Getty SPAC Presentation Deck

Transaction Overview

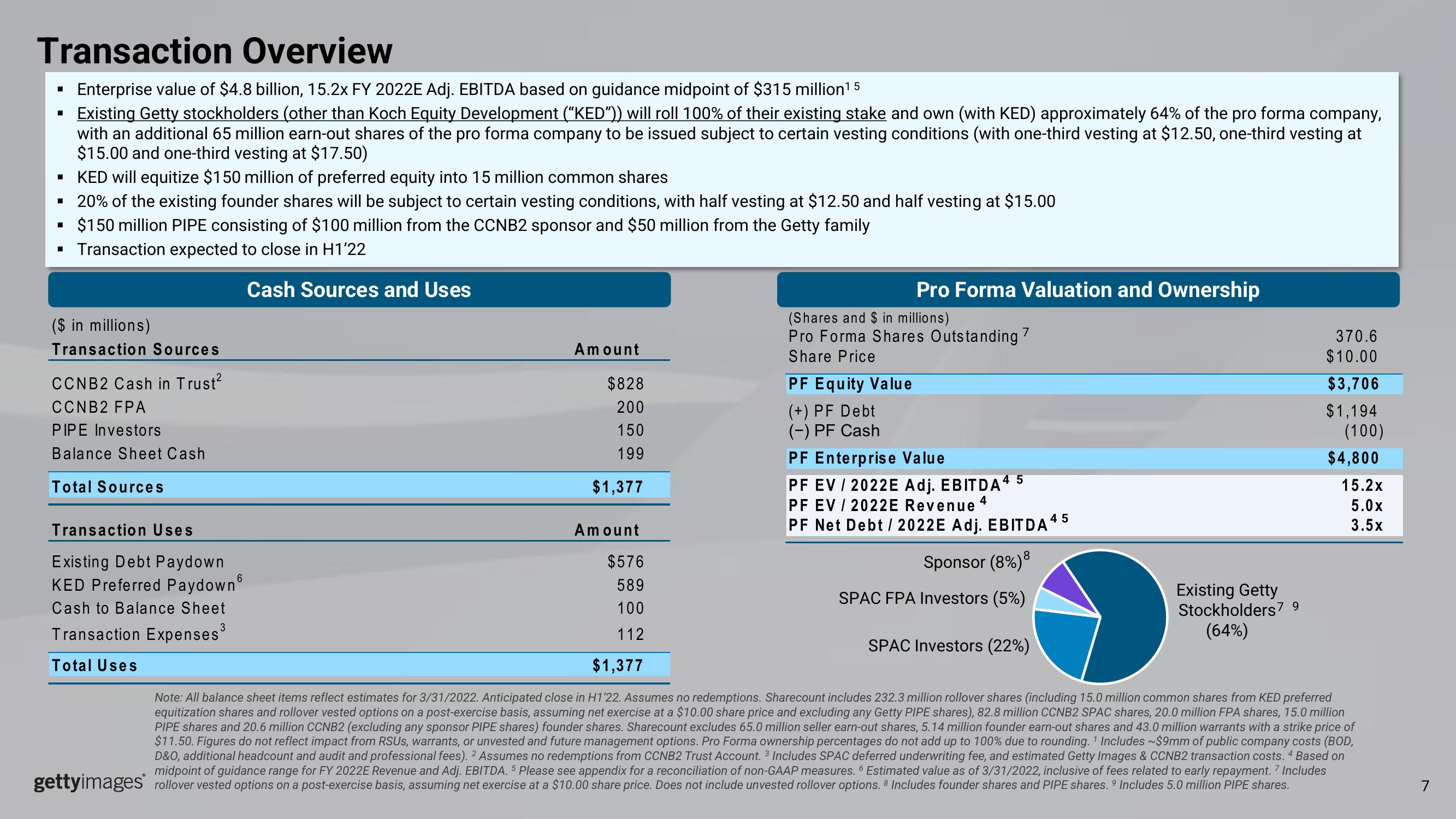

Enterprise value of $4.8 billion, 15.2x FY 2022E Adj. EBITDA based on guidance midpoint of $315 million¹5

Existing Getty stockholders (other than Koch Equity Development ("KED")) will roll 100% of their existing stake and own (with KED) approximately 64% of the pro forma company,

with an additional 65 million earn-out shares of the pro forma company to be issued subject to certain vesting conditions (with one-third vesting at $12.50, one-third vesting at

$15.00 and one-third vesting at $17.50)

KED will equitize $150 million of preferred equity into 15 million common shares

▪ 20% of the existing founder shares will be subject to certain vesting conditions, with half vesting at $12.50 and half vesting at $15.00

$150 million PIPE consisting of $100 million from the CCNB2 sponsor and $50 million from the Getty family

▪ Transaction expected to close in H1'22

■

■

■

■

($ in millions)

Transaction Sources

CCNB2 Cash in Trust²

CCNB2 FPA

PIPE Investors

Balance Sheet Cash

Total Sources

Transaction Uses

Existing Debt Paydown

KED Preferred Paydown

Cash to Balance Sheet

Transaction Expenses ³

Total Uses

Cash Sources and Uses

6

Amount

$828

200

150

199

$1,377

Pro Forma Valuation and Ownership

(Shares and $ in millions)

Pro Forma Shares Outstanding 7

Share Price

PF Equity Value

(+) PF Debt

(-) PF Cash

PF Enterprise Value

PF EV / 2022E Adj. EBITDA 4 5

PF EV / 2022E Revenue 4

PF Net Debt / 2022E Adj. EBITDA4

Sponsor (8%) 8

SPAC FPA Investors (5%)

SPAC Investors (22%)

45

Amount

$576

589

100

112

$1,377

Note: All balance sheet items reflect estimates for 3/31/2022. Anticipated close in H1'22. Assumes no redemptions. Sharecount includes 232.3 million rollover shares (including 15.0 million common shares from KED preferred

equitization shares and rollover vested options on a post-exercise basis, assuming net exercise at a $10.00 share price and excluding any Getty PIPE shares), 82.8 million CCNB2 SPAC shares, 20.0 million FPA shares, 15.0 million

PIPE shares and 20.6 million CCNB2 (excluding any sponsor PIPE shares) founder shares. Sharecount excludes 65.0 million seller earn-out shares, 5.14 million founder earn-out shares and 43.0 million warrants with a strike price of

$11.50. Figures do not reflect impact from RSUS, warrants, or unvested and future management options. Pro Forma ownership percentages do not add up to 100% due to rounding. 1 Includes ~$9mm of public company costs (BOD,

D&O, additional headcount and audit and professional fees). 2 Assumes no redemptions from CCNB2 Trust Account. ³ Includes SPAC deferred underwriting fee, and estimated Getty Images & CCNB2 transaction costs. 4 Based on

midpoint of guidance range for FY 2022E Revenue and Adj. EBITDA. 5 Please see appendix for a reconciliation of non-GAAP measures. 6 Estimated value as of 3/31/2022, inclusive of fees related to early repayment. 7 Includes

9

gettyimages rollover vested options on a post-exercise basis, assuming net exercise at a $10.00 share price. Does not include unvested rollover options. 8 Includes founder shares and PIPE shares. Includes 5.0 million PIPE shares.

370.6

$10.00

$3,706

$1,194

(100)

$4,800

15.2x

5.0x

3.5x

Existing Getty

Stockholders7 9

(64%)

7View entire presentation