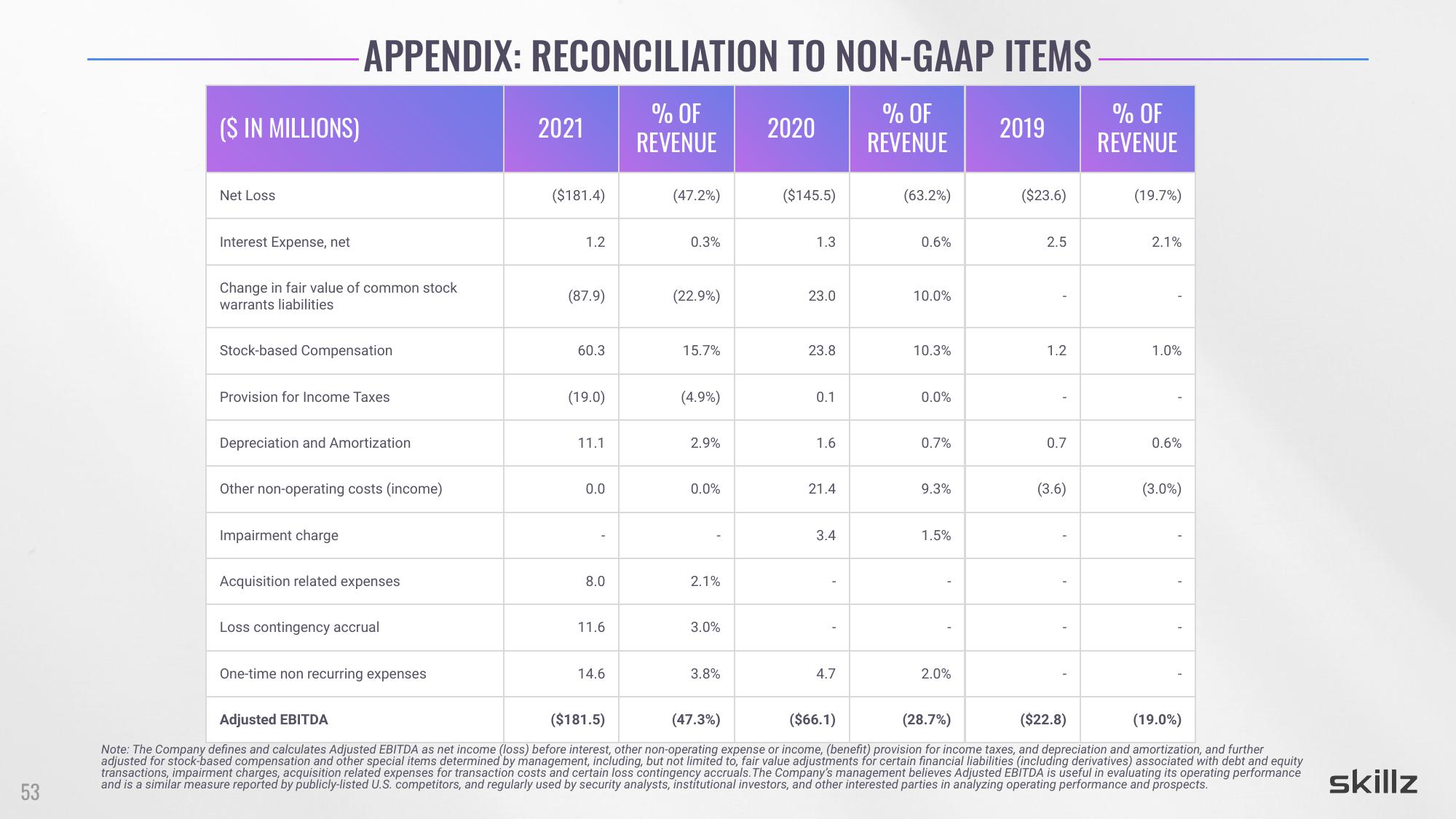

($ IN MILLIONS)

Net Loss

Interest Expense, net

APPENDIX: RECONCILIATION TO NON-GAAP ITEMS

% OF

REVENUE

% OF

REVENUE

Change in fair value of common stock

warrants liabilities

Stock-based Compensation

Provision for Income Taxes

Depreciation and Amortization

Other non-operating costs (income)

Impairment charge

Acquisition related expenses

Loss contingency accrual

One-time non recurring expenses

2021

($181.4)

1.2

(87.9)

60.3

(19.0)

11.1

0.0

8.0

11.6

14.6

(47.2%)

0.3%

(22.9%)

15.7%

(4.9%)

2.9%

0.0%

2.1%

3.0%

3.8%

2020

($145.5)

1.3

23.0

23.8

0.1

1.6

21.4

3.4

4.7

(63.2%)

0.6%

10.0%

10.3%

0.0%

0.7%

9.3%

1.5%

2.0%

2019

($23.6)

2.5

1.2

0.7

(3.6)

% OF

REVENUE

(19.7%)

2.1%

1.0%

0.6%

(3.0%)

Adjusted EBITDA

($181.5)

(47.3%)

($66.1)

(28.7%)

($22.8)

(19.0%)

Note: The Company defines and calculates Adjusted EBITDA as net income (loss) before interest, other non-operating expense or income, (benefit) provision for income taxes, and depreciation and amortization, and further

adjusted for stock-based compensation and other special items determined by management, including, but not limited to, fair value adjustments for certain financial liabilities (including derivatives) associated with debt and equity

transactions, impairment charges, acquisition related expenses for transaction costs and certain loss contingency accruals. The Company's management believes Adjusted EBITDA is useful in evaluating its operating performance

and is a similar measure reported by publicly-listed U.S. competitors, and regularly used by security analysts, institutional investors, and other interested parties in analyzing operating performance and prospects.

skillzView entire presentation