FIGS Results Presentation Deck

Q2 2023 Operating Expense

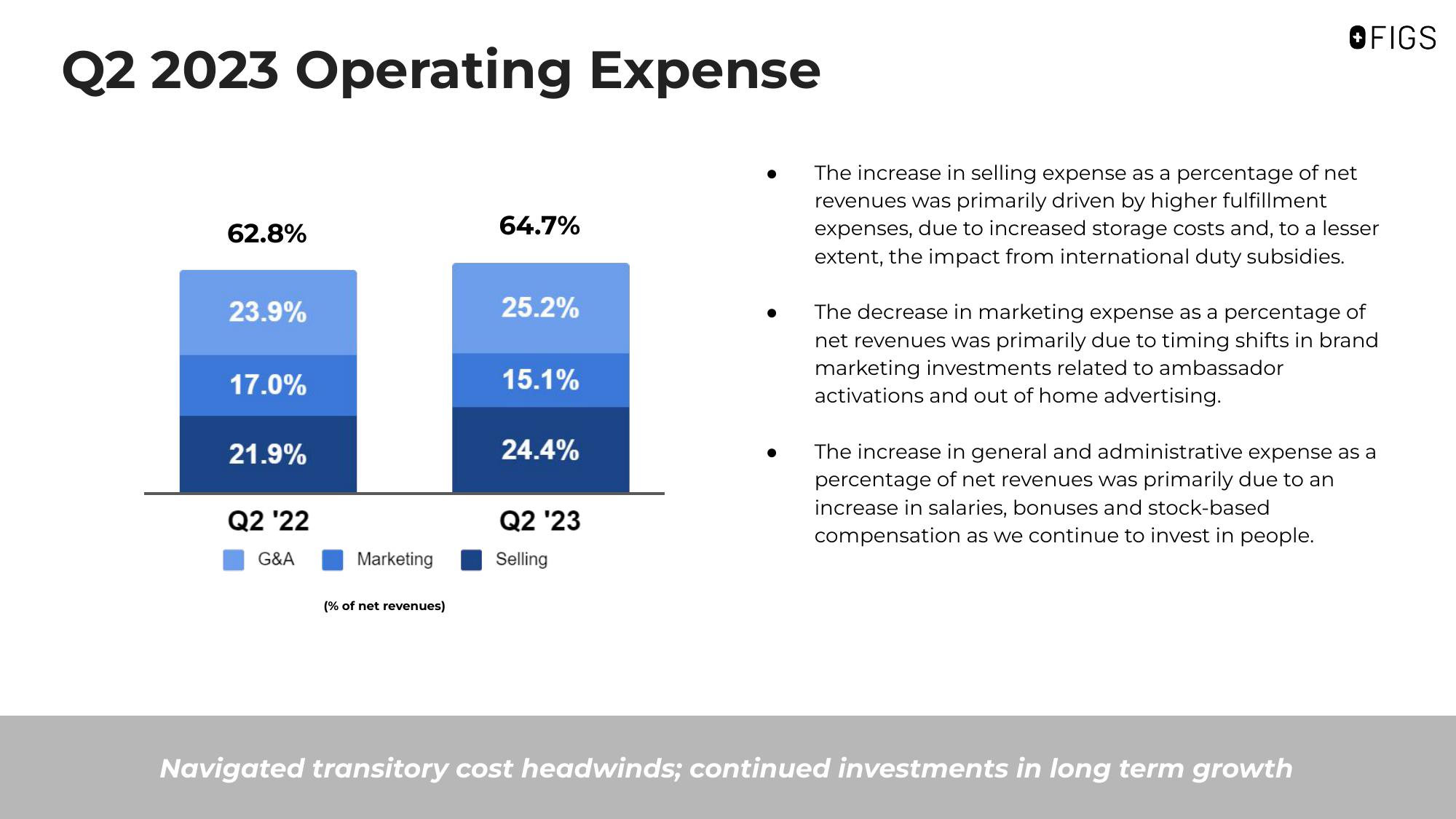

62.8%

23.9%

17.0%

21.9%

Q2 '22

G&A

Marketing

(% of net revenues)

64.7%

25.2%

15.1%

24.4%

Q2 '23

Selling

OFIGS

The increase in selling expense as a percentage of net

revenues was primarily driven by higher fulfillment

expenses, due to increased storage costs and, to a lesser

extent, the impact from international duty subsidies.

The decrease in marketing expense as a percentage of

net revenues was primarily due to timing shifts in brand

marketing investments related to ambassador

activations and out of home advertising.

The increase in general and administrative expense as a

percentage of net revenues was primarily due to an

increase in salaries, bonuses and stock-based

compensation as we continue to invest in people.

Navigated transitory cost headwinds; continued investments in long term growthView entire presentation