Gogoro SPAC Presentation Deck

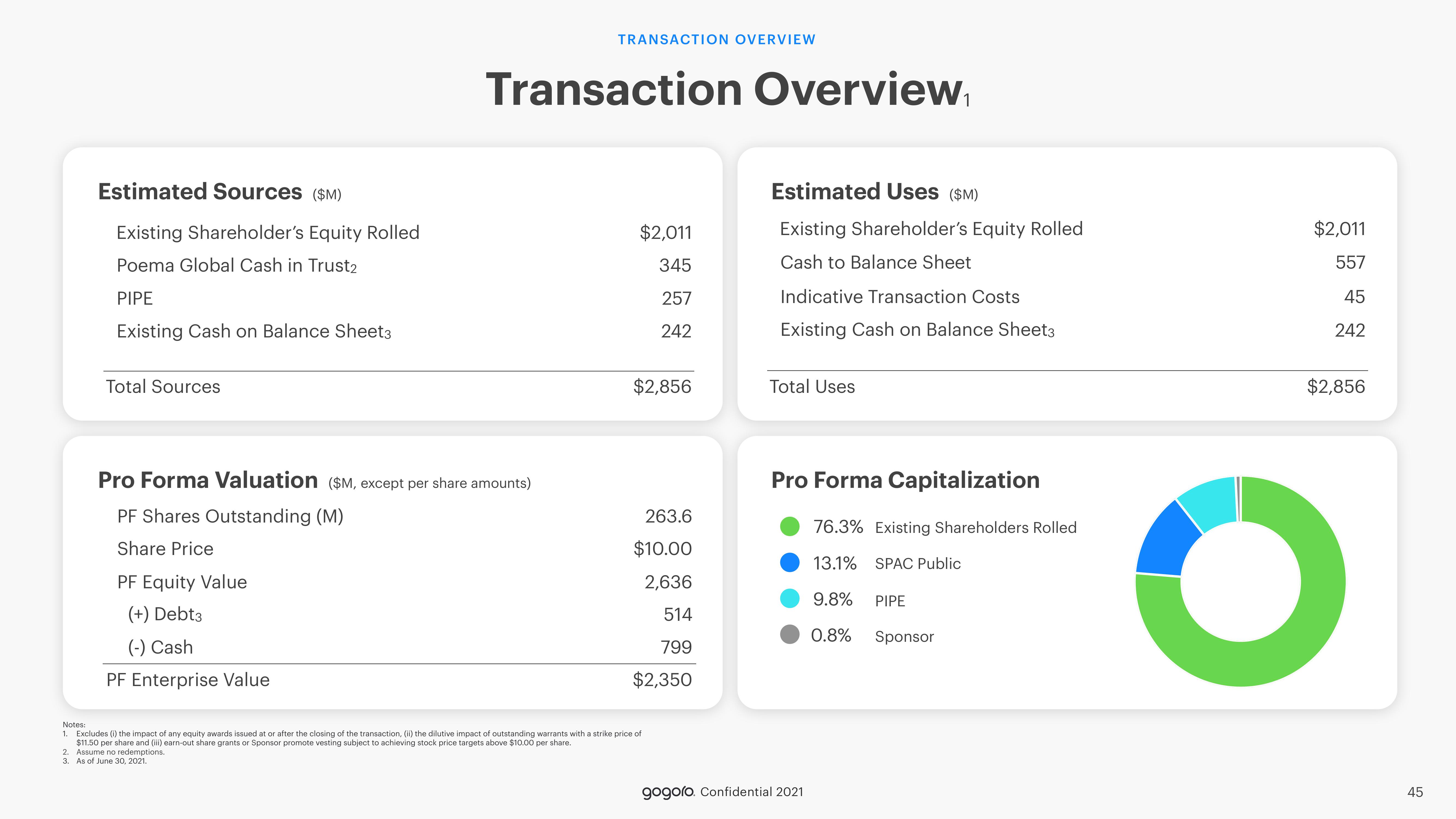

Estimated Sources ($M)

Existing Shareholder's Equity Rolled

Poema Global Cash in Trust2

PIPE

Existing Cash on Balance Sheet3

Total Sources

TRANSACTION OVERVIEW

Transaction Overview

Pro Forma Valuation ($M, except per share amounts)

PF Shares Outstanding (M)

Share Price

PF Equity Value

(+) Debt3

(-) Cash

PF Enterprise Value

$2,011

345

257

242

$2,856

263.6

$10.00

2,636

514

799

$2,350

Notes:

1. Excludes (i) the impact of any equity awards issued at or after the closing of the transaction, (ii) the dilutive impact of outstanding warrants with a strike price of

$11.50 per share and (iii) earn-out share grants or Sponsor promote vesting subject to achieving stock price targets above $10.00 per share.

2. Assume no redemptions.

3. As of June 30, 2021.

Estimated Uses ($M)

Existing Shareholder's Equity Rolled

Cash to Balance Sheet

Indicative Transaction Costs

Existing Cash on Balance Sheet3

Total Uses

Pro Forma Capitalization

gogoro. Confidential 2021

76.3% Existing Shareholders Rolled

13.1% SPAC Public

9.8% PIPE

0.8% Sponsor

$2,011

557

45

242

$2,856

O

45View entire presentation