Paysafe SPAC Presentation Deck

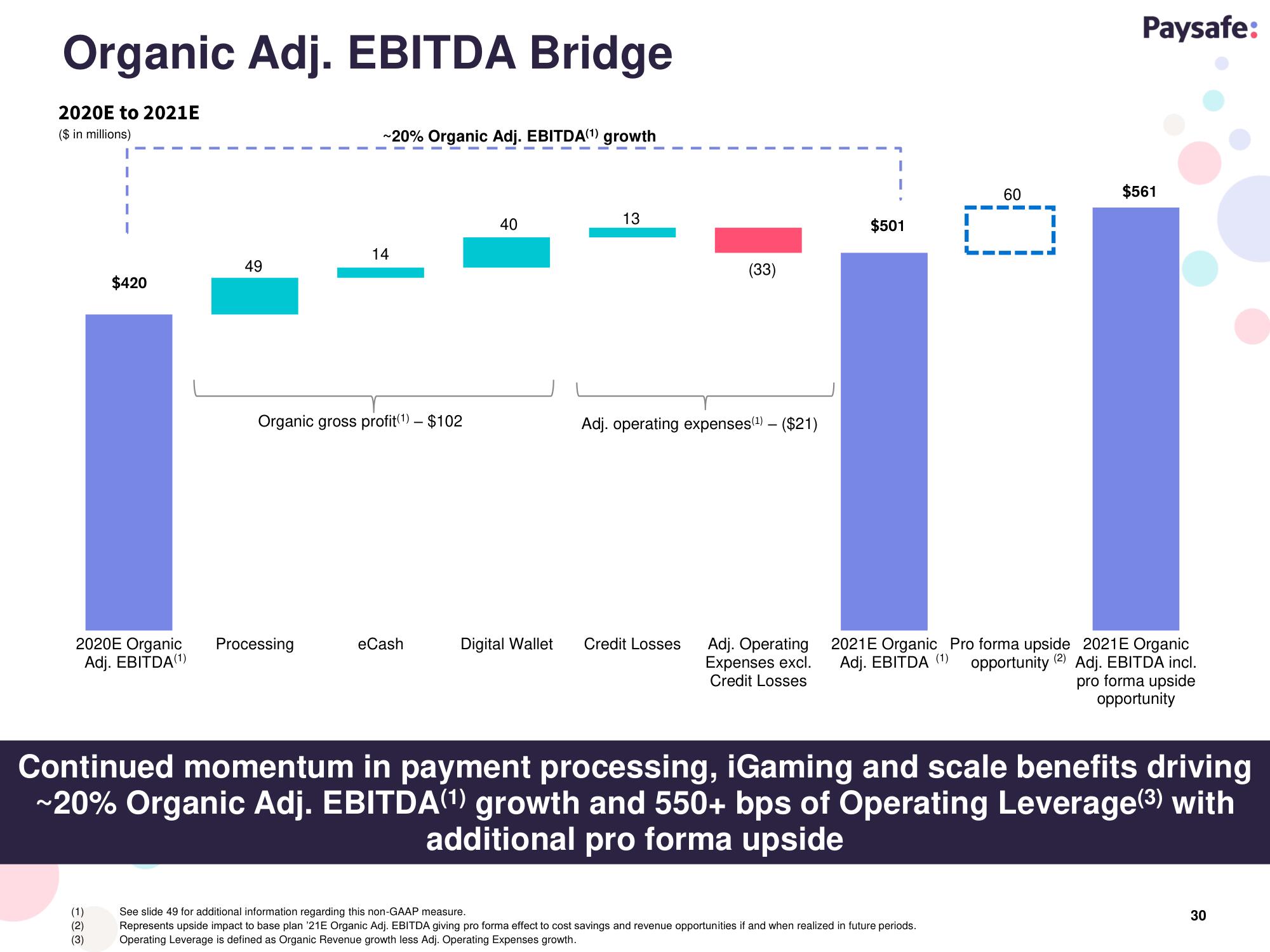

Organic Adj. EBITDA Bridge

2020E to 2021E

($ in millions)

$420

2020E Organic

Adj. EBITDA(1)

(2)

(3)

49

~20% Organic Adj. EBITDA(¹) growth

Processing

14

Organic gross profit (¹) - $102

eCash

40

Digital Wallet

13

(33)

Adj. operating expenses(¹) - ($21)

Credit Losses

$501

60

Paysafe:

See slide 49 for additional information regarding this non-GAAP measure.

Represents upside impact to base plan '21E Organic Adj. EBITDA giving pro forma effect to cost savings and revenue opportunities if and when realized in future periods.

Operating Leverage is defined as Organic Revenue growth less Adj. Operating Expenses growth.

$561

Adj. Operating 2021E Organic Pro forma upside 2021E Organic

Expenses excl. Adj. EBITDA (1)

(2)

opportunity Adj. EBITDA incl.

Credit Losses

pro forma upside

opportunity

Continued momentum in payment processing, iGaming and scale benefits driving

~20% Organic Adj. EBITDA(¹) growth and 550+ bps of Operating Leverage (3) with

additional pro forma upside

30View entire presentation