Marti SPAC Presentation Deck

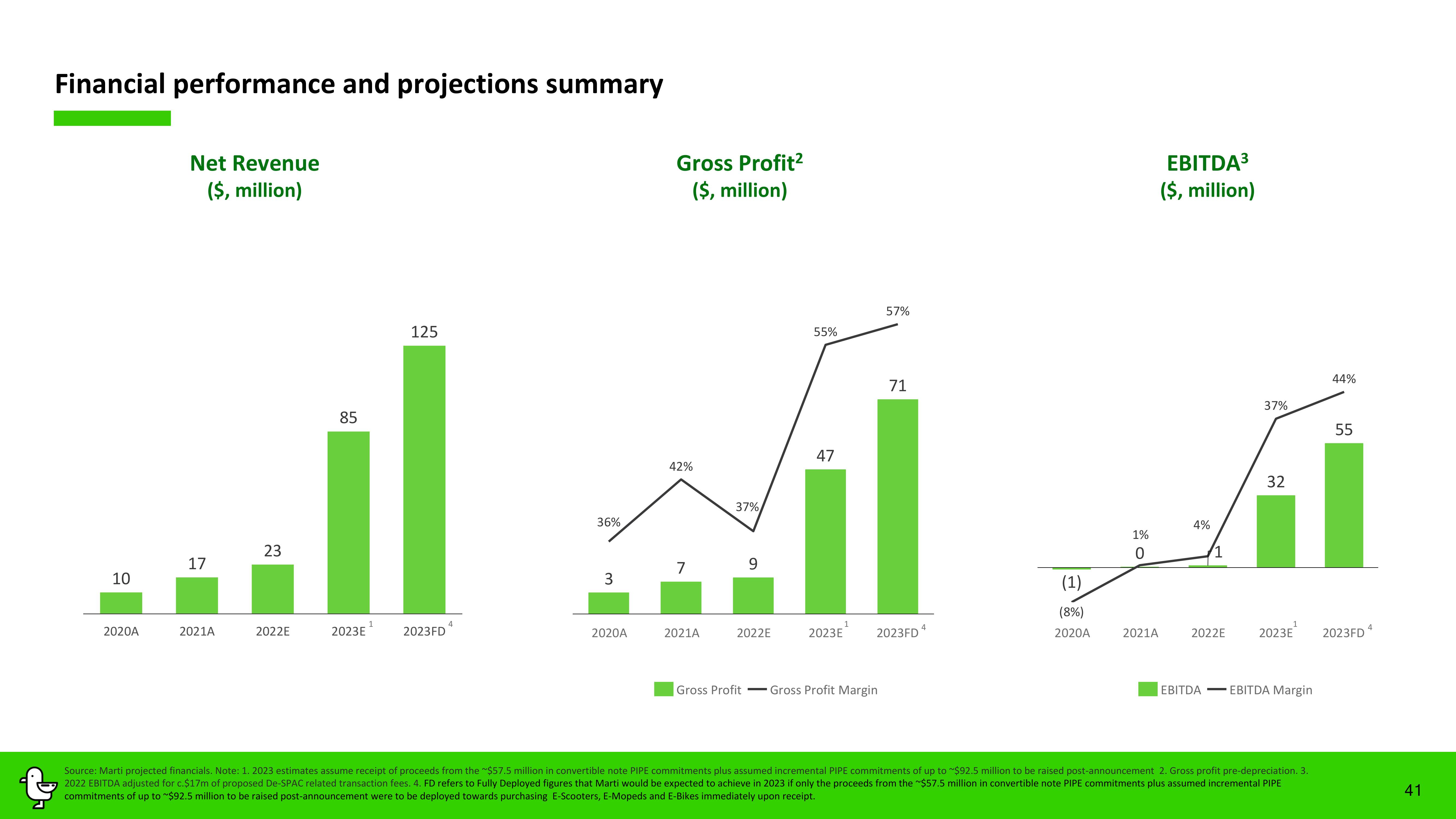

Financial performance and projections summary

10

2020A

Net Revenue

($, million)

17

2021A

23

2022E

85

2023E

125

2023FD

36%

3

2020A

Gross Profit²

($, million)

42%

7

2021A

37%

9

2022E

55%

47

2023E

57%

Gross Profit Gross Profit Margin

71

2023FD

4

(1)

(8%)

2020A

1%

0

2021A

EBITDA³

($, million)

4%

1

2022E

37%

32

2023E

EBITDAEBITDA Margin

Source: Marti projected financials. Note: 1. 2023 estimates assume receipt of proceeds from the ~$57.5 million in convertible note PIPE commitments plus assumed incremental PIPE commitments of up to $92.5 million to be raised post-announcement 2. Gross profit pre-depreciation. 3.

2022 EBITDA adjusted for c.$17m of proposed De-SPAC related transaction fees. 4. FD refers to Fully Deployed figures that Marti would be expected to achieve in 2023 if only the proceeds from the ~$57.5 million in convertible note PIPE commitments plus assumed incremental PIPE

commitments of up to ~$92.5 million to be raised post-announcement were to be deployed towards purchasing E-Scooters, E-Mopeds and E-Bikes immediately upon receipt.

44%

55

2023FD

4

41View entire presentation