Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

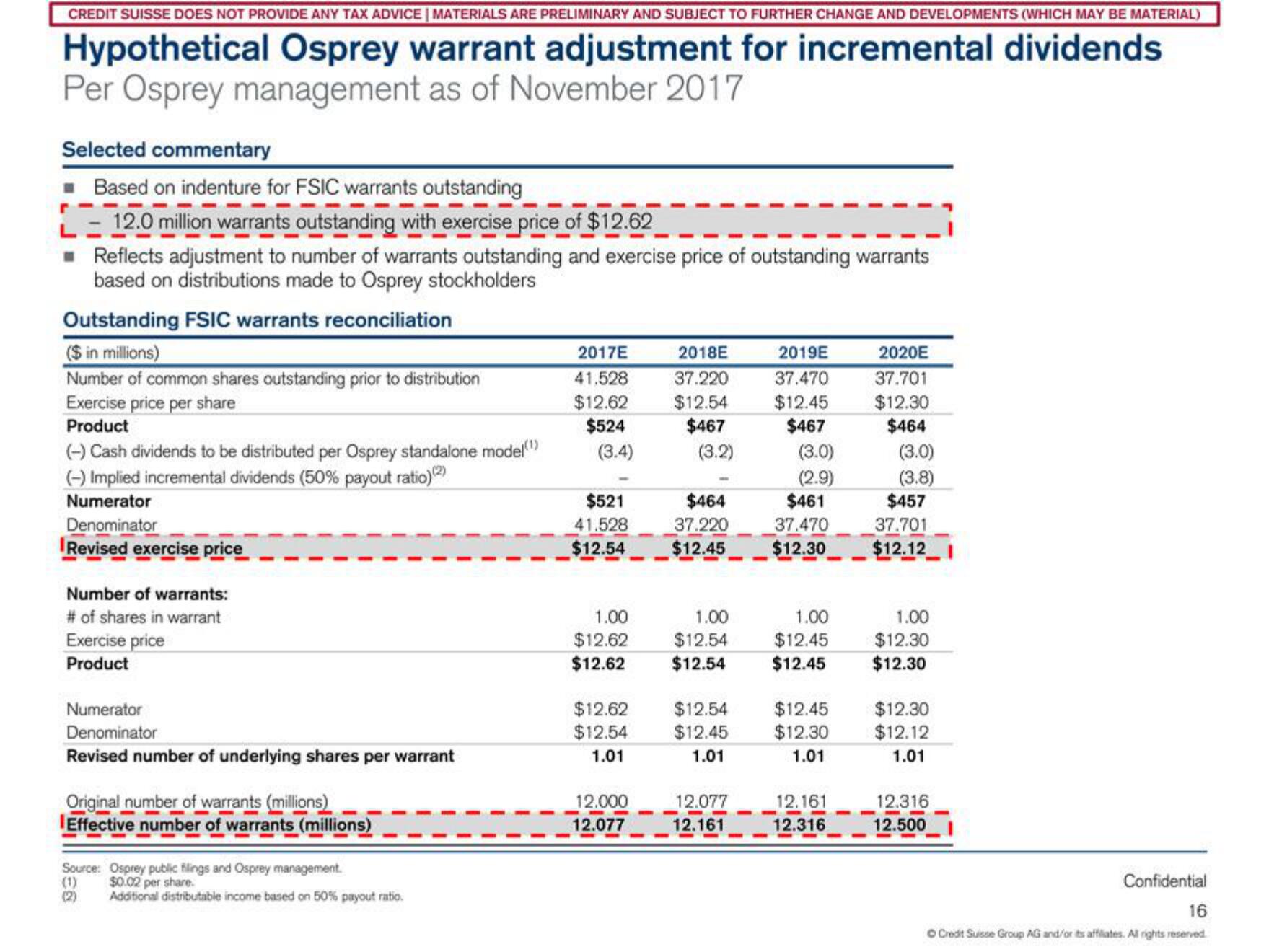

Hypothetical Osprey warrant adjustment for incremental dividends

Per Osprey management as of November 2017

Selected commentary

Based on indenture for FSIC warrants outstanding

12.0 million warrants outstanding with exercise price of $12.62

Reflects adjustment to number of warrants outstanding and exercise price of outstanding warrants

based on distributions made to Osprey stockholders

Outstanding FSIC warrants reconciliation

($ in millions)

Number of common shares outstanding prior to distribution

Exercise price per share

Product

(-) Cash dividends to be distributed per Osprey standalone model(¹)

(-) Implied incremental dividends (50% payout ratio)(2)

Numerator

Denominator

Revised exercise price

Number of warrants:

# of shares in warrant

Exercise price

Product

Numerator

Denominator

Revised number of underlying shares per warrant

Original number of warrants (millions)

Effective number of warrants (millions)

Source: Osprey public filings and Osprey management.

$0.02 per share.

Additional distributable income based on 50% payout ratio.

(1)

(2)

2017E

41.528

$12.62

$524

(3.4)

$521

41.528

$12.54

1.00

$12.62

$12.62

$12.62

$12.54

1.01

12.000

12.077

2018E

37.220

$12.54

$467

(3.2)

$464

37.220

$12.45

1.00

$12.54

$12.54

$12.54

$12.45

1.01

12.077

12.161

2019E

37.470

$12.45

$467

(3.0)

(2.9)

$461

37.470

$12.30

1.00

$12.45

$12.45

$12.45

$12.30

1.01

12.161

12.316

2020E

37.701

$12.30

$464

(3.0)

(3.8)

$457

37.701

$12.12

1.00

$12.30

$12.30

$12.30

$12.12

1.01

12.316

12.500

Confidential

16

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation