Credit Suisse Investor Event Presentation Deck

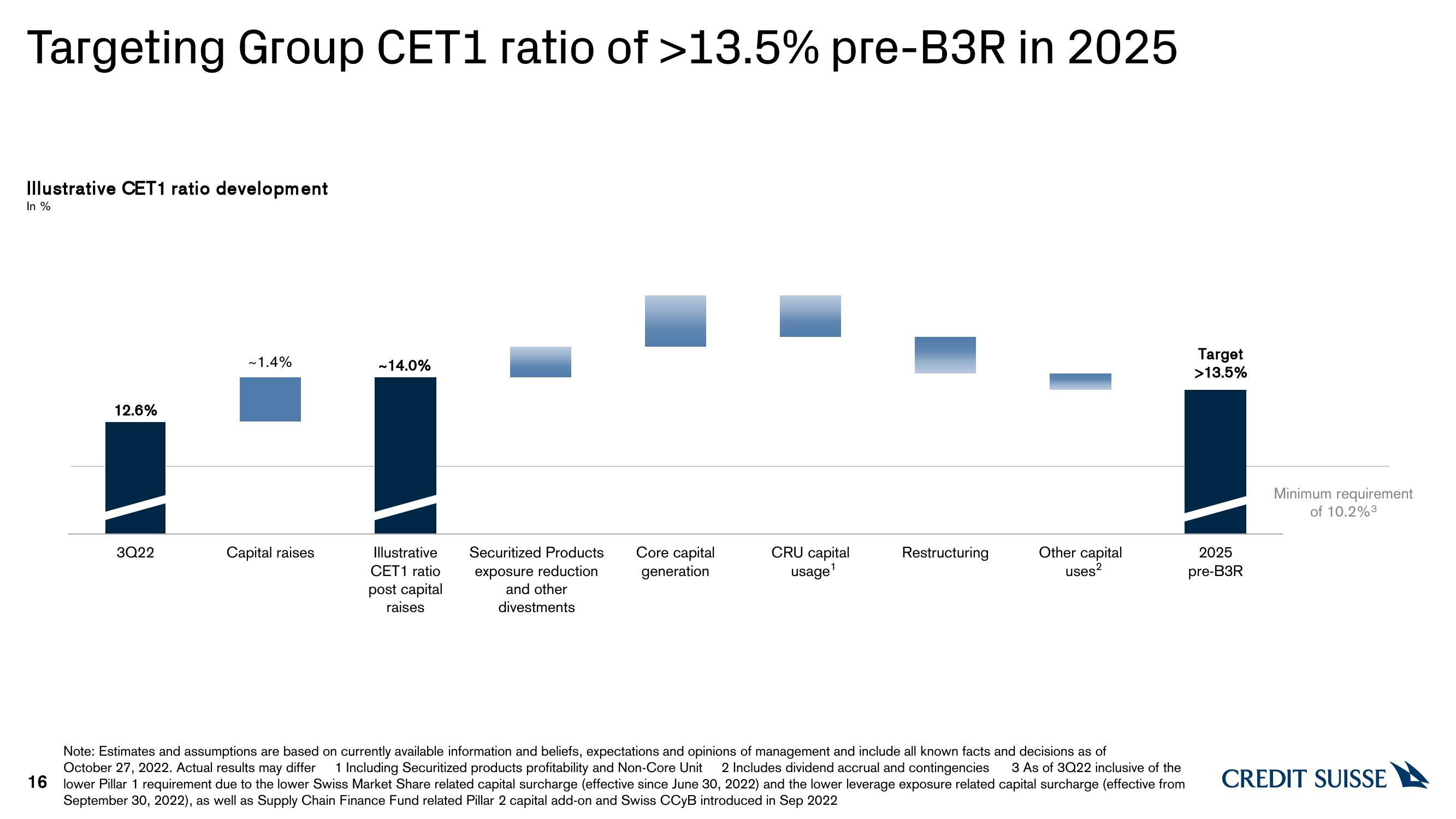

Targeting Group CET1 ratio of >13.5% pre-B3R in 2025

Illustrative CET1 ratio development

In %

12.6%

3Q22

~1.4%

Capital raises

~14.0%

Illustrative

CET1 ratio

post capital

raises

Securitized Products

exposure reduction

and other

divestments

Core capital

generation

CRU capital

usage¹

Restructuring

Other capital

uses²

3 As of 3Q22 inclusive of the

Note: Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of

October 27, 2022. Actual results may differ 1 Including Securitized products profitability and Non-Core Unit 2 Includes dividend accrual and contingencies

16 lower Pillar 1 requirement due to the lower Swiss Market Share related capital surcharge (effective since June 30, 2022) and the lower leverage exposure related capital surcharge (effective from

September 30, 2022), as well as Supply Chain Finance Fund related Pillar 2 capital add-on and Swiss CCyB introduced in Sep 2022

Target

>13.5%

2025

pre-B3R

Minimum requirement

of 10.2%³

CREDIT SUISSEView entire presentation