Bakkt SPAC Presentation Deck

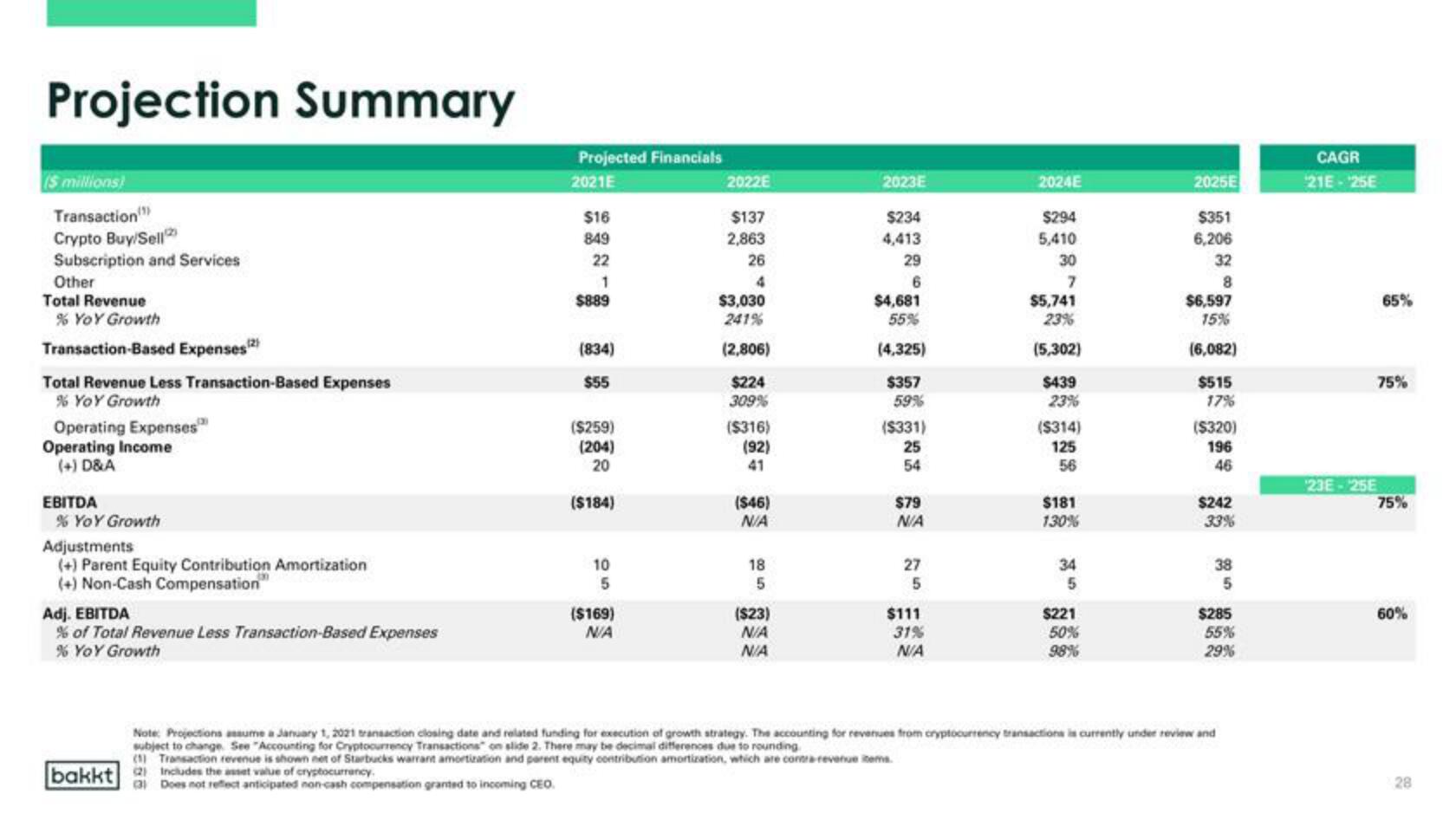

Projection Summary

(S millions)

Transaction

Crypto Buy/Sell2

Subscription and Services

Other

Total Revenue

% YoY Growth

Transaction-Based Expenses 2)

Total Revenue Less Transaction-Based Expenses

% YoY Growth

Operating Expenses

Operating Income

(+) D&A

EBITDA

% YoY Growth

Adjustments

(+) Parent Equity Contribution Amortization

(+) Non-Cash Compensation

Adj. EBITDA

% of Total Revenue Less Transaction-Based Expenses

% YoY Growth

Projected Financials

2021E

bakkt Includes the asset value of cryptocurrency.

$16

849

22

1

$889

(3) Does not reflect anticipated non-cash compensation granted to incoming CEO

(834)

$55

($259)

(204)

20

($184)

10

5

($169)

N/A

2022E

$137

2,863

26

4

$3,030

241%

(2,806)

$224

99%

($316)

(92)

($46)

N/A

18

5

($23)

N/A

N/A

2023E

$234

4,413

29

6

$4,681

55%

(4,325)

$357

59%

($331)

25

54

(1) Transaction revenue is shown net of Starbucks warrant amortization and parent equity contribution amortization, which are contra revenue items.

$79

N/A

27

5

$111

31%

N/A

2024E

$294

5,410

30

7

$5,741

23%

(5,302)

$439

23%

($314)

125

56

$181

130%

34

5

$221

50%

98%

2025E

$351

6,206

32

8

$6,597

15%

(6,082)

$515

179

($320)

196

46

$242

33%

Note: Projections assume a January 1, 2021 transaction closing date and related funding for execution of growth strategy. The accounting for revenues from cryptocurrency transactions is currently under review and

subject to change. See "Accounting for Cryptocurrency Transactions on slide 2. There may be decimal differences due to rounding

38

5

$285

55%

29%

CAGR

21E-25E

23E-25E

65%

75%

75%

60%

28View entire presentation