Allwyn Investor Conference Presentation Deck

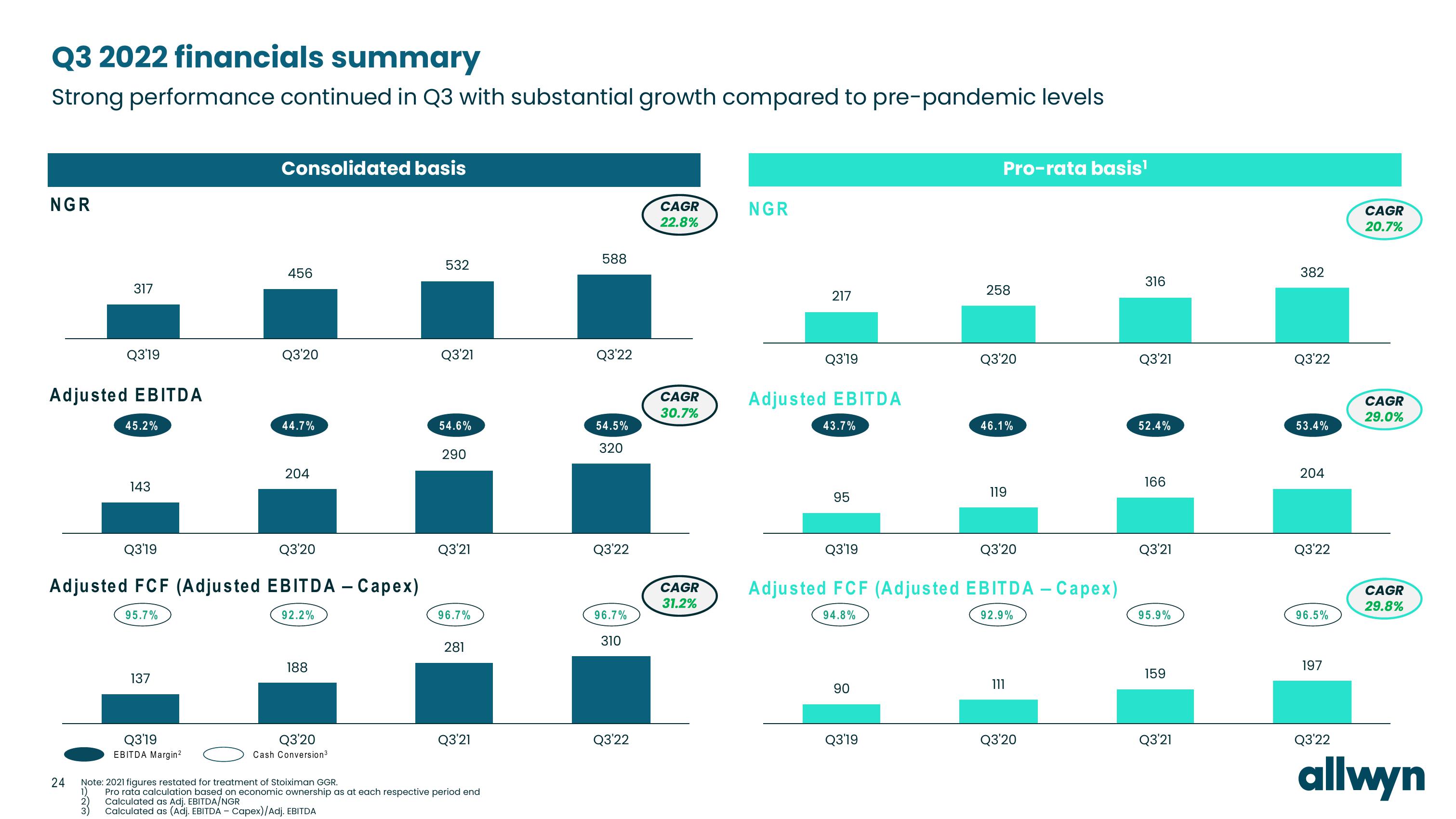

Q3 2022 financials summary

Strong performance continued in Q3 with substantial growth compared to pre-pandemic levels

NGR

317

Adjusted EBITDA

24

Q3'19

1)

2)

3)

45.2%

143

95.7%

137

Consolidated basis

Q3'19

Q3'20

Adjusted FCF (Adjusted EBITDA - Capex)

92.2%

Q3'19

EBITDA Margin²

456

Q3'20

44.7%

204

188

Q3'20

Cash Conversion ³

532

Q3'21

54.6%

290

Q3'21

96.7%

281

Q3'21

Note: 2021 figures restated for treatment of Stoiximan GGR.

Pro rata calculation based on economic ownership as at each respective period end

Calculated as Adj. EBITDA/NGR

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

588

Q3'22

54.5%

320

Q3'22

96.7%

310

Q3'22

CAGR

22.8%

CAGR

30.7%

CAGR

31.2%

NGR

217

Q3'19

Adjusted EBITDA

43.7%

95

Q3'19

90

Pro-rata basis¹

Q3'19

258

Q3'20

46.1%

119

Adjusted FCF (Adjusted EBITDA - Capex)

94.8%

92.9%

Q3'20

111

Q3'20

316

Q3'21

52.4%

166

Q3'21

95.9%

159

Q3'21

382

Q3'22

53.4%

204

Q3'22

96.5%

197

Q3'22

CAGR

20.7%

CAGR

29.0%

CAGR

29.8%

allwynView entire presentation