Vale Results Presentation Deck

Vale's Performance in 2022: Finance

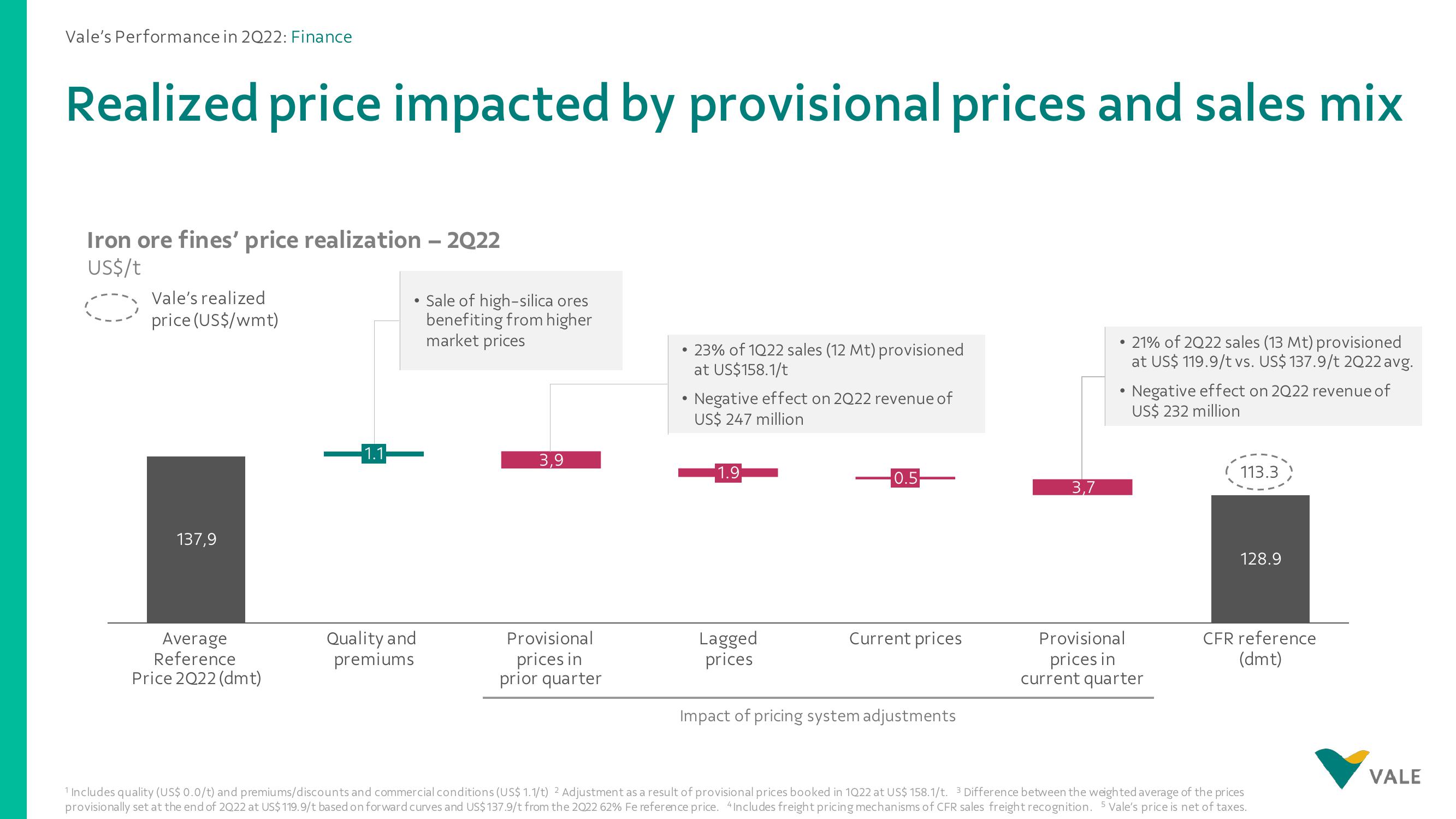

Realized price impacted by provisional prices and sales mix

Iron ore fines' price realization - 2022

US$/t

Vale's realized

price (US$/wmt)

137,9

Average

Reference

Price 2022 (dmt)

1.1

Quality and

premiums

Sale of high-silica ores

benefiting from higher

market prices

3,9

Provisional

prices in

prior quarter

●

●

23% of 1022 sales (12 Mt) provisioned

at US$158.1/t

Negative effect on 2022 revenue of

US$ 247 million

1.9

Lagged

prices

0.5

Current prices

Impact of pricing system adjustments

3,7

●

21% of 2022 sales (13 Mt) provisioned

at US$ 119.9/t vs. US$ 137.9/t 2022 avg.

Negative effect on 2022 revenue of

US$ 232 million

Provisional

prices in

current quarter

113.3

128.9

CFR reference

(dmt)

1 Includes quality (US$ 0.0/t) and premiums/discounts and commercial conditions (US$ 1.1/t) 2 Adjustment as a result of provisional prices booked in 1022 at US$ 158.1/t. 3 Difference between the weighted average of the prices

provisionally set at the end of 2022 at US$ 119.9/t based on forward curves and US$137.9/t from the 2022 62% Fe reference price. 4Includes freight pricing mechanisms of CFR sales freight recognition. 5 Vale's price is net of taxes.

VALEView entire presentation