Sonos Results Presentation Deck

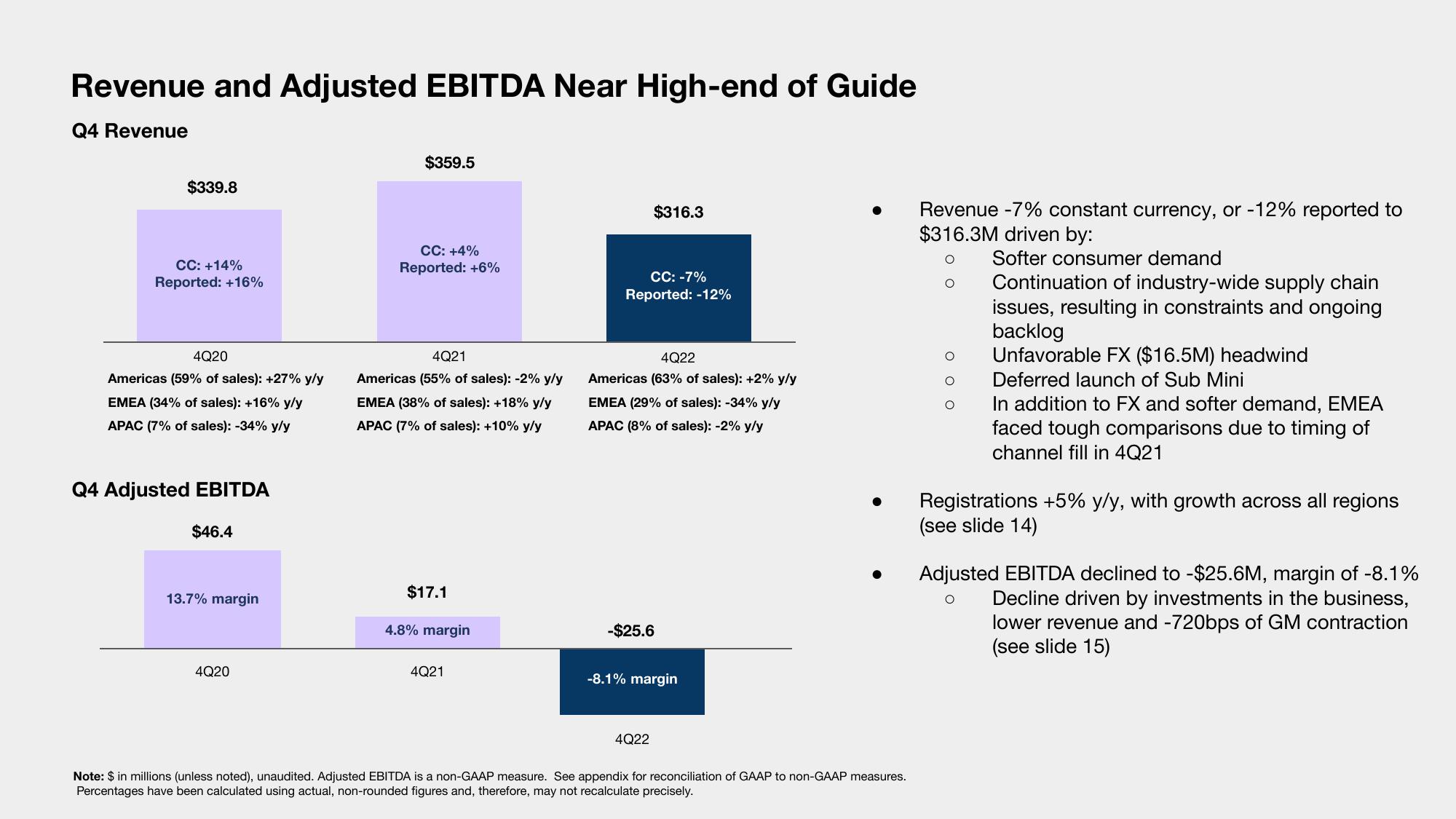

Revenue and Adjusted EBITDA Near High-end of Guide

Q4 Revenue

$339.8

CC: +14%

Reported: +16%

4Q20

Americas (59% of sales): +27% y/y

EMEA (34% of sales): +16% y/y

APAC (7% of sales): -34% y/y

Q4 Adjusted EBITDA

$46.4

13.7% margin

4Q20

$359.5

CC: +4%

Reported: +6%

4Q21

Americas (55% of sales): -2% y/y

EMEA (38% of sales): +18% y/y

APAC (7% of sales): +10% y/y

$17.1

4.8% margin

4Q21

CC: -7%

Reported: -12%

$316.3

4Q22

Americas (63% of sales): +2% y/y

EMEA (29% of sales): -34% y/y

APAC (8% of sales): -2% y/y

-$25.6

-8.1% margin

4Q22

Note: $ in millions (unless noted), unaudited. Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation of GAAP to non-GAAP measures.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

Revenue -7% constant currency, or -12% reported to

$316.3M driven by:

O

Softer consumer demand

O

OOO

Continuation of industry-wide supply chain

issues, resulting in constraints and ongoing

backlog

Unfavorable FX ($16.5M) headwind

Deferred launch of Sub Mini

In addition to FX and softer demand, EMEA

faced tough comparisons due to timing of

channel fill in 4Q21

Registrations +5% y/y, with growth across all regions

(see slide 14)

Adjusted EBITDA declined to -$25.6M, margin of -8.1%

Decline driven by investments in the business,

O

lower revenue and -720bps of GM contraction

(see slide 15)View entire presentation