Wix Results Presentation Deck

Business Outlook

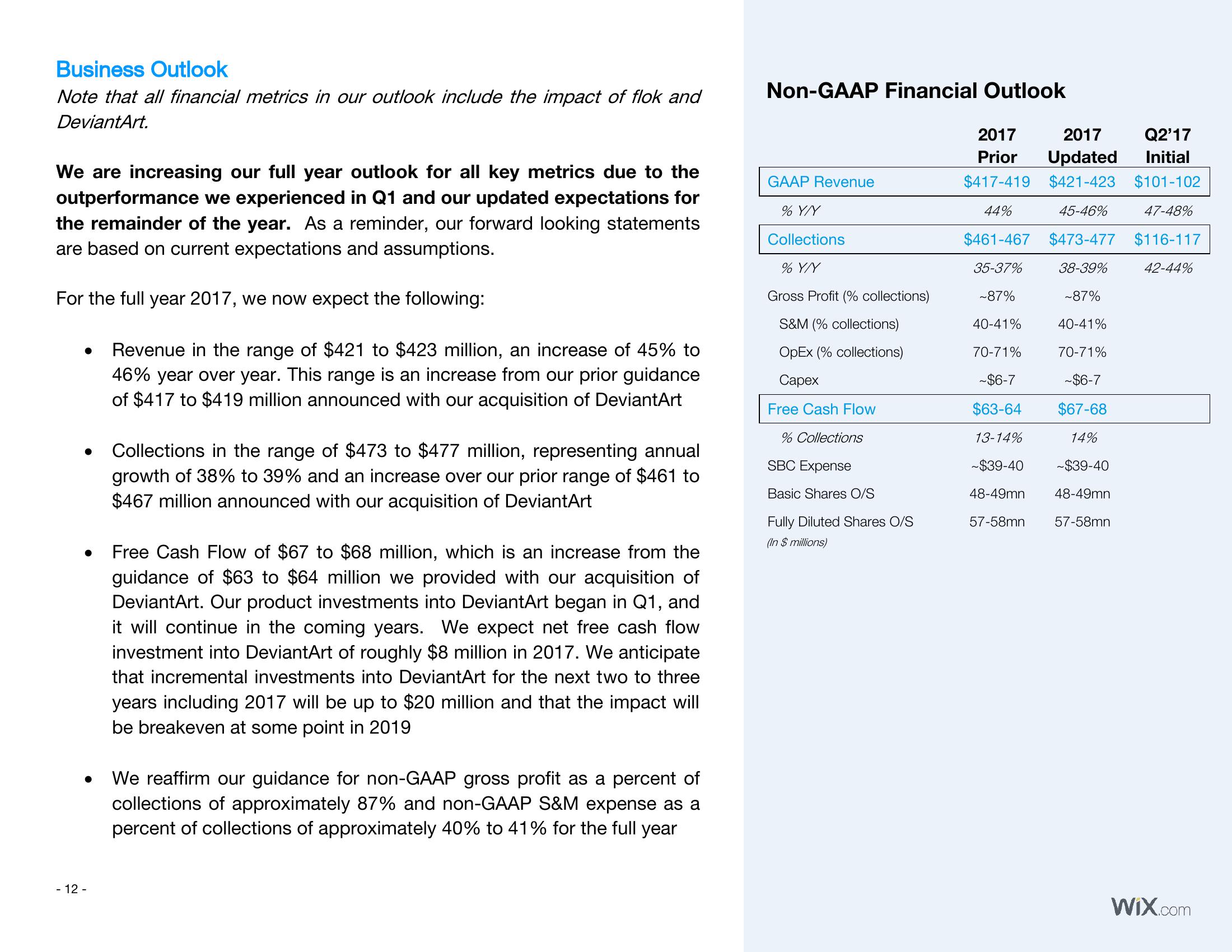

Note that all financial metrics in our outlook include the impact of flok and

DeviantArt.

We are increasing our full year outlook for all key metrics due to the

outperformance we experienced in Q1 and our updated expectations for

the remainder of the year. As a reminder, our forward looking statements

are based on current expectations and assumptions.

For the full year 2017, we now expect the following:

Revenue in the range of $421 to $423 million, an increase of 45% to

46% year over year. This range is an increase from our prior guidance

of $417 to $419 million announced with our acquisition of DeviantArt

●

●

●

●

- 12-

Collections in the range of $473 to $477 million, representing annual

growth of 38% to 39% and an increase over our prior range of $461 to

$467 million announced with our acquisition of DeviantArt

Free Cash Flow of $67 to $68 million, which is an increase from the

guidance of $63 to $64 million we provided with our acquisition of

DeviantArt. Our product investments into DeviantArt began in Q1, and

it will continue in the coming years. We expect net free cash flow

investment into DeviantArt of roughly $8 million in 2017. We anticipate

that incremental investments into DeviantArt for the next two to three

years including 2017 will be up to $20 million and that the impact will

be breakeven at some point in 2019

We reaffirm our guidance for non-GAAP gross profit as a percent of

collections of approximately 87% and non-GAAP S&M expense as a

percent of collections of approximately 40% to 41% for the full year

Non-GAAP Financial Outlook

GAAP Revenue

% Y/Y

Collections

% Y/Y

Gross Profit (% collections)

S&M (% collections)

OpEx (% collections)

Capex

Free Cash Flow

% Collections

SBC Expense

Basic Shares O/S

Fully Diluted Shares O/S

(In $ millions)

Q2'17

2017 2017

Prior Updated Initial

$417-419 $421-423 $101-102

44%

45-46% 47-48%

$461-467 $473-477 $116-117

35-37%

42-44%

38-39%

~87%

~87%

40-41%

40-41%

70-71%

70-71%

~$6-7

~$6-7

$63-64 $67-68

13-14%

14%

~$39-40 ~$39-40

48-49mn

48-49mn

57-58mn

57-58mn

WIX.comView entire presentation