J.P.Morgan 4Q23 Earnings Results

JPMORGAN CHASE & CO.

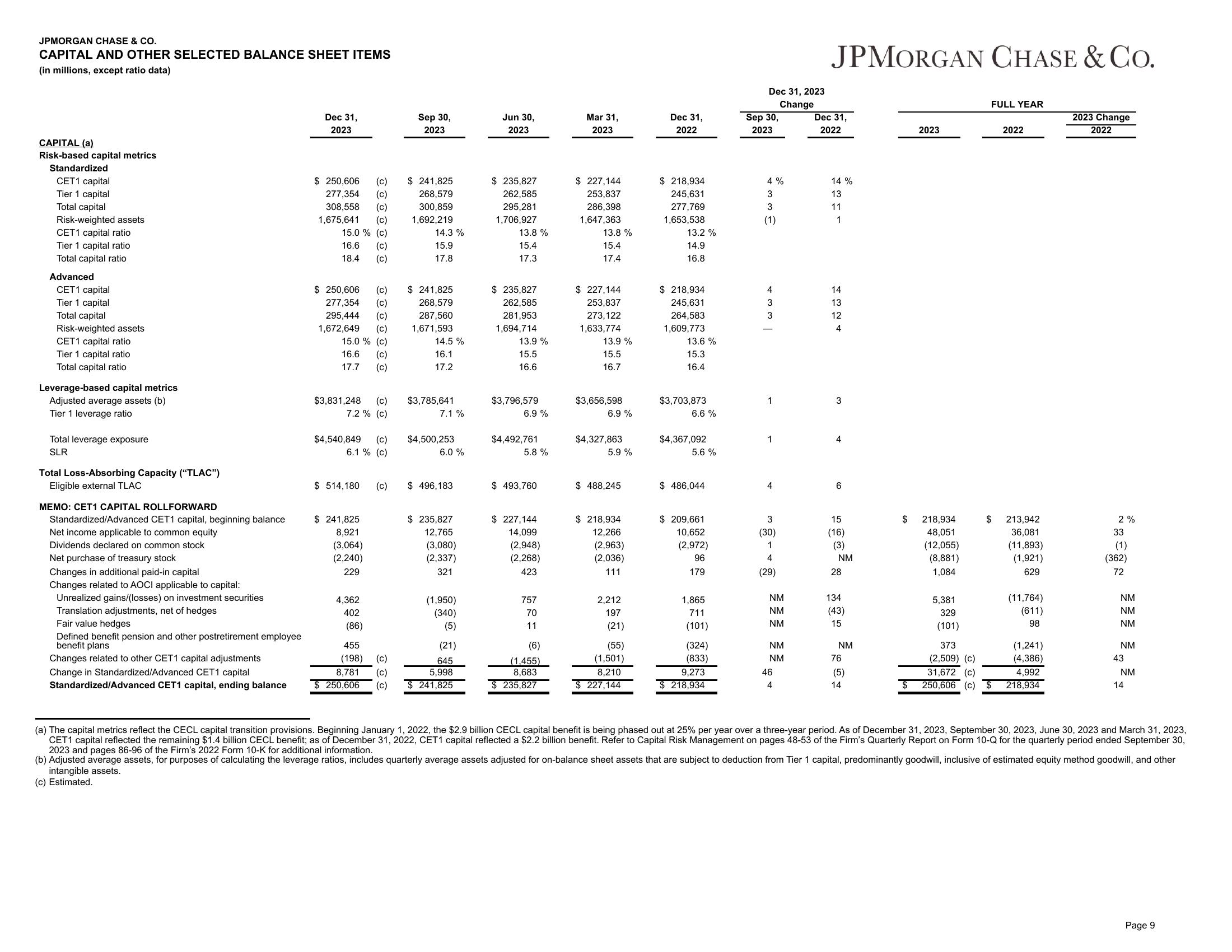

CAPITAL AND OTHER SELECTED BALANCE SHEET ITEMS

(in millions, except ratio data)

CAPITAL (a)

Risk-based capital metrics

Standardized

CET1 capital

Tier 1 capital

Total capital

Risk-weighted assets

CET1 capital ratio

Tier 1 capital ratio

Total capital ratio

Advanced

CET1 capital

Tier 1 capital

Total capital

Risk-weighted assets

CET1 capital ratio

Tier 1 capital ratio

Total capital ratio

Leverage-based capital metrics

Adjusted average assets (b)

Tier 1 leverage ratio

Total leverage exposure

SLR

Total Loss-Absorbing Capacity ("TLAC")

