Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

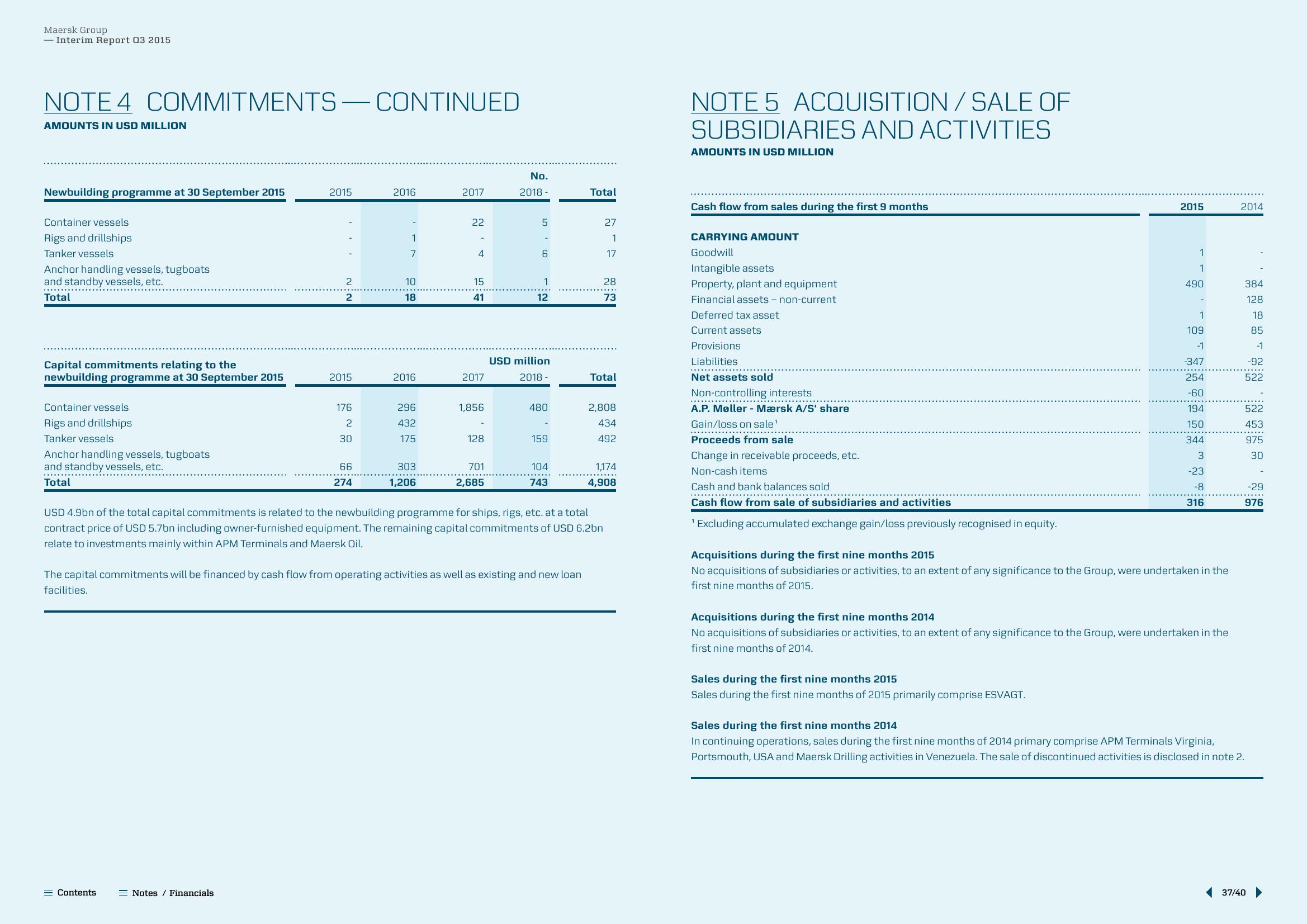

NOTE 4 COMMITMENTS-CONTINUED

AMOUNTS IN USD MILLION

Newbuilding programme at 30 September 2015

Container vessels

Rigs and drillships

Tanker vessels

Anchor handling vessels, tugboats

and standby vessels, etc.

Total

Capital commitments relating to the

newbuilding programme at 30 September 2015

Container vessels

Rigs and drillships

Tanker vessels

Anchor handling vessels, tugboats

and standby vessels, etc.

Total

2015

= Contents

N:N

Notes / Financials

2

2

2015

176

2

30

66

274

2016

7

10

18

2016

296

432

175

303

1,206

2017

22

-

4

15

41

2017

1,856.

128

701

2,685

No.

2018

5

6

1

12

USD million

2018-

480

159

104

743

The capital commitments will be financed by cash flow from operating activities as well as existing and new loan

facilities.

Total

USD 4.9bn of the total capital commitments is related to the newbuilding programme for ships, rigs, etc. at a total

contract price of USD 5.7bn including owner-furnished equipment. The remaining capital commitments of USD 6.2bn

relate to investments mainly within APM Terminals and Maersk Oil.

27

1

17

28

73

Total

2,808

434

492

1,174

4,908

NOTE 5 ACQUISITION / SALE OF

SUBSIDIARIES AND ACTIVITIES

AMOUNTS IN USD MILLION

Cash flow from sales during the first 9 months

CARRYING AMOUNT

Goodwill

Intangible assets

Property, plant and equipment

Financial assets - non-current

Deferred tax asset

Current assets

Provisions

Liabilities

******

Net assets sold

Non-controlling interests

..….….…..…………………….

A.P. Møller-Mærsk A/S' share

Gain/loss on sale¹

Proceeds from sale

Change in receivable proceeds, etc.

Non-cash items

Cash and bank balances sold

*******....

Cash flow from sale of subsidiaries and activities

¹ Excluding accumulated exchange gain/loss previously recognised in equity.

2015

1

1

490

Sales during the first nine months 2015

Sales during the first nine months of 2015 primarily comprise ESVAGT.

1

109

-1

-347

254

-60

194

150

344

3

-23

-8

316

Acquisitions during the first nine months 2015

No acquisitions of subsidiaries or activities, to an extent of any significance to the Group, were undertaken in the

first nine months of 2015.

Acquisitions during the first nine months 2014

No acquisitions of subsidiaries or activities, to an extent of any significance to the Group, were undertaken in the

first nine months of 2014.

2014

384

128

18

85

-1

-92

522

522

453

975

30

-29

976

Sales during the first nine months 2014

In continuing operations, sales during the first nine months of 2014 primary comprise APM Terminals Virginia,

Portsmouth, USA and Maersk Drilling activities in Venezuela. The sale of discontinued activities is disclosed in note 2.

37/40 ▶View entire presentation