Hilltop Holdings Results Presentation Deck

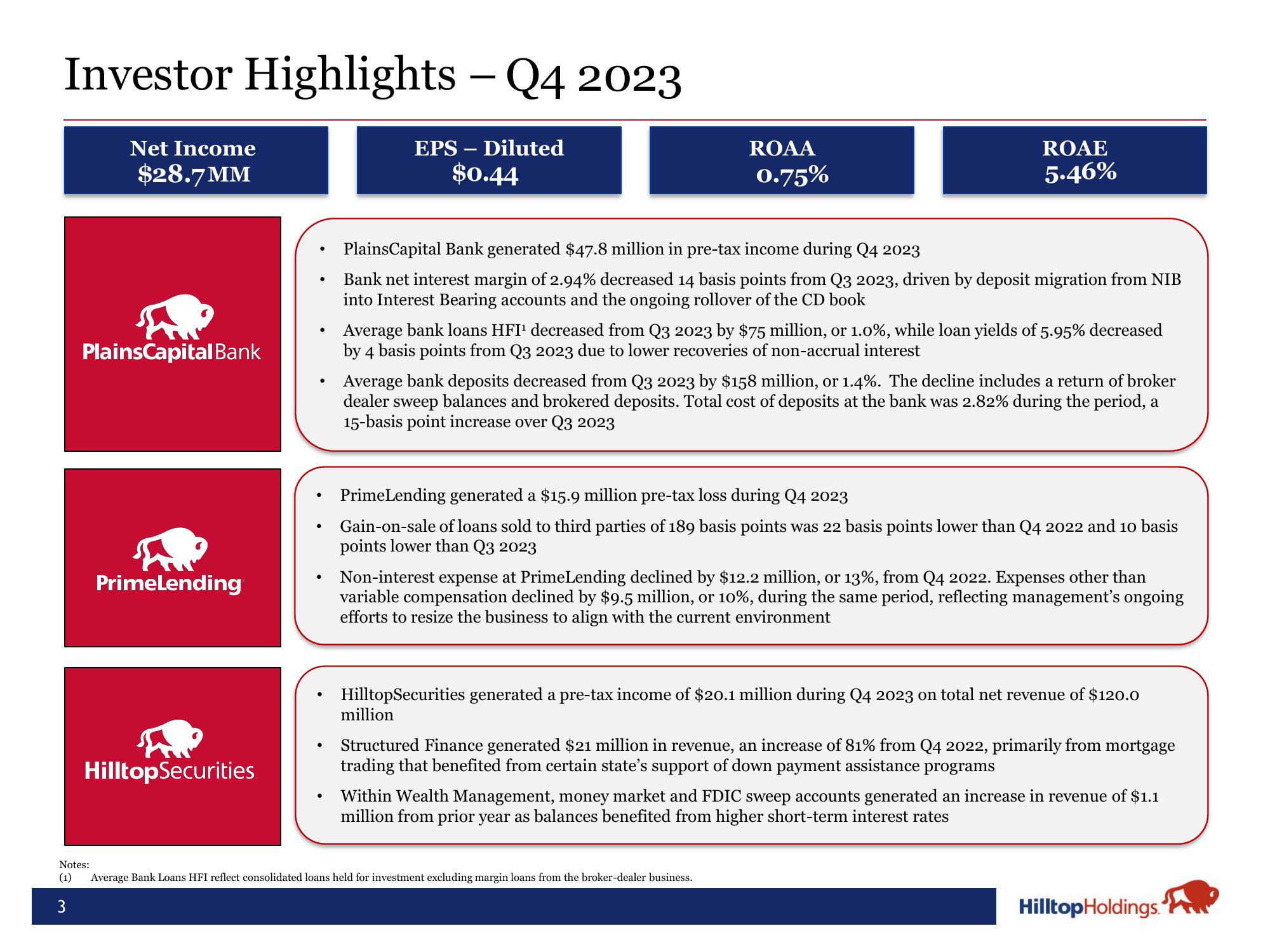

Investor Highlights – Q4 2023

EPS - Diluted

$0.44

3

Net Income

$28.7MM

PlainsCapital Bank

Notes:

(1)

PrimeLending

HilltopSecurities

●

●

●

ROAA

0.75%

ROAE

5.46%

PlainsCapital Bank generated $47.8 million in pre-tax income during Q4 2023

Bank net interest margin of 2.94% decreased 14 basis points from Q3 2023, driven by deposit migration from NIB

into Interest Bearing accounts and the ongoing rollover of the CD book

Average bank loans HFI¹ decreased from Q3 2023 by $75 million, or 1.0%, while loan yields of 5.95% decreased

by 4 basis points from Q3 2023 due to lower recoveries of non-accrual interest

Average bank deposits decreased from Q3 2023 by $158 million, or 1.4%. The decline includes a return of broker

dealer sweep balances and brokered deposits. Total cost of deposits at the bank was 2.82% during the period, a

15-basis point increase over Q3 2023

PrimeLending generated a $15.9 million pre-tax loss during Q4 2023

Gain-on-sale of loans sold to third parties of 189 basis points was 22 basis points lower than Q4 2022 and 10 basis

points lower than Q3 2023

Non-interest expense at PrimeLending declined by $12.2 million, or 13%, from Q4 2022. Expenses other than

variable compensation declined by $9.5 million, or 10%, during the same period, reflecting management's ongoing

efforts to resize the business to align with the current environment

HilltopSecurities generated a pre-tax income of $20.1 million during Q4 2023 on total net revenue of $120.0

million

Structured Finance generated $21 million in revenue, an increase of 81% from Q4 2022, primarily from mortgage

trading that benefited from certain state's support of down payment assistance programs

Average Bank Loans HFI reflect consolidated loans held for investment excluding margin loans from the broker-dealer business.

Within Wealth Management, money market and FDIC sweep accounts generated an increase in revenue of $1.1

million from prior year as balances benefited from higher short-term interest rates

Hilltop Holdings.View entire presentation