Baird Investment Banking Pitch Book

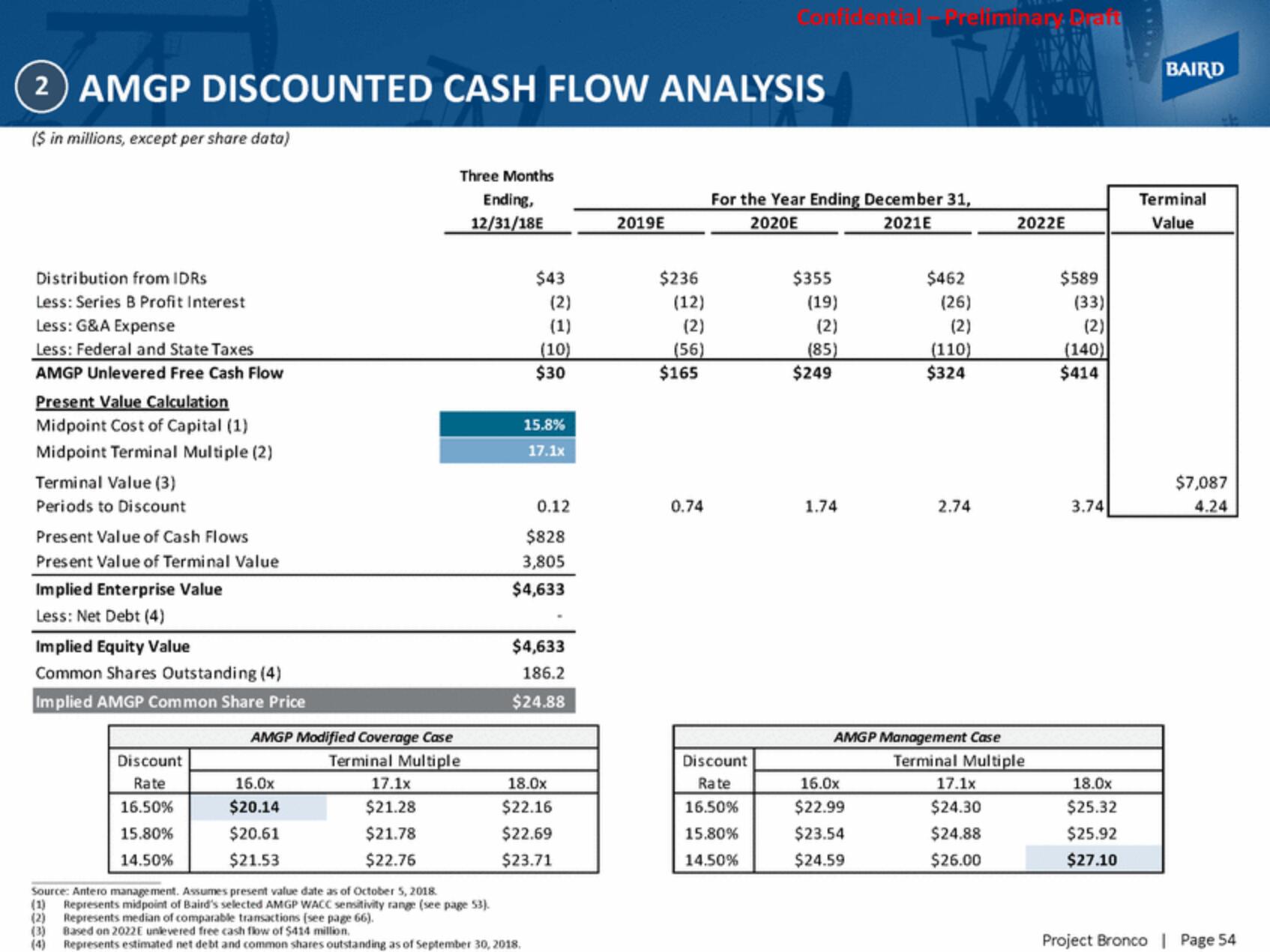

2 AMGP DISCOUNTED CASH FLOW ANALYSIS

($ in millions, except per share data)

Distribution from IDRs

Less: Series B Profit Interest

Less: G&A Expense

Less: Federal and State Taxes

AMGP Unlevered Free Cash Flow

Present Value Calculation

Midpoint Cost of Capital (1)

Midpoint Terminal Multiple (2)

Terminal Value (3)

Periods to Discount

Present Value of Cash Flows

Present Value of Terminal Value

Implied Enterprise Value

Less: Net Debt (4)

Implied Equity Value

Common Shares Outstanding (4)

Implied AMGP Common Share Price

Discount

Rate

16.50%

15.80%

14.50%

(3)

(4)

AMGP Modified Coverage Case

Terminal Multiple

16.0x

$20.14

$20.61

$21.53

17.1x

$21.28

Three Months

Ending,

12/31/18E

$21.78

$22.76

$43

(2)

(1)

Source: Antero management. Assumes present value date as of October 5, 2018.

(1) Represents midpoint of Baird's selected AMGP WACC sensitivity range (see page 53).

(2)

Represents median of comparable transactions (see page 66).

Based on 2022E unlevered free cash flow of $414 million.

Represents estimated net debt and common shares outstanding as of September 30, 2018.

(10)

$30

15.8%

17.1x

0.12

$828

3,805

$4,633

$4,633

186.2

$24.88

18.0x

$22.16

$22.69

$23.71

2019E

$236

(12)

(2)

(56)

$165

0.74

For the Year Ending December 31,

2020E

2021E

Discount

Rate

16.50%

15.80%

14.50%

$355

(19)

(2)

(85)

$249

1.74

Trellminan. Draft

16.0x

$22.99

$23.54

$24.59

$462

(26)

(2)

(110)

$324

2.74

AMGP Management Case

Terminal Multiple

2022E

17.1x

$24.30

$24.88

$26.00

$589

(33)

(2)

(140)

$414

3.74

18.0x

$25.32

$25.92

$27.10

****

BAIRD

Terminal

Value

$7,087

4.24

Project Bronco | Page 54View entire presentation