Skillsoft SPAC Presentation Deck

Introduction

Strategy

CASH², 3

TOTAL DEBT²

Content

NET DEBT

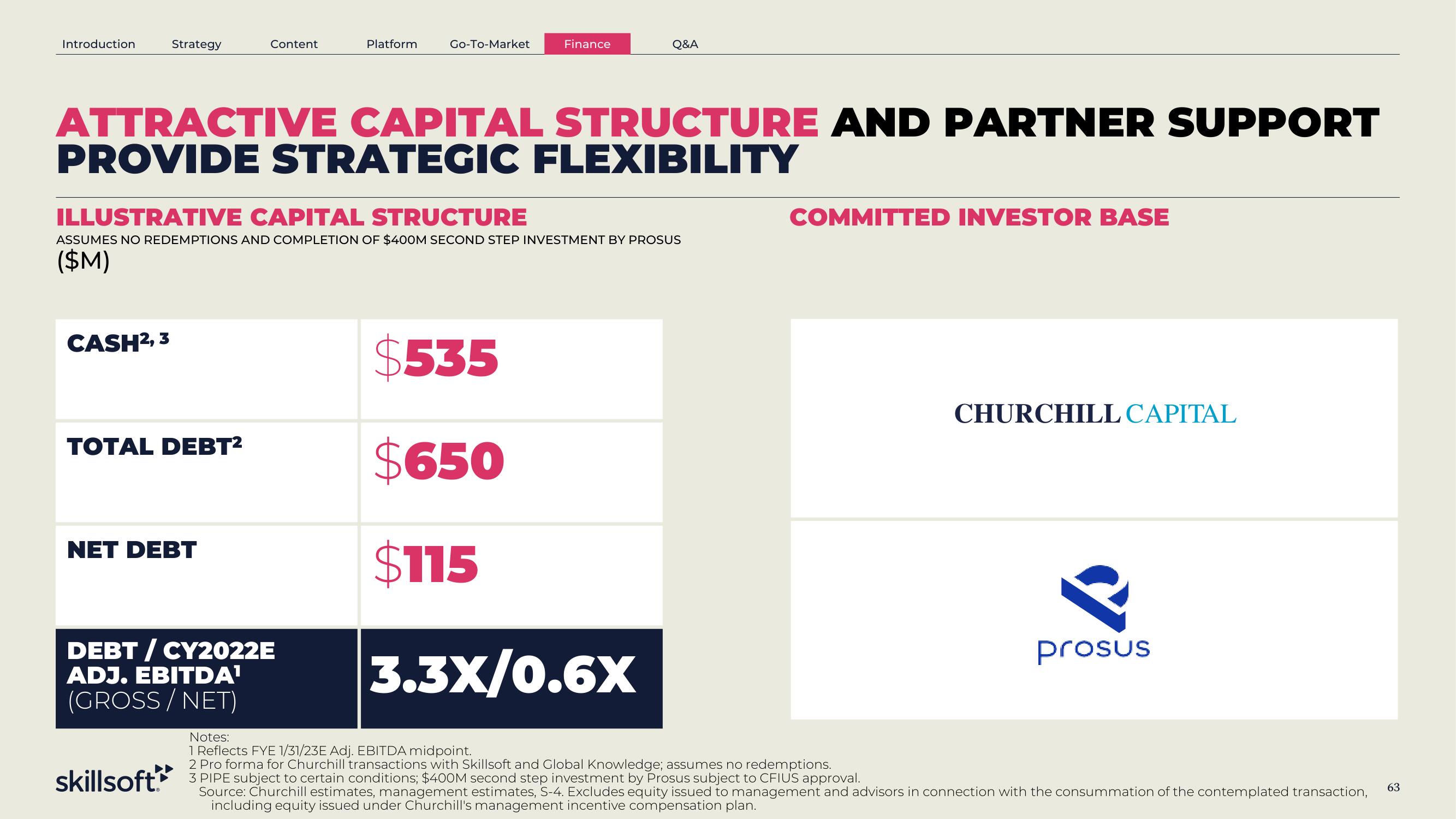

ATTRACTIVE CAPITAL STRUCTURE AND PARTNER SUPPORT

PROVIDE STRATEGIC FLEXIBILITY

skillsoft

Platform

ILLUSTRATIVE CAPITAL STRUCTURE

ASSUMES NO REDEMPTIONS AND COMPLETION OF $400M SECOND STEP INVESTMENT BY PROSUS

($M)

DEBT/CY2022E

ADJ. EBITDA¹

(GROSS / NET)

Go-To-Market

Finance

$535

$650

$115

Q&A

3.3X/0.6X

COMMITTED INVESTOR BASE

CHURCHILL CAPITAL

y

prosus

Notes:

1 Reflects FYE 1/31/23E Adj. EBITDA midpoint.

2 Pro forma for Churchill transactions with Skillsoft and Global Knowledge; assumes no redemptions.

3 PIPE subject to certain conditions; $400M second step investment by Prosus subject to CFIUS approval.

Source: Churchill estimates, management estimates, S-4. Excludes equity issued to management and advisors in connection with the consummation of the contemplated transaction,

including equity issued under Churchill's management incentive compensation plan.

63View entire presentation