Credit Suisse Investor Event Presentation Deck

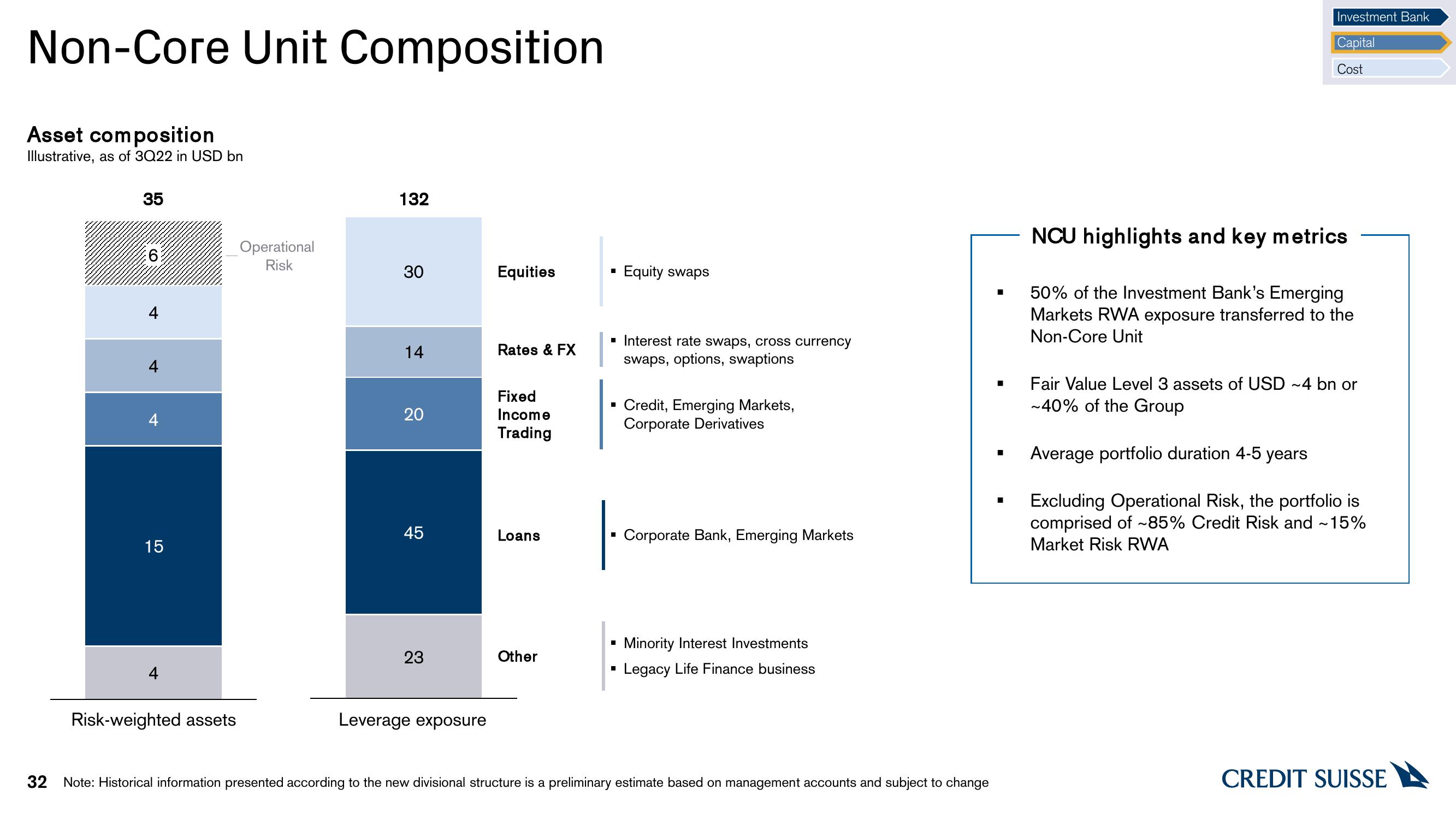

Non-Core Unit Composition

Asset composition

Illustrative, as of 3Q22 in USD bn

35

15

Risk-weighted assets

Operational

Risk

132

30

14

20

45

23

Leverage exposure

Equities

Rates & FX

Fixed

Income

Trading

Loans

Other

Equity swaps

■ Interest rate swaps, cross currency

swaps, options, swaptions

■

Credit, Emerging Markets,

Corporate Derivatives

Corporate Bank, Emerging Markets

▪ Minority Interest Investments

Legacy Life Finance business

32 Note: Historical information presented according to the new divisional structure is a preliminary estimate based on management accounts and subject to change

■

■

■

■

Investment Bank

Capital

Cost

NCU highlights and key metrics

50% of the Investment Bank's Emerging

Markets RWA exposure transferred to the

Non-Core Unit

Fair Value Level 3 assets of USD ~4 bn or

~40% of the Group

Average portfolio duration 4-5 years

Excluding Operational Risk, the portfolio is

comprised of ~85% Credit Risk and ~15%

Market Risk RWA

CREDIT SUISSEView entire presentation