Evercore Investment Banking Pitch Book

Transaction Overview

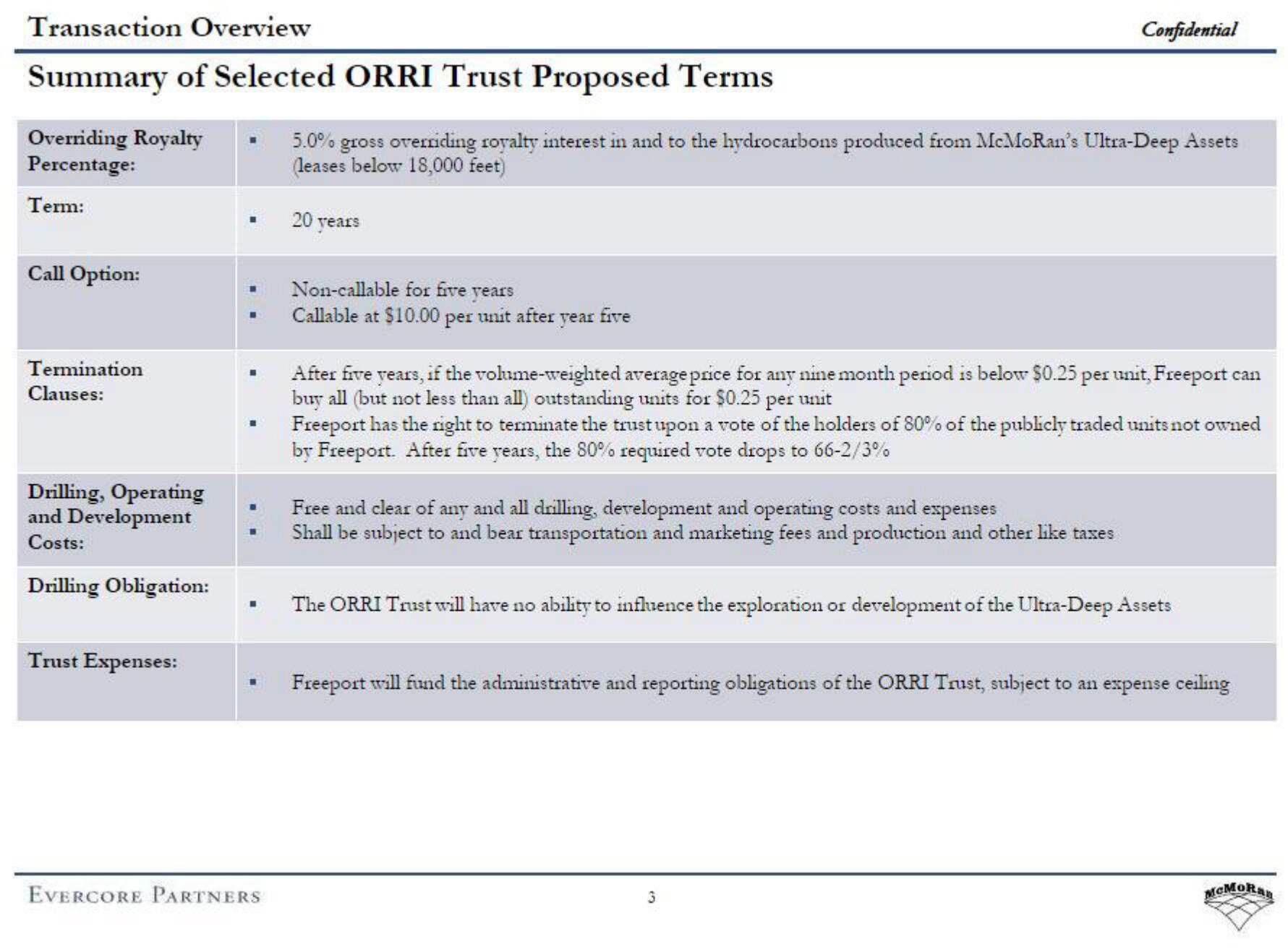

Summary of Selected ORRI Trust Proposed Terms

Overriding Royalty

Percentage:

Term:

Call Option:

Termination

Clauses:

Drilling, Operating

and Development

Costs:

Drilling Obligation:

Trust Expenses:

■

■

EVERCORE PARTNERS

5.0% gross overriding royalty interest in and to the hydrocarbons produced from McMoRan's Ultra-Deep Assets

(leases below 18,000 feet)

20 years

Non-callable for five years

Callable at $10.00 per unit after year five

Confidential

After five years, if the volume-weighted average price for any nine month period is below $0.25 per unit, Freeport can

buy all (but not less than all) outstanding units for $0.25 per unit

Freeport has the right to terminate the trust upon a vote of the holders of 80% of the publicly traded units not owned

by Freeport. After five years, the 80% required vote drops to 66-2/3%

Free and clear of any and all drilling, development and operating costs and expenses

Shall be subject to and bear transportation and marketing fees and production and other like taxes

The ORRI Trust will have no ability to influence the exploration or development of the Ultra-Deep Assets

Freeport will fund the administrative and reporting obligations of the ORRI Trust, subject to an expense ceiling

3

MCMORanView entire presentation