KKR Real Estate Finance Trust Results Presentation Deck

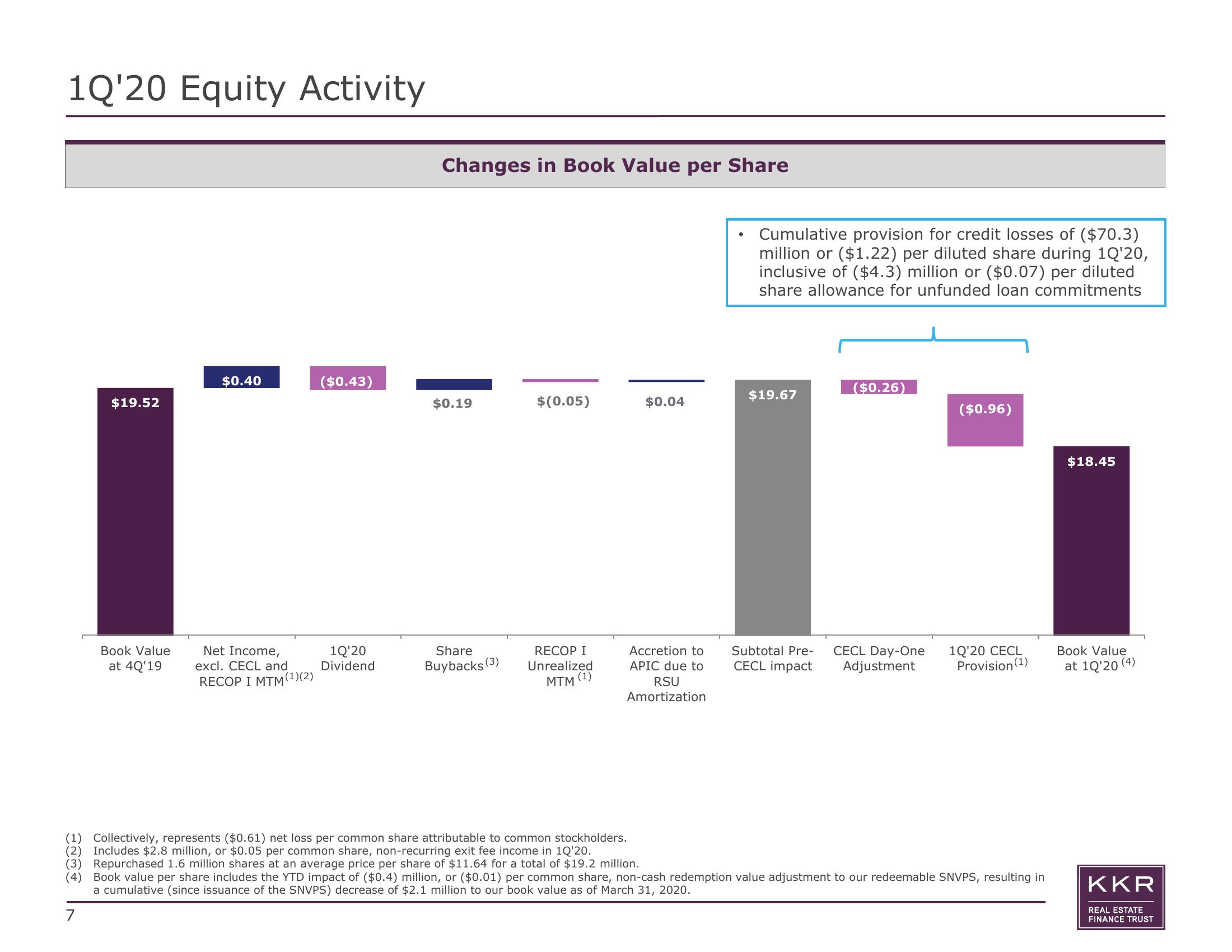

1Q'20 Equity Activity

$19.52

Book Value

at 4Q'19

7

$0.40

Net Income,

excl. CECL and

RECOP I MTM (1)(2)

($0.43)

1Q'20

Dividend

Changes in Book Value per Share

$0.19

Share

Buybacks (3)

$(0.05)

RECOP I

Unrealized

MTM (1)

(1) Collectively, represents ($0.61) net loss per common share attributable to common stockholders.

(2) Includes $2.8 million, or $0.05 per common share, non-recurring exit fee income in 1Q'20.

(3) Repurchased 1.6 million shares at an average price per share of $11.64 for a total of $19.2 million.

$0.04

Accretion to

APIC due to

RSU

Amortization

Cumulative provision for credit losses of ($70.3)

million or ($1.22) per diluted share during 1Q'20,

inclusive of ($4.3) million or ($0.07) per diluted

share allowance for unfunded loan commitments

$19.67

Subtotal Pre-

CECL impact

($0.26)

CECL Day-One

Adjustment

($0.96)

1Q'20 CECL

Provision (1)

(4) Book value per share includes the YTD impact of ($0.4) million, or ($0.01) per common share, non-cash redemption value adjustment to our redeemable SNVPS, resulting in

a cumulative (since issuance of the SNVPS) decrease of $2.1 million to our book value as of March 31, 2020.

$18.45

Book Value

at 10'20 (4)

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation