AG Direct Lending SMA

ANGELO

AG GORDON

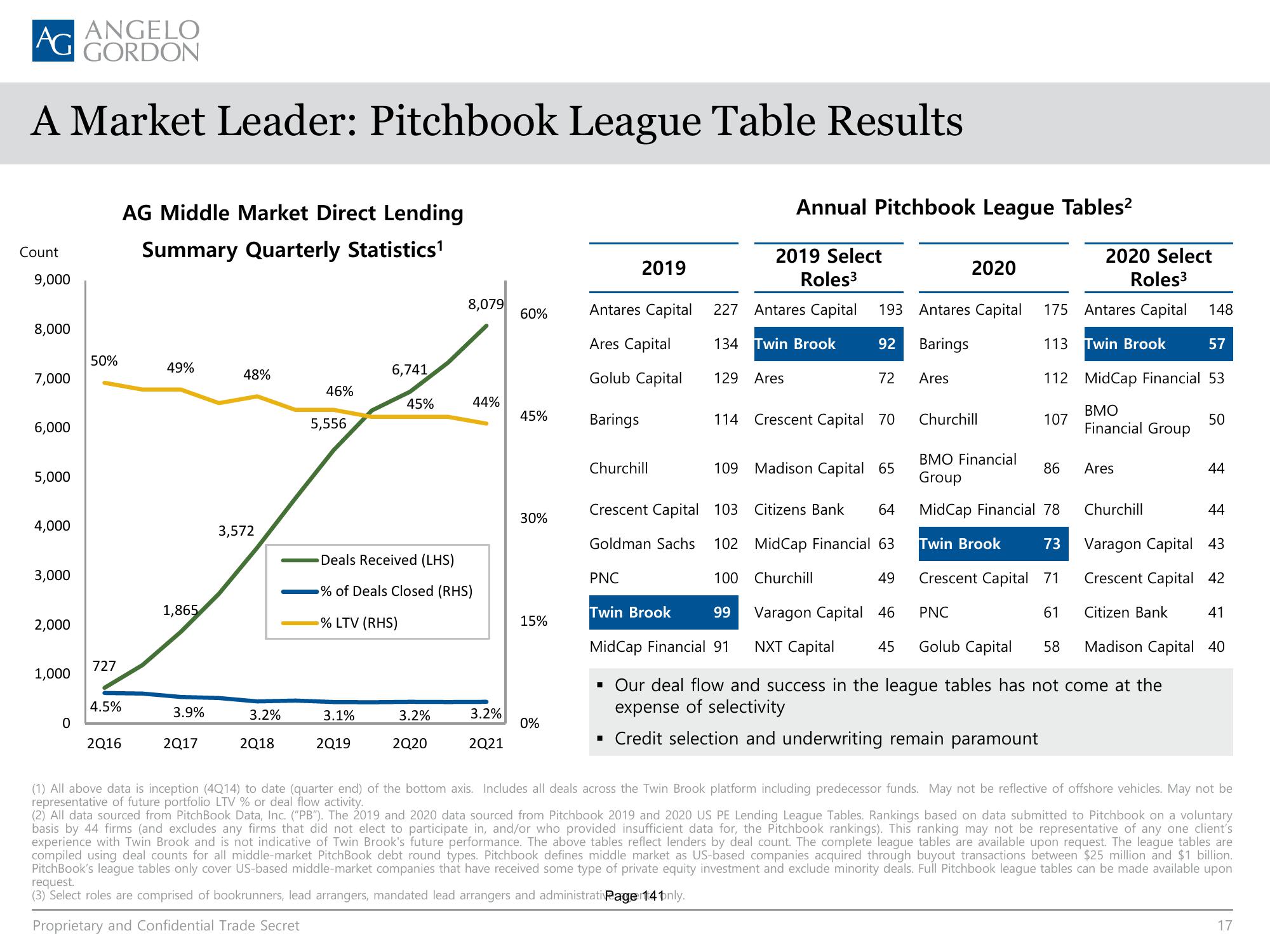

A Market Leader: Pitchbook League Table Results

Count

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

50%

727

4.5%

AG Middle Market Direct Lending

Summary Quarterly Statistics¹

2Q16

49%

1,865

3.9%

2017

48%

3,572

3.2%

2Q18

46%

5,556

6,741

3.1%

2Q19

45%

8,079

Deals Received (LHS)

% of Deals Closed (RHS)

% LTV (RHS)

3.2%

2Q20

44%

3.2%

2Q21

60%

45%

30%

15%

0%

Antares Capital

Ares Capital

Golub Capital

Barings

2019

Churchill

PNC

227

134

Twin Brook

129 Ares

Crescent Capital 103

Goldman Sachs 102

100

Annual Pitchbook League Tables²

2019 Select

Roles³

Antares Capital 193 Antares Capital

Twin Brook

92

Barings

Ares

72

114 Crescent Capital 70

109 Madison Capital 65

Citizens Bank 64

MidCap Financial 63

Churchill

49

Varagon Capital 46

NXT Capital 45

2020

Churchill

PNC

2020 Select

Roles³

Antares Capital 148

113

57

112 MidCap Financial 53

BMO

Financial Group

175

BMO Financial

Group

Mid Cap Financial 78

Twin Brook

Crescent Capital 71

61

58

Golub Capital

107

86

73

Twin Brook

Ares

99

Mid Cap Financial 91

▪ Our deal flow and success in the league tables has not come at the

expense of selectivity

▪ Credit selection and underwriting remain paramount

50

44

Churchill

Varagon Capital 43

Crescent Capital 42

Citizen Bank 41

Madison Capital 40

44

(1) All above data is inception (4Q14) to date (quarter end) of the bottom axis. Includes all deals across the Twin Brook platform including predecessor funds. May not be reflective of offshore vehicles. May not be

representative of future portfolio LTV % or deal flow activity.

(2) All data sourced from PitchBook Data, Inc. ("PB"). The 2019 and 2020 data sourced from Pitchbook 2019 and 2020 US PE Lending League Tables. Rankings based on data submitted to Pitchbook on a voluntary

basis by 44 firms (and excludes any firms that did not elect to participate in, and/or who provided insufficient data for, the Pitchbook rankings). This ranking may not be representative of any one client's

experience with Twin Brook and is not indicative of Twin Brook's future performance. The above tables reflect lenders by deal count. The complete league tables are available upon request. The league tables are

compiled using deal counts for all middle-market PitchBook debt round types. Pitchbook defines middle market as US-based companies acquired through buyout transactions between $25 million and $1 billion.

PitchBook's league tables only cover US-based middle-market companies that have received some type of private equity investment and exclude minority deals. Full Pitchbook league tables can be made available upon

request.

(3) Select roles are comprised of bookrunners, lead arrangers, mandated lead arrangers and administrati Page 14 only.

Proprietary and Confidential Trade Secret

17View entire presentation