Pathward Financial Investor Presentation Deck

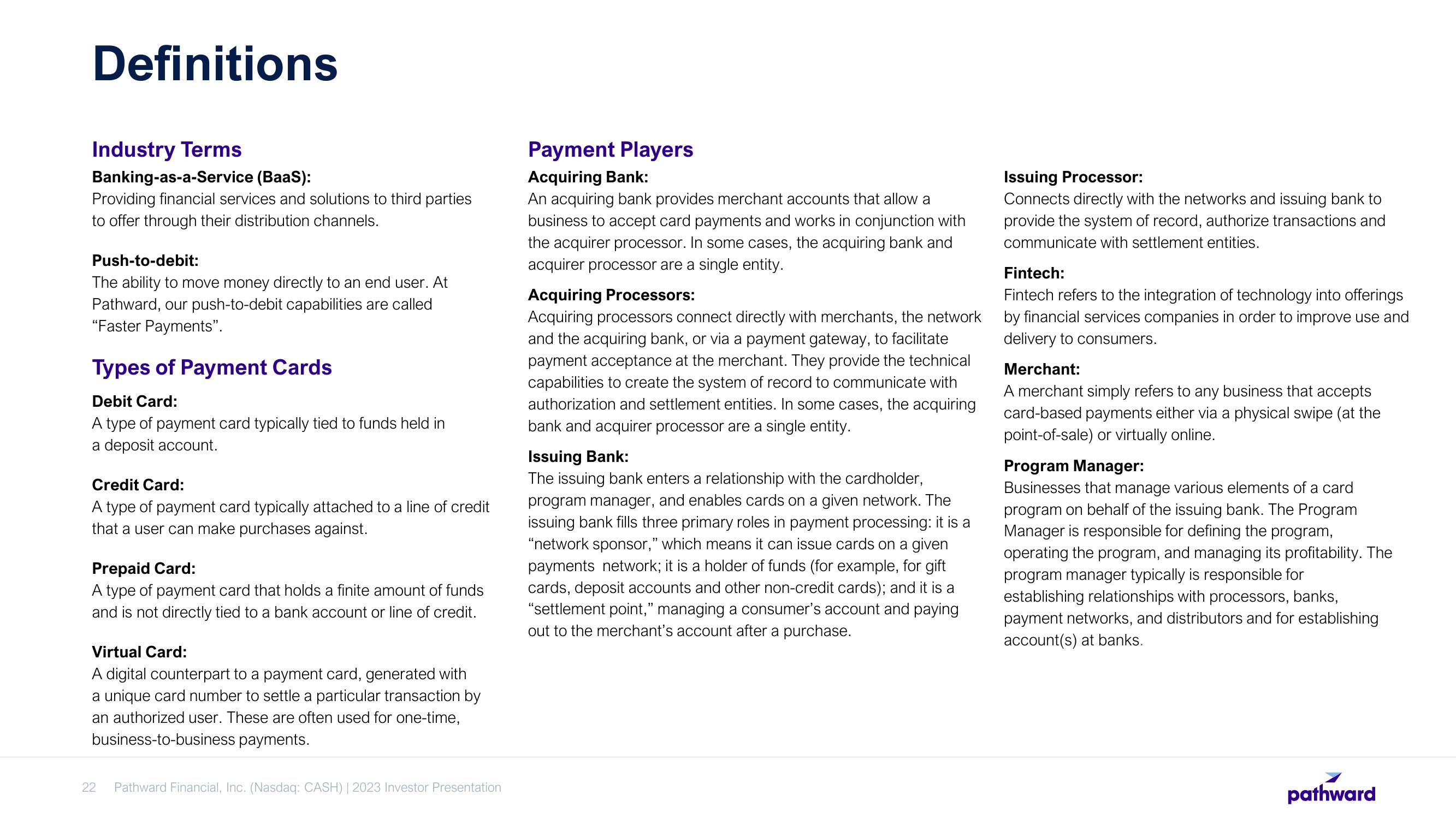

Definitions

Industry Terms

Banking-as-a-Service (BaaS):

Providing financial services and solutions to third parties

to offer through their distribution channels.

Push-to-debit:

The ability to move money directly to an end user. At

Pathward, our push-to-debit capabilities are called

"Faster Payments".

Types of Payment Cards

Debit Card:

A type of payment card typically tied to funds held in

a deposit account.

Credit Card:

A type of payment card typically attached to a line of credit

that a user can make purchases against.

Prepaid Card:

A type of payment card that holds a finite amount of funds

and is not directly tied to a bank account or line of credit.

Virtual Card:

A digital counterpart to a payment card, generated with

a unique card number to settle a particular transaction by

an authorized user. These are often used for one-time,

business-to-business payments.

22

Pathward Financial, Inc. (Nasdaq: CASH) | 2023 Investor Presentation

Payment Players

Acquiring Bank:

An acquiring bank provides merchant accounts that allow a

business to accept card payments and works in conjunction with

the acquirer processor. In some cases, the acquiring bank and

acquirer processor are a single entity.

Acquiring Processors:

Acquiring processors connect directly with merchants, the network

and the acquiring bank, or via a payment gateway, to facilitate

payment acceptance at the merchant. They provide the technical

capabilities to create the system of record to communicate with

authorization and settlement entities. In some cases, the acquiring

bank and acquirer processor are a single entity.

Issuing Bank:

The issuing bank enters a relationship with the cardholder,

program manager, and enables cards on a given network. The

issuing bank fills three primary roles in payment processing: it is a

"network sponsor," which means it can issue cards on a given

payments network; it is a holder of funds (for example, for gift

cards, deposit accounts and other non-credit cards); and it is a

"settlement point," managing a consumer's account and paying

out to the merchant's account after a purchase.

Issuing Processor:

Connects directly with the networks and issuing bank to

provide the system of record, authorize transactions and

communicate with settlement entities.

Fintech:

Fintech refers to the integration of technology into offerings

by financial services companies in order to improve use and

delivery to consumers.

Merchant:

A merchant simply refers to any business that accepts

card-based payments either via a physical swipe (at the

point-of-sale) or virtually online.

Program Manager:

Businesses that manage various elements of a card

program on behalf of the issuing bank. The Program

Manager is responsible for defining the program,

operating the program, and managing its profitability. The

program manager typically is responsible for

establishing relationships with processors, banks,

payment networks, and distributors and for establishing

account(s) at banks.

pathwardView entire presentation