Zegna SPAC Presentation Deck

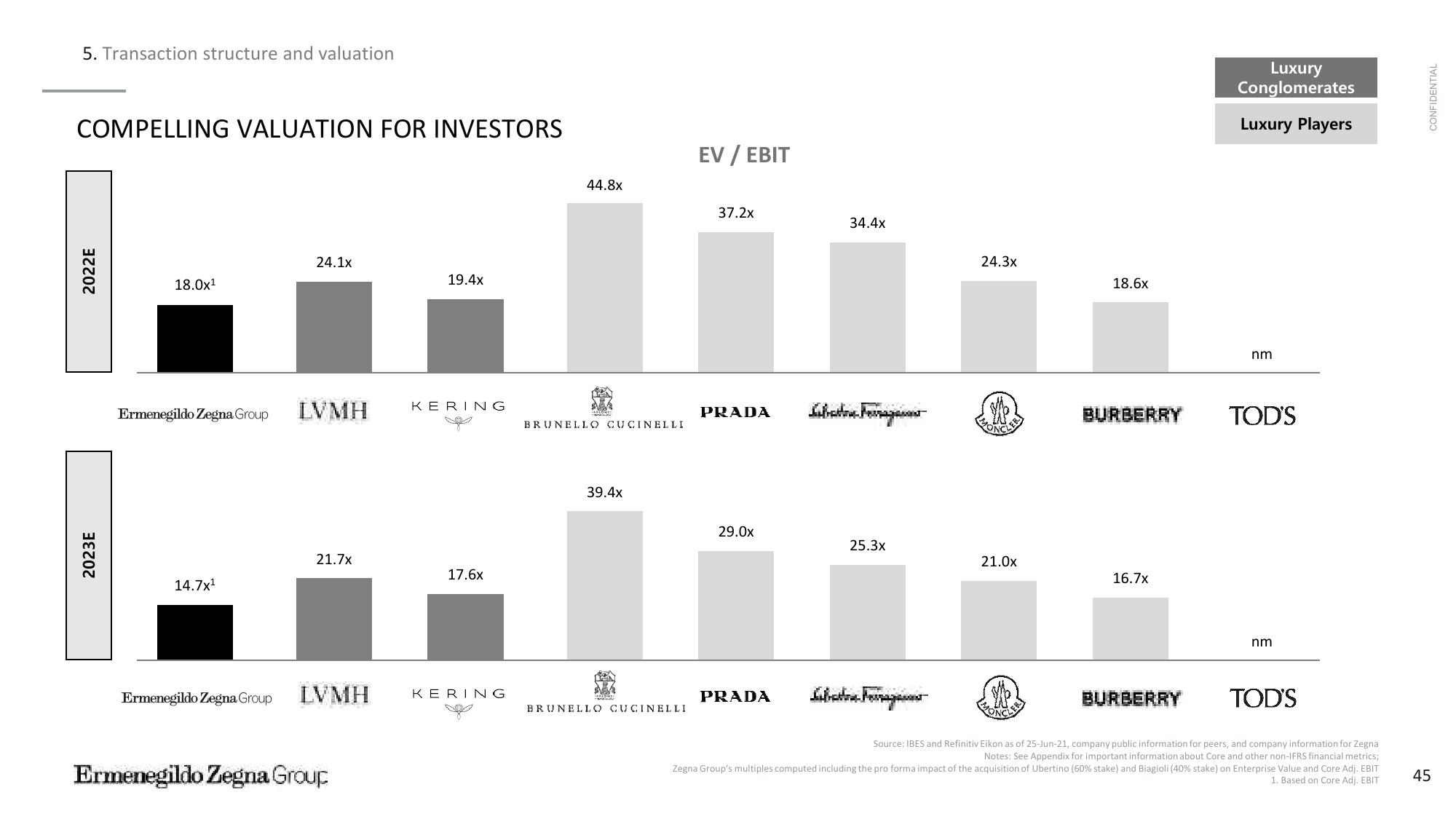

5. Transaction structure and valuation

COMPELLING VALUATION FOR INVESTORS

2022E

2023E

18.0x¹

24.1x

Ermenegildo Zegna Group LVMH

14.7x¹

21.7x

Ermenegildo Zegna Group LVMH

Ermenegildo Zegna Group

19.4x

KERING

17.6x

KERING

44.8x

BRUNELLO CUCINELLI

39.4x

EV / EBIT

BRUNELLO CUCINELLI

37.2x

PRADA

29.0x

PRADA

34.4x

Sabattre Ferraga

25.3x

24.3x

yp

21.0x

18.6x

MONC

BURBERRY

16.7x

BURBERRY

Luxury

Conglomerates

Luxury Players

TOD'S

Source: IBES and Refinitiv Eikon as of 25-Jun-21, company public information for peers, and company information for Zegna

Notes: See Appendix for important information about Core and other non-IFRS financial metrics;

Zegna Group's multiples computed including the pro forma impact of the acquisition of Ubertino (60% stake) and Biagioli (40% stake) on Enterprise Value and Core Adj. EBIT

1. Based on Core Adj. EBIT

nm

TOD'S

nm

CONFIDENTIAL

45View entire presentation