Comcast Results Presentation Deck

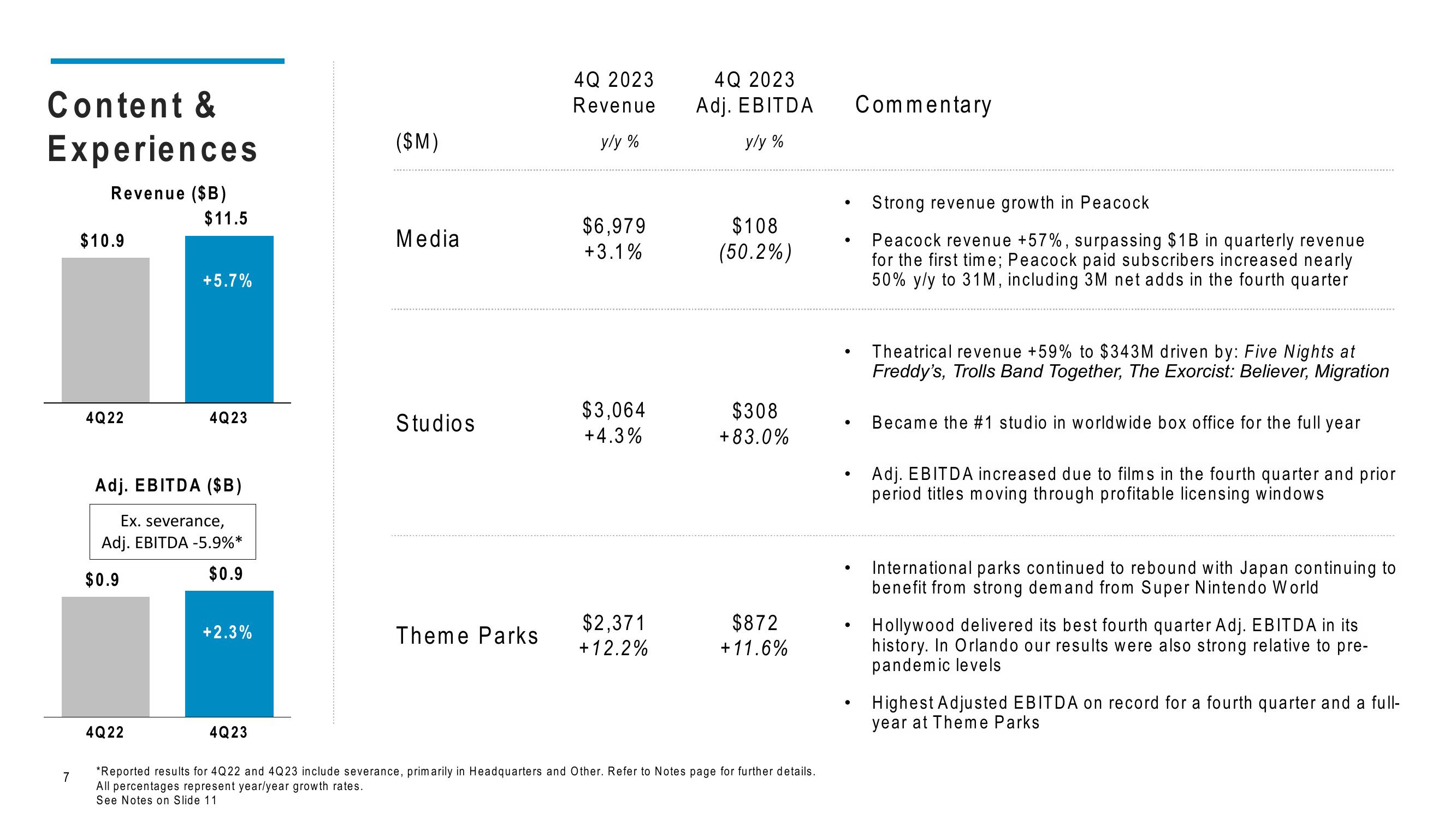

Content &

Experiences

Revenue ($B)

7

$10.9

4Q22

$0.9

$11.5

4Q22

+5.7%

Adj. EBITDA ($B)

Ex. severance,

Adj. EBITDA -5.9%*

$0.9

4Q23

+2.3%

4Q23

($M)

Media

Studios

Theme Parks

4Q 2023

Revenue

y/y%

$6,979

+3.1%

$3,064

+4.3%

$2,371

+ 12.2%

4Q 2023

Adj. EBITDA

y/y%

$108

(50.2%)

$308

+83.0%

$872

+11.6%

*Reported results for 4Q22 and 4Q23 include severance, primarily in Headquarters and Other. Refer to Notes page for further details.

All percentages represent year/year growth rates.

See Notes on Slide 11

●

●

●

●

●

Commentary

Strong revenue growth in Peacock

Peacock revenue +57%, surpassing $1B in quarterly revenue

for the first time; Peacock paid subscribers increased nearly

50% y/y to 31M, including 3M net adds in the fourth quarter

Theatrical revenue +59% to $343M driven by: Five Nights at

Freddy's, Trolls Band Together, The Exorcist: Believer, Migration

Became the #1 studio in worldwide box office for the full year

Adj. EBITDA increased due to films in the fourth quarter and prior

period titles moving through profitable licensing windows

International parks continued to rebound with Japan continuing to

benefit from strong demand from Super Nintendo World

Hollywood delivered its best fourth quarter Adj. EBITDA in its

history. In Orlando our results were also strong relative to pre-

pandemic levels

Highest Adjusted EBITDA on record for a fo

year at Theme Parks

quarter and a full-View entire presentation