Eligible external TLAC

MEMO: CET1 CAPITAL ROLLFORWARD

Standardized/Advanced CET1 capital, beginning balance

Net income applicable to common equity

Dividends declared on common stock

Net purchase of treasury stock

Changes in additional paid-in capital

Changes related to AOCI applicable to capital:

Unrealized gains/(losses) on investment securities

Translation adjustments, net of hedges

Fair value hedges

Defined benefit pension and other postretirement employee

benefit plans

Changes related to other CET1 capital adjustments

Change in Standardized/Advanced CET1 capital

Standardized/Advanced CET1 capital, ending balance

Dec 31,

2023

$ 250,606

277,354

308,558

1,675,641

15.0 % (c)

16.6

18.4

$ 250,606 (c)

295,444

1,672,649

이이이이이이이

277,354 (c)

이이이이이이이

15.0 % (c)

16.6

17.7

$ 241,825

8,921

(3,064)

(2,240)

229

(c)

4,362

402

(c)

$4,540,849 (c)

6.1 % (c)

(86)

$ 514,180 (c)

$3,831,248 (c) $3,785,641

7.2% (c)

Sep 30,

2023

455

(198) (c)

8,781 (c)

250,606 (c)

$241,825

268,579

300,859

1,692,219

14.3%

15.9

17.8

$241,825

268,579

287,560

1,671,593

14.5%

16.1

17.2

7.1 %

$4,500,253

6.0 %

$ 496,183

$ 235,827

12,765

(3,080)

(2,337)

321

(1,950)

(340)

(5)

(21)

645

5,998

$241,825

Jun 30,

2023

$ 235,827

262,585

295,281

1,706,927

13.8%

15.4

17.3

$ 235,827

262,585

281,953

1,694,714

13.9%

15.5

16.6

$3,796,579

6.9 %

$4,492,761

5.8 %

$493,760

$ 227,144

14,099

(2,948)

(2,268)

423

757

70

11

(6)

(1,455)

8,683

235,827

Mar 31,

2023

$ 227,144

253,837

286,398

1,647,363

13.8 %

15.4

17.4

$ 227,144

253,837

273, 122

1,633,774

13.9%

15.5

16.7

$3,656,598

6.9 %

$4,327,863

5.9 %

$ 488,245

$ 218,934

12,266

(2,963)

(2,036)

111

2,212

197

(21)

(55)

(1,501)

8,210

$227,144

Dec 31,

2022

$218,934

245,631

277,769

1,653,538

13.2 %

14.9

16.8

$218,934

245,631

264,583

1,609,773

13.6 %

15.3

16.4

$3,703,873

6.6 %

$4,367,092

5.6 %

$ 486,044

$ 209,661

10,652

(2,972)

96

179

1,865

711

(101)

(324)

(833)

9,273

$218,934

Dec 31, 2023

Change

Sep 30,

2023

4%

3

3

(1)

4

3

3

1

1

4

3

(30)

1

4

(29)

NM

NM

NM

NM

NM

46

4

JPMORGAN CHASE & Co.

Dec 31,

2022

14 %

13

11

1

14

13

12

4

3

4

6

15

(16)

(3)

NM

28

134

(43)

15

NM

76

(5)

14

$

$

2023

218,934

48,051

(12,055)

(8,881)

1,084

5,381

329

(101)

FULL YEAR

2022

$ 213,942

36,081

(11,893)

(1,921)

629

373

(2,509) (c)

31,672 (c)

250,606 (c) $

(11,764)

(611)

98

(1,241)

(4,386)

4,992

218,934

2023 Change

2022

*æēgs 11³ 1,1,

(362)

(a) The capital metrics reflect the CECL capital transition provisions. Beginning January 1, 2022, the $2.9 billion CECL capital benefit is being phased out at 25% per year over a three-year period. As of December 31, 2023, September 30, 2023, June 30, 2023 and March 31, 2023,

CET1 capital reflected the remaining $1.4 billion CECL benefit; as of December 31, 2022, CET1 capital reflected a $2.2 billion benefit. Refer to Capital Risk Management on pages 48-53 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended September 30,

2023 and pages 86-96 of the Firm's 2022 Form 10-K for additional information.

(b) Adjusted average assets, for purposes of calculating the leverage ratios, includes quarterly average assets adjusted for on-balance sheet assets that are subject to deduction from Tier 1 capital, predominantly goodwill, inclusive of estimated equity method goodwill, and other

intangible assets.

(c) Estimated.

Page 9View entire presentation