Corecentric Investor Presentation Deck

Corcentric at a glance

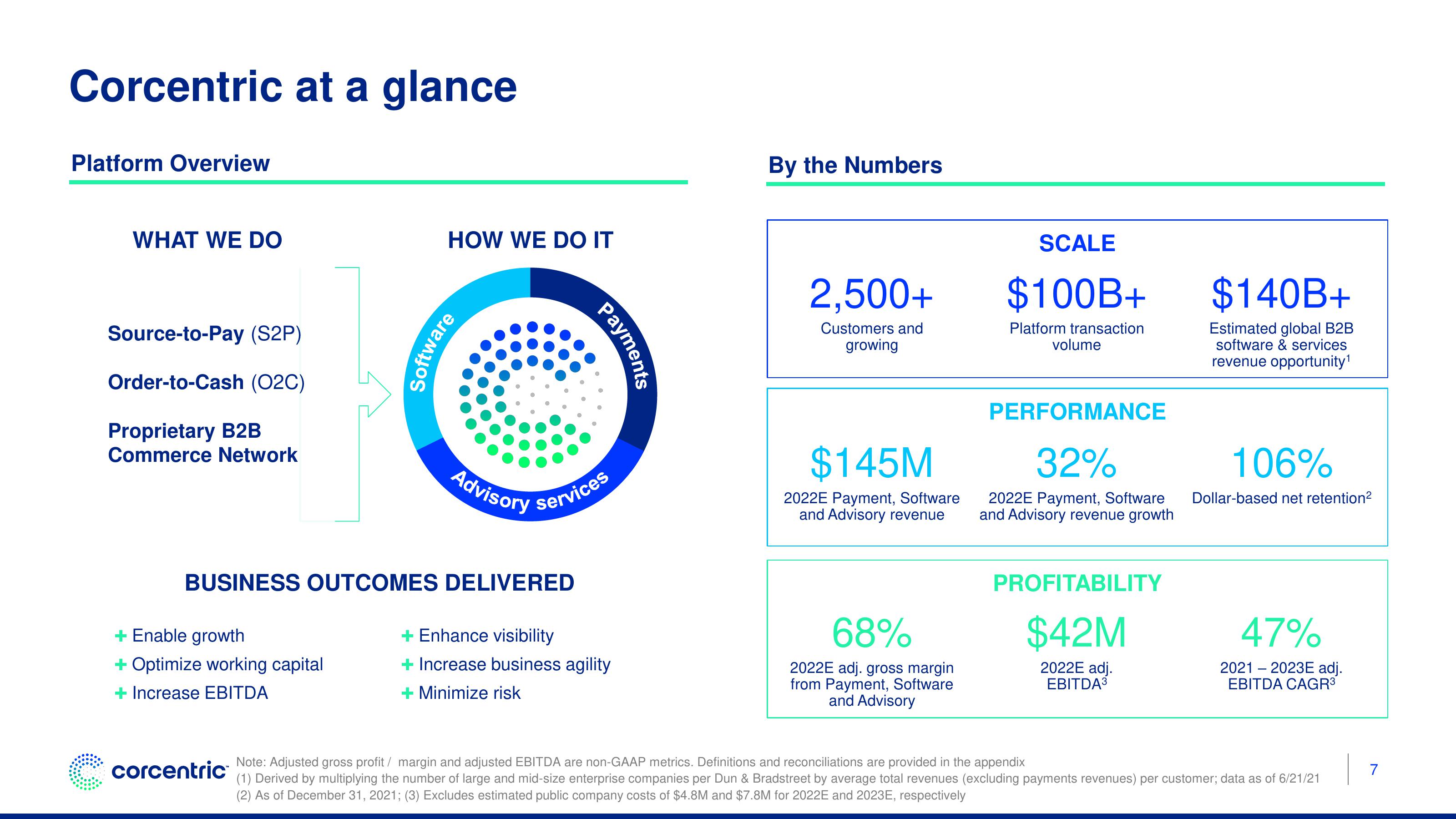

Platform Overview

WHAT WE DO

Source-to-Pay (S2P)

Order-to-Cash (O2C)

Proprietary B2B

Commerce Network

+ Enable growth

+ Optimize working capital

+ Increase EBITDA

HOW WE DO IT

corcentric

Software

BUSINESS OUTCOMES DELIVERED

Payments

Advisory services

+ Enhance visibility

+ Increase business agility

Minimize risk

By the Numbers

2,500+

Customers and

growing

$145M

2022E Payment, Software

and Advisory revenue

68%

2022E adj. gross margin

from Payment, Software

and Advisory

SCALE

$100B+

Platform transaction

volume

PERFORMANCE

32%

2022E Payment, Software

and Advisory revenue growth

PROFITABILITY

$42M

2022E adj.

EBITDA³

$140B+

Estimated global B2B

software & services

revenue opportunity¹

106%

Dollar-based net retention²

47%

2021 2023E adj.

EBITDA CAGR³

Note: Adjusted gross profit/ margin and adjusted EBITDA are non-GAAP metrics. Definitions and reconciliations are provided in the appendix

(1) Derived by multiplying the number of large and mid-size enterprise companies per Dun & Bradstreet by average total revenues (excluding payments revenues) per customer; data as of 6/21/21

(2) As of December 31, 2021; (3) Excludes estimated public company costs of $4.8M and $7.8M for 2022E and 2023E, respectively

7View entire presentation