DiDi IPO Presentation Deck

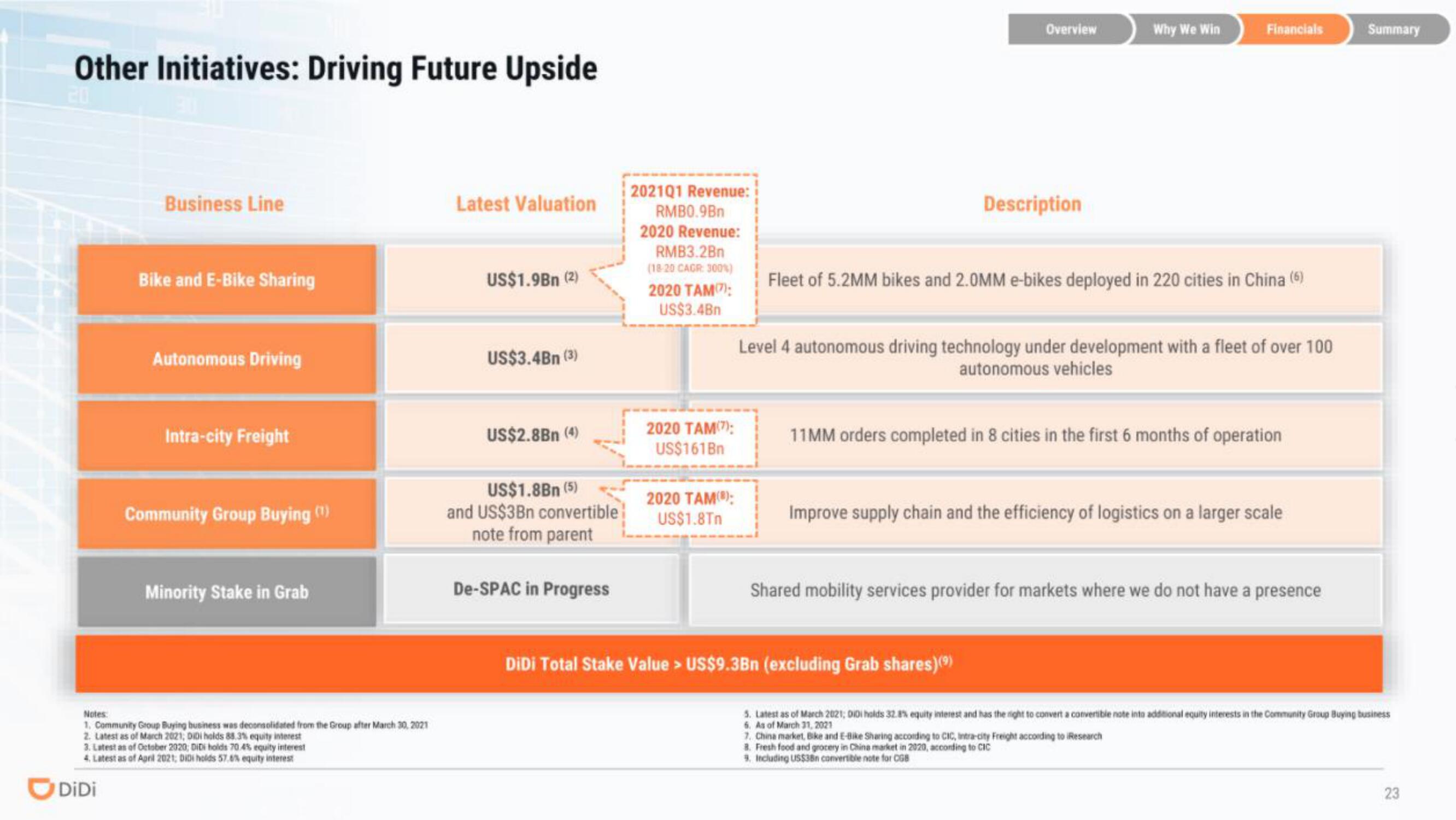

Other Initiatives: Driving Future Upside

Business Line

DiDi

Bike and E-Bike Sharing

Autonomous Driving

Intra-city Freight

Community Group Buying (¹)

Minority Stake in Grab

Notes:

1. Community Group Buying business was deconsolidated from the Group after March 30, 2021

2. Latest as of March 2021, DIDi holds 85.3% equity interest

3. Latest as of October 2020; DiDi holds 70.4% equity interest

4. Latest as of April 2021, DIDi holds 57.6% equity interest

Latest Valuation

US$1.9Bn (2)

US$3.4Bn (3)

US$2.8Bn (4)

US$1.8Bn (5)

and US$3Bn convertible

note from parent

De-SPAC in Progress

202101 Revenue:

RMB0.9Bn

2020 Revenue:

RMB3.2Bn

(18-20 CAGR: 300%)

2020 TAM);

US$3.4Bn

2020 TAM();

US$161Bn

2020 TAM(8):

US$1.8Tn

Overview

Description

Why We Win

Fleet of 5.2MM bikes and 2.0MM e-bikes deployed in 220 cities in China (6)

Financials

Level 4 autonomous driving technology under development with a fleet of over 100

autonomous vehicles

DiDi Total Stake Value > US$9.3Bn (excluding Grab shares) (⁹)

11MM orders completed in 8 cities in the first 6 months of operation

Improve supply chain and the efficiency of logistics on a larger scale

Shared mobility services provider for markets where we do not have a presence

7. China market, Bike and E-Bike Sharing according to CIC, Intra-city Freight according to Research

8. Fresh food and grocery in China market in 2020, according to CIC

9. Including US$38n convertible note for CGB

Summary

3. Latest as of March 2021; DIDI holds 32.8% equity interest and has the right to convert a convertible note into additional equity interests in the Community Group Buying business

6. As of March 31, 2021

23View entire presentation