Evercore Investment Banking Pitch Book

Why Evercore?

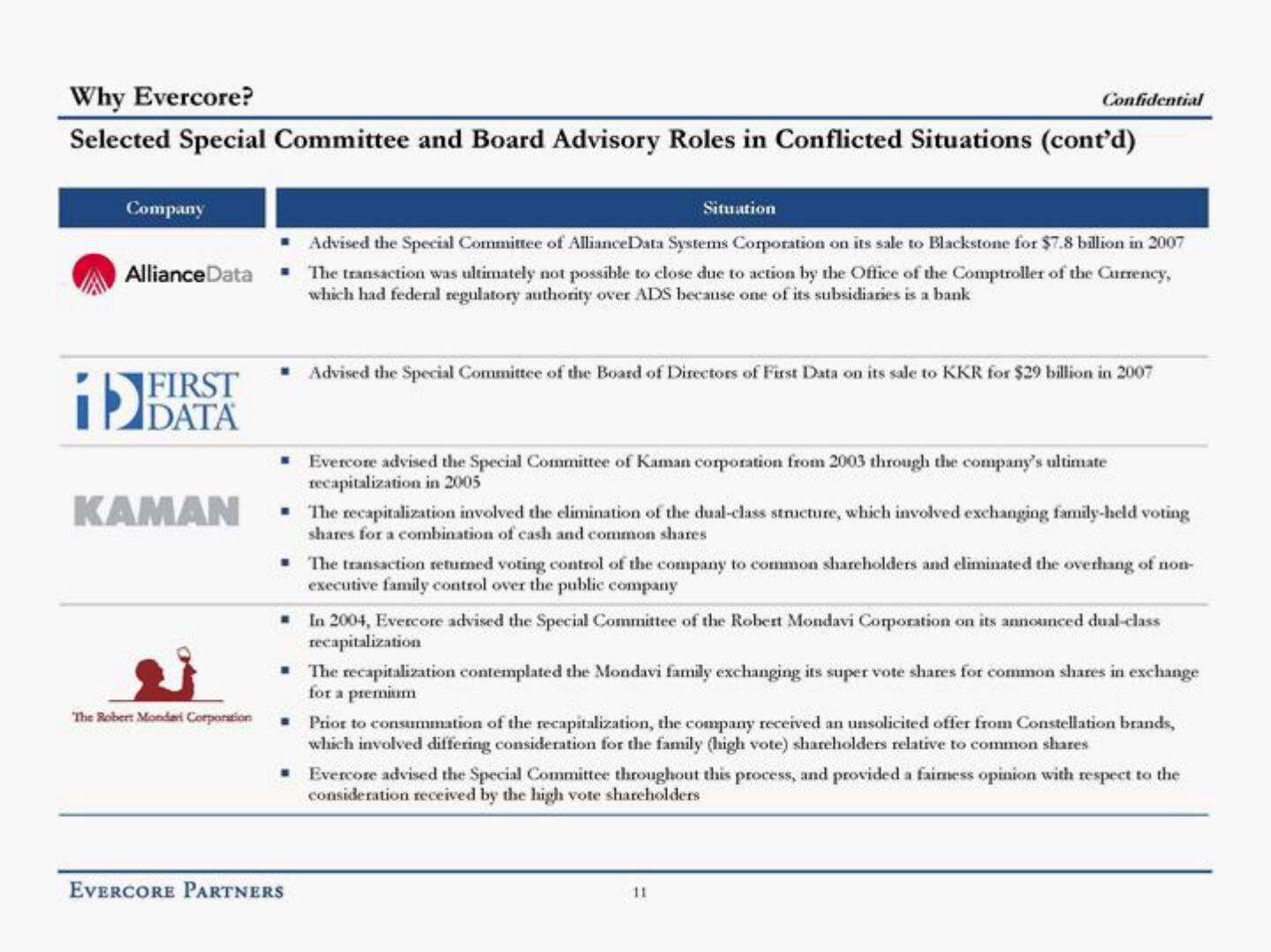

Selected Special Committee and Board Advisory Roles in Conflicted Situations (cont'd)

Company

D

Advised the Special Committee of AllianceData Systems Corporation on its sale to Blackstone for $7.8 billion in 2007

Alliance Data The transaction was ultimately not possible to close due to action by the Office of the Comptroller of the Currency,

which had federal regulatory authority over ADS because one of its subsidiaries is a bank

FIRST

DATA

KAMAN

The Robert Mondari Corporation

Situation

Confidential

Advised the Special Committee of the Board of Directors of First Data on its sale to KKR for $29 billion in 2007

▪ Evercore advised the Special Committee of Kaman corporation from 2003 through the company's ultimate

recapitalization in 2005

▪

The recapitalization involved the elimination of the dual-class structure, which involved exchanging family-held voting

shares for a combination of cash and common shares

EVERCORE PARTNERS

The transaction returned voting control of the company to common shareholders and eliminated the overhang of non-

executive family control over the public company

In 2004, Evercore advised the Special Committee of the Robert Mondavi Corporation on its announced dual-class

recapitalization

■

The recapitalization contemplated the Mondavi family exchanging its super vote shares for common shares in exchange

for a premium

■

Prior to consummation of the recapitalization, the company received an unsolicited offer from Constellation brands,

which involved differing consideration for the family (high vote) shareholders relative to common shares

■

11

Evercore advised the Special Committee throughout this process, and provided a faimess opinion with respect to the

consideration received by the high vote shareholdersView entire presentation