WeWork Investor Day Presentation Deck

Transaction overview

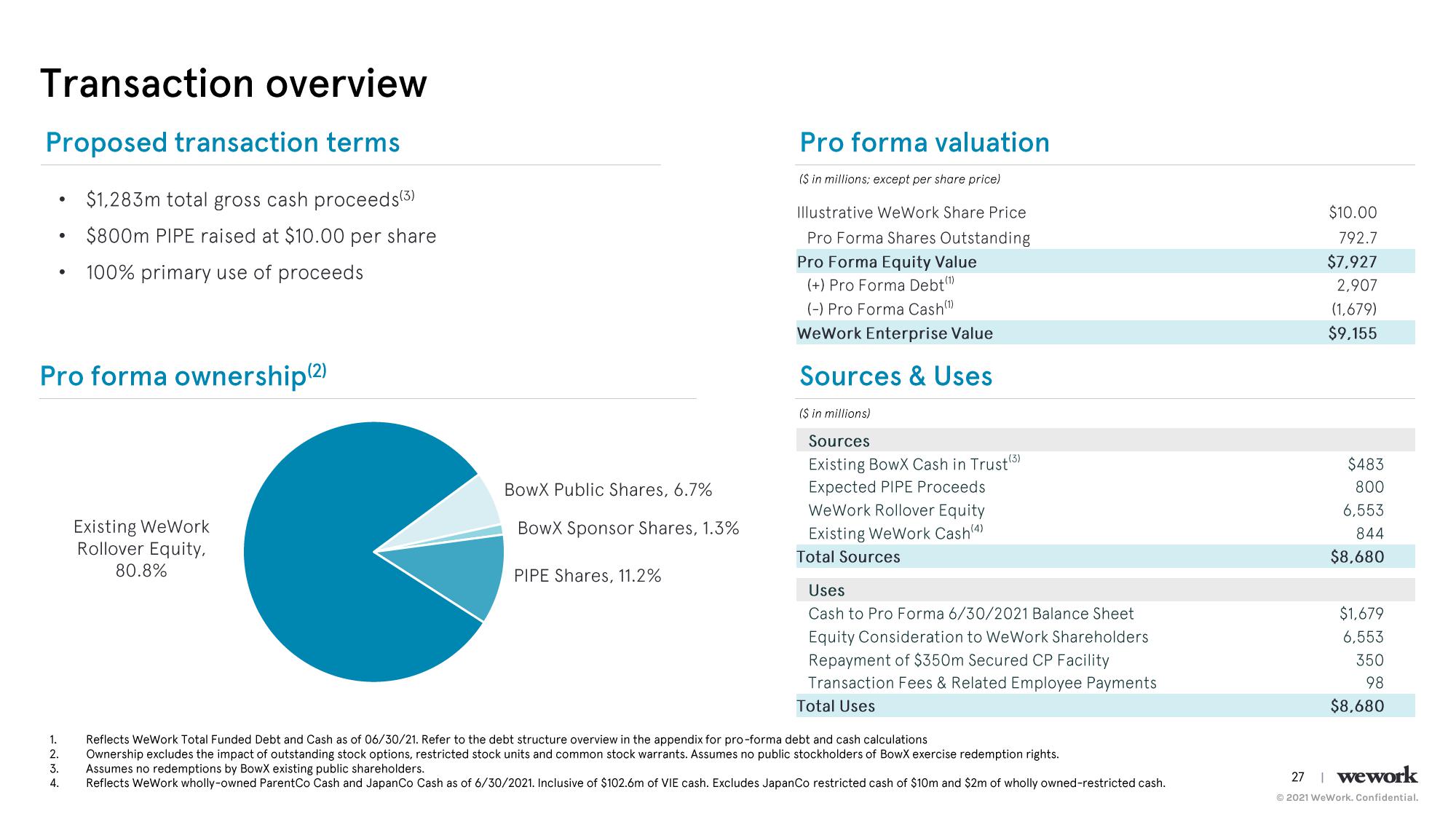

Proposed transaction terms

$1,283m total gross cash proceeds (3)

$800m PIPE raised at $10.00 per share

100% primary use of proceeds

●

●

Pro forma ownership(2)

1.

2.

3.

4.

Existing WeWork

Rollover Equity,

80.8%

BowX Public Shares, 6.7%

BowX Sponsor Shares, 1.3%

PIPE Shares, 11.2%

Pro forma valuation

($ in millions; except per share price)

Illustrative WeWork Share Price

Pro Forma Shares Outstanding

Pro Forma Equity Value

(+) Pro Forma Debt(¹)

(-) Pro Forma Cash (¹)

WeWork Enterprise Value

Sources & Uses

($ in millions)

Sources

Existing BowX Cash in Trust (3)

Expected PIPE Proceeds

WeWork Rollover Equity

Existing WeWork Cash (4)

Total Sources

Uses

Cash to Pro Forma 6/30/2021 Balance Sheet

Equity Co deration to WeWork Shareholders

Repayment of $350m Secured CP Facility

Transaction Fees & Related Employee Payments

Total Uses

Reflects WeWork Total Funded Debt and Cash as of 06/30/21. Refer to the debt structure overview in the appendix for pro-forma debt and cash calculations

Ownership excludes the impact of outstanding stock options, restricted stock units and common stock warrants. Assumes no public stockholders of BowX exercise redemption rights.

Assumes no redemptions by BowX existing public shareholders.

Reflects WeWork wholly-owned ParentCo Cash and JapanCo Cash as of 6/30/2021. Inclusive of $102.6m of VIE cash. Excludes JapanCo restricted cash of $10m and $2m of wholly owned-restricted cash.

$10.00

792.7

$7,927

2,907

(1,679)

$9,155

$483

800

6,553

844

$8,680

$1,679

6,553

350

98

$8,680

27 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation