DiamondRock Hospitality Investor Presentation Deck

10 2023 HIGHLIGHTS

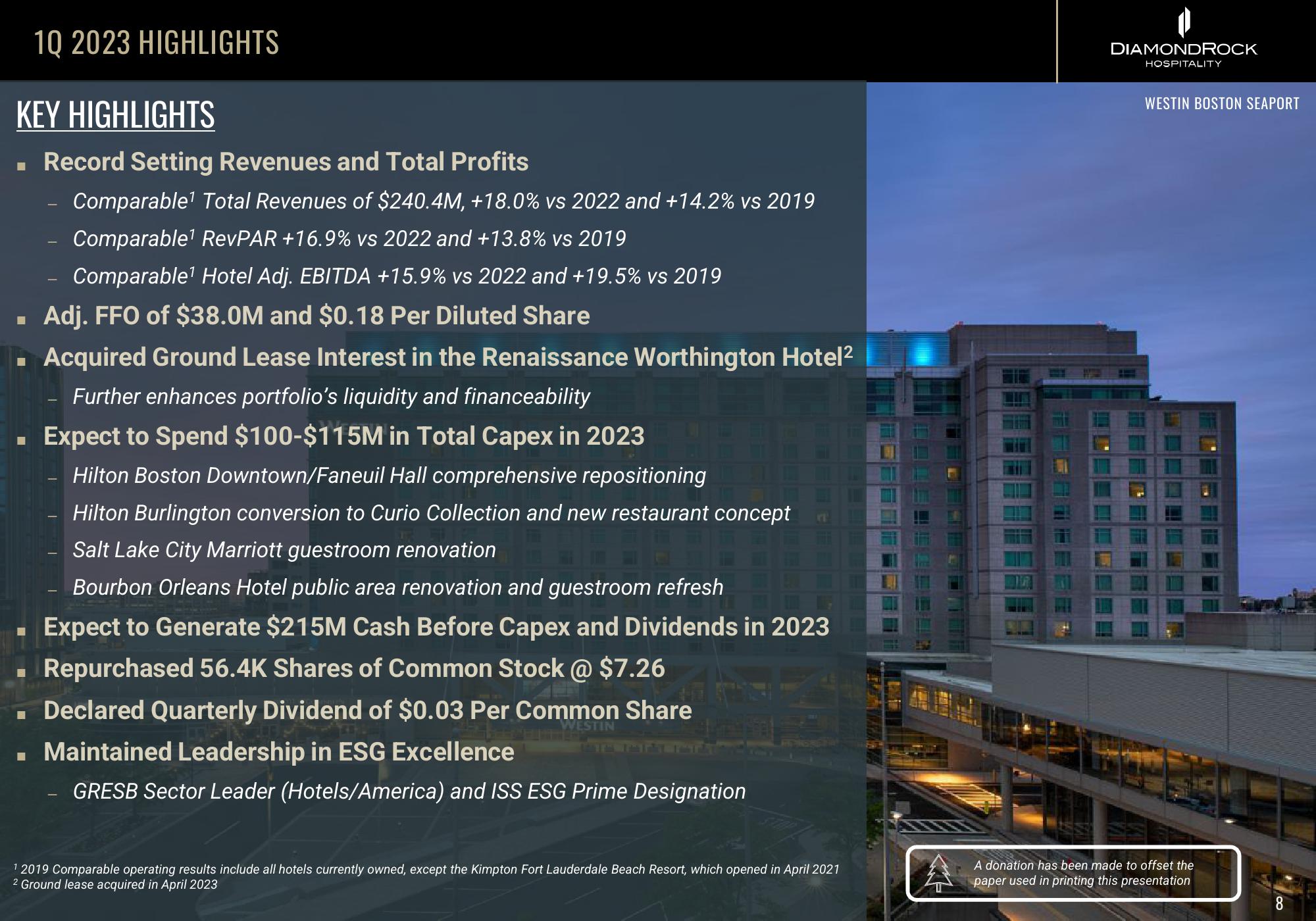

KEY HIGHLIGHTS

Record Setting Revenues and Total Profits

Comparable¹ Total Revenues of $240.4M, +18.0% vs 2022 and +14.2% vs 2019

Comparable¹ RevPAR +16.9% vs 2022 and +13.8% vs 2019

Comparable¹ Hotel Adj. EBITDA +15.9% vs 2022 and +19.5% vs 2019

■ Adj. FFO of $38.0M and $0.18 Per Diluted Share

■

Acquired Ground Lease Interest in the Renaissance Worthington Hotel²

Further enhances portfolio's liquidity and financeability

■ Expect to Spend $100-$115M in Total Capex in 2023

Hilton Boston Downtown/Faneuil Hall comprehensive repositioning

Hilton Burlington conversion to Curio Collection and new restaurant concept

Salt Lake City Marriott guestroom renovation

Bourbon Orleans Hotel public area renovation and guestroom refresh

Expect to Generate $215M Cash Before Capex and Dividends in 2023

Repurchased 56.4K Shares of Common Stock @ $7.26

Declared Quarterly Dividend of $0.03 Per Common Share

WESTIN

. Maintained Leadership in ESG Excellence

GRESB Sector Leader (Hotels/America) and ISS ESG Prime Designation

¯

¹2019 Comparable operating results include all hotels currently owned, except the Kimpton Fort Lauderdale Beach Resort, which opened in April 2021

2 Ground lease acquired in April 2023

DIAMONDROCK

HOSPITALITY

WESTIN BOSTON SEAPORT

A donation has been made to offset the

paper used in printing this presentationView entire presentation