Barclays Capital 2010 Global Financial Services Conference

GBM - credible performance, in line with peers

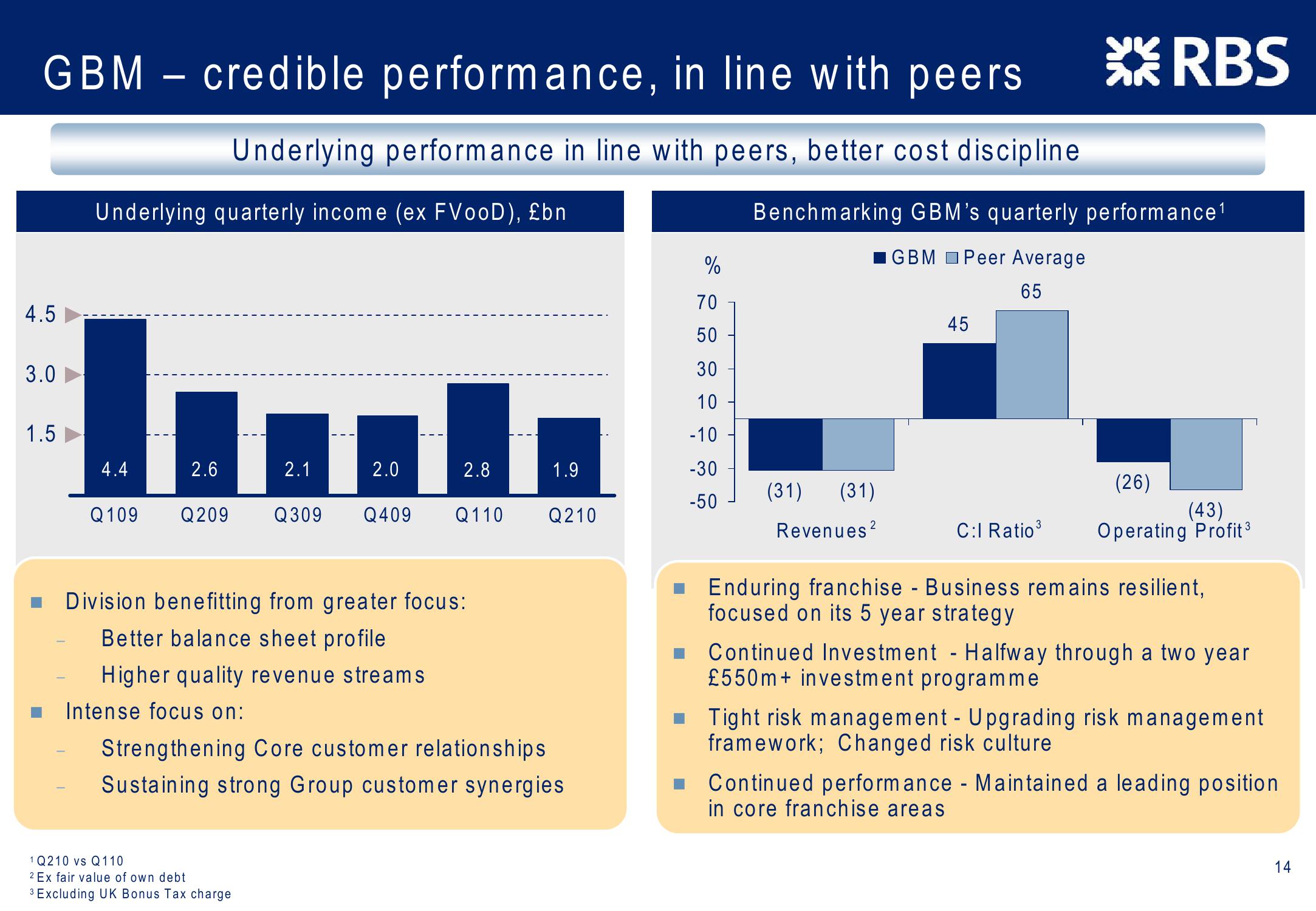

Underlying performance in line with peers, better cost discipline

Underlying quarterly income (ex FVooD), £bn

%

RBS

Benchmarking GBM's quarterly performance1

GBM Peer Average

4.5

3.0

1.5

70

65

45

50

30

10

-10

4.4

2.6

2.1

2.0

2.8

1.9

-30

-50

(31)

(31)

(26)

Q109

Q209 Q309 Q409 Q110

Q210

(43)

Revenues²

C:l Ratio³

Operating Profit³

Division benefitting from greater focus:

Better balance sheet profile

Higher quality revenue streams

Intense focus on:

Strengthening Core customer relationships

Sustaining strong Group customer synergies

Enduring franchise - Business remains resilient,

focused on its 5 year strategy

Continued Investment Halfway through a two year

£550m+ investment programme

■Tight risk management - Upgrading risk management

framework; Changed risk culture

Continued performance - Maintained a leading position

in core franchise areas

1 Q210 vs Q110

2 Ex fair value of own debt

3 Excluding UK Bonus Tax charge

14View entire presentation