Babylon SPAC Presentation Deck

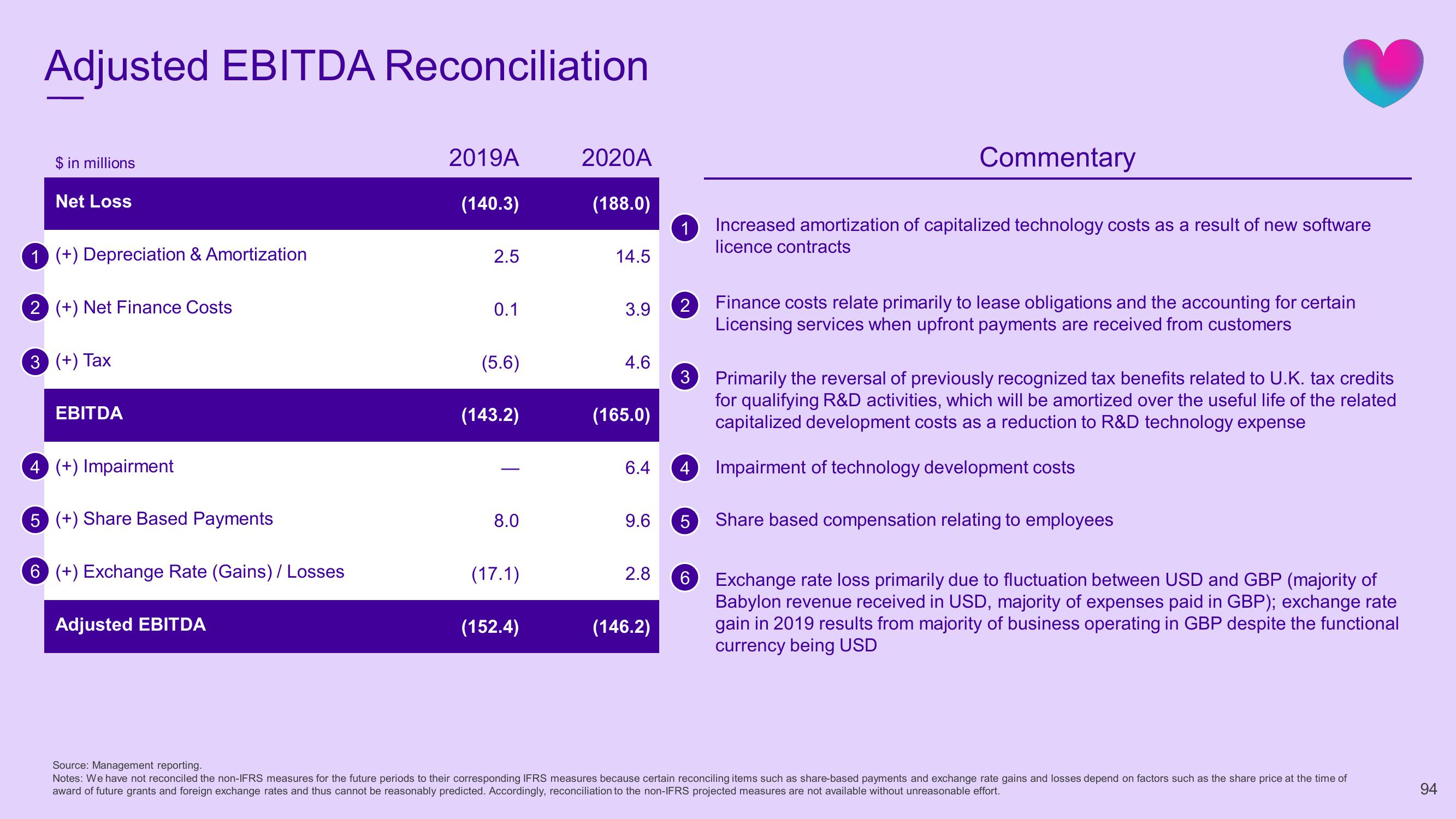

Adjusted EBITDA Reconciliation

$ in millions

Net Loss

1 (+) Depreciation & Amortization

2 (+) Net Finance Costs

3 (+) Tax

EBITDA

4 (+) Impairment

5 (+) Share Based Payments

6 (+) Exchange Rate (Gains) / Losses

Adjusted EBITDA

2019A

(140.3)

2.5

0.1

(5.6)

(143.2)

8.0

(17.1)

(152.4)

2020A

(188.0)

14.5

3.9

4.6

(165.0)

6.4

1

2

(146.2)

3

Commentary

Increased amortization of capitalized technology costs as a result of new software

licence contracts

Primarily the reversal of previously recognized tax benefits related to U.K. tax credits

for qualifying R&D activities, which will be amortized over the useful life of the related

capitalized development costs as a reduction to R&D technology expense

4 Impairment of technology development costs

2.8 6

Finance costs relate primarily to lease obligations and the accounting for certain

Licensing services when upfront payments are received from customers

9.6 5 Share based compensation relating to employees

Exchange rate loss primarily due to fluctuation between USD and GBP (majority of

Babylon revenue received in USD, majority of expenses paid in GBP); exchange rate

gain in 2019 results from majority of business operating in GBP despite the functional

currency being USD

Source: Management reporting.

Notes: We have not reconciled the non-IFRS measures for the future periods to their corresponding IFRS measures because certain reconciling items such as share-based payments and exchange rate gains and losses depend on factors such as the share price at the time of

award of future grants and foreign exchange rates and thus cannot be reasonably predicted. Accordingly, reconciliation to the non-IFRS projected measures are not available without unreasonable effort.

94View entire presentation