WeWork SPAC Presentation Deck

Transaction overview (cont'd)

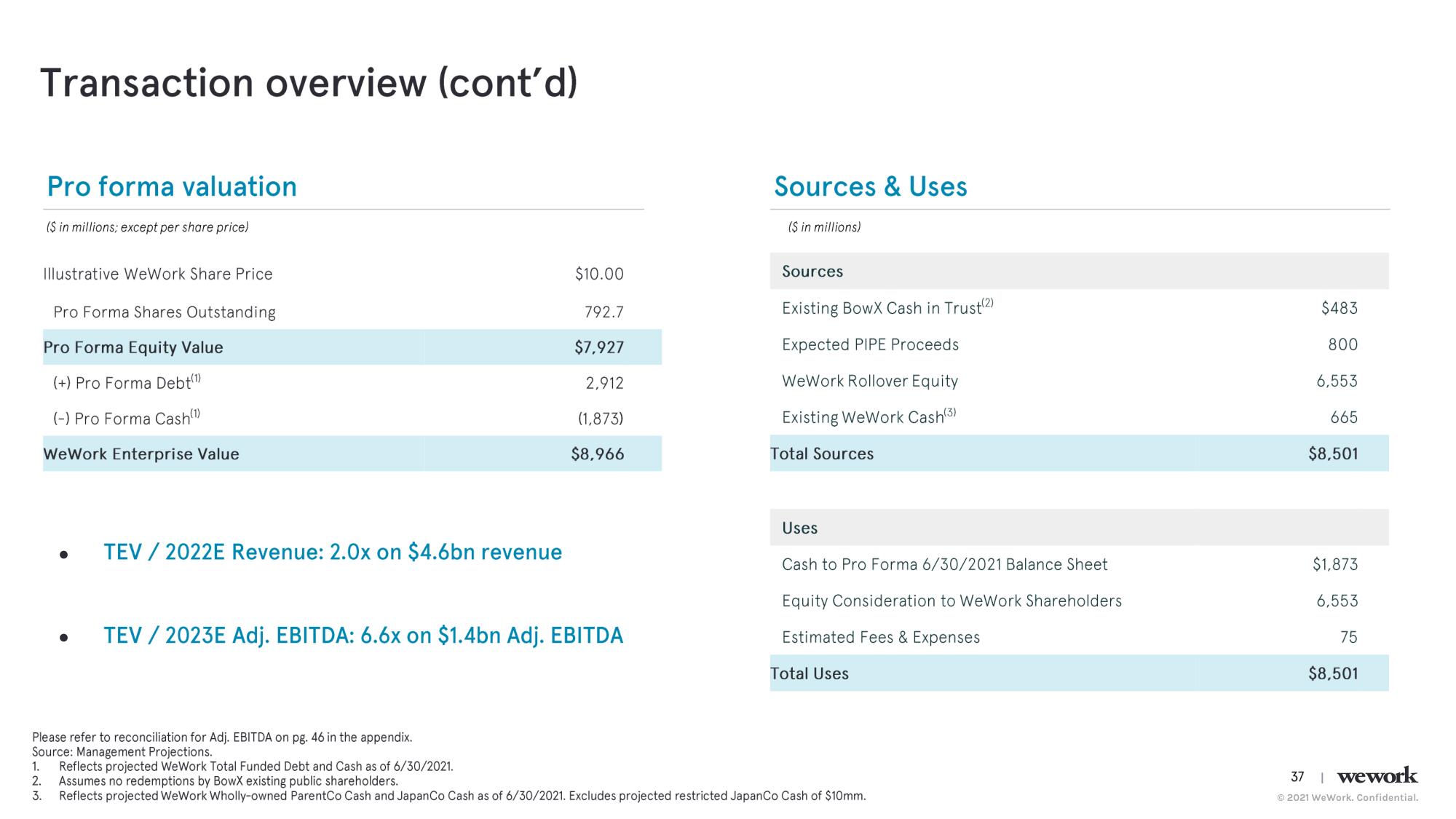

Pro forma valuation

($ in millions; except per share price)

Illustrative WeWork Share Price

Pro Forma Shares Outstanding

Pro Forma Equity Value

(+) Pro Forma Debt(¹)

(-) Pro Forma Cash(1)

We Work Enterprise Value

●

●

TEV / 2022E Revenue: 2.0x on $4.6bn revenue

$10.00

Please refer to reconciliation for Adj. EBITDA on pg. 46 in the appendix.

Source: Management Projections.

1. Reflects projected WeWork Total Funded Debt and Cash as of 6/30/2021.

2.

3.

792.7

$7,927

2,912

(1,873)

$8,966

TEV / 2023E Adj. EBITDA: 6.6x on $1.4bn Adj. EBITDA

Sources & Uses

($ in millions)

Sources

Existing BowX Cash in Trust(2)

Expected PIPE Proceeds

WeWork Rollover Equity

Existing WeWork Cash(3)

Total Sources

Uses

Cash to Pro Forma 6/30/2021 Balance Sheet

Equity Consideration to WeWork Shareholders

Estimated Fees & Expenses

Total Uses

Assumes no redemptions by BowX existing public shareholders.

Reflects projected WeWork Wholly-owned ParentCo Cash and Japan Co Cash as of 6/30/2021. Excludes projected restricted Japan Co Cash of $10mm.

$483

800

6,553

665

$8,501

$1,873

6,553

75

$8,501

37 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation