Selina SPAC

Destination Case Study: Miami Gold Dust and Little River

SUMMARY

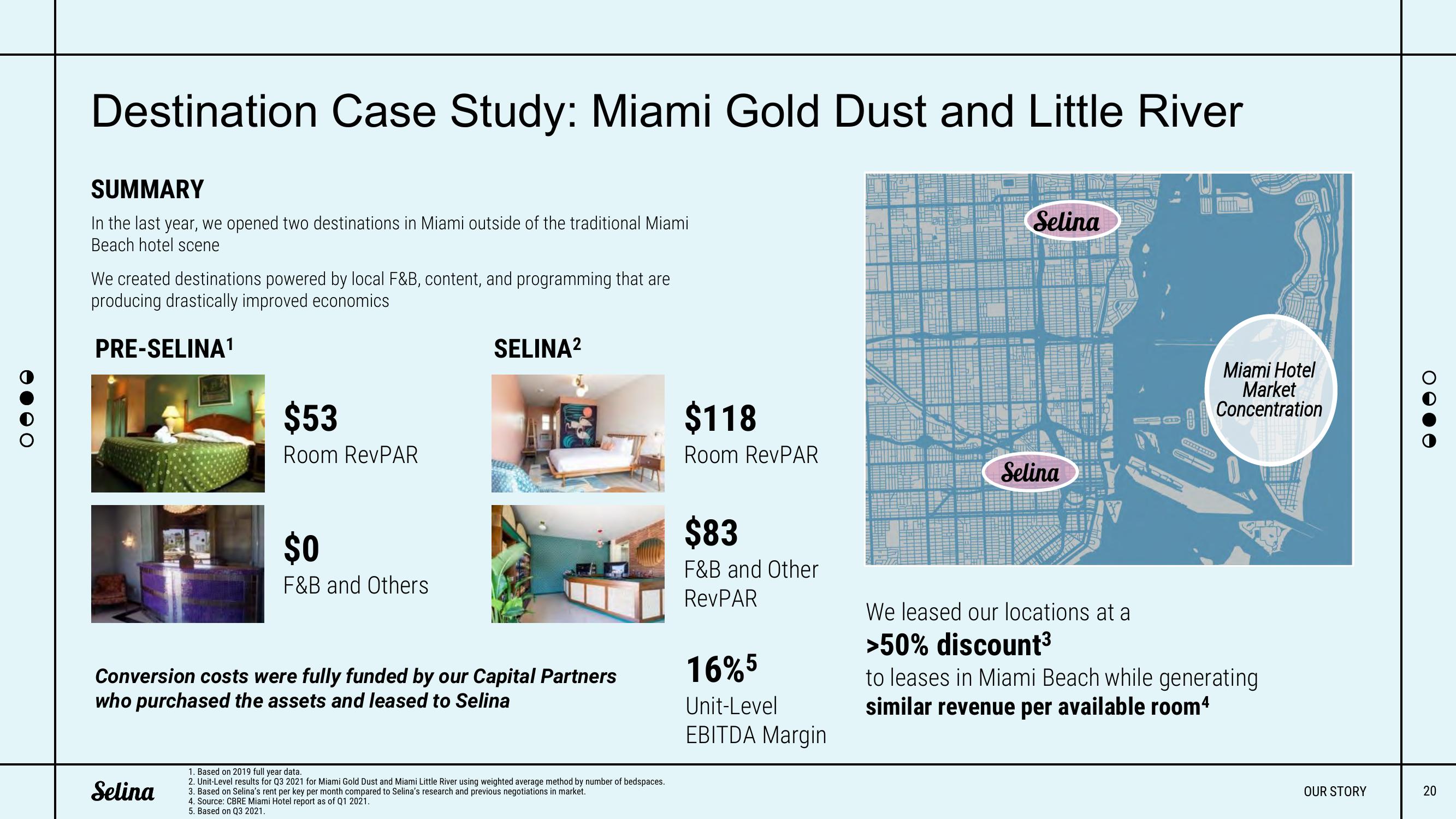

In the last year, we opened two destinations in Miami outside of the traditional Miami

Beach hotel scene

We created destinations powered by local F&B, content, and programming that are

producing drastically improved economics

PRE-SELINA¹

$53

Room RevPAR

Selina

$0

F&B and Others

Conversion costs were fully funded by our Capital Partners

who purchased the assets and leased to Selina

SELINA²

1. Based on 2019 full year data.

2. Unit-Level results for Q3 2021 for Miami Gold Dust and Miami Little River using weighted average method by number of bedspaces.

3. Based on Selina's rent per key per month compared to Selina's research and previous negotiations in market.

4. Source: CBRE Miami Hotel report as of Q1 2021.

5. Based on Q3 2021.

$118

Room RevPAR

$83

F&B and Other

RevPAR

16% 5

Unit-Level

EBITDA Margin

Ein

BEAM EE

Selina

Selina

Miami Hotel

Market

Concentration

SHEH

We leased our locations at a

>50% discount³

to leases in Miami Beach while generating

similar revenue per available room4

OUR STORY

20View entire presentation