Clover Health Investor Presentation Deck

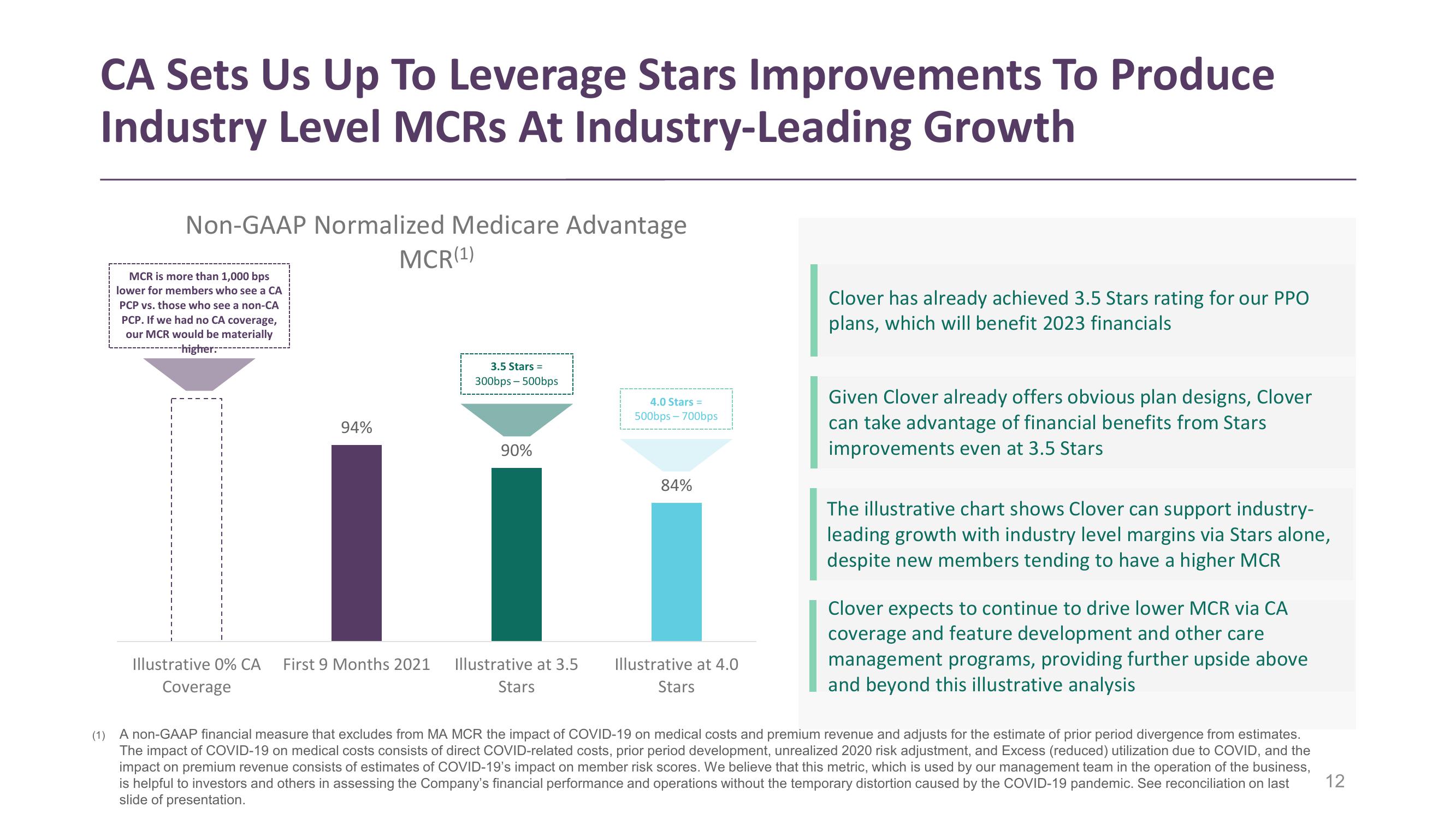

CA Sets Us Up To Leverage Stars Improvements To Produce

Industry Level MCRs At Industry-Leading Growth

Non-GAAP Normalized Medicare Advantage

MCR (1)

MCR is more than 1,000 bps

lower for members who see a CA

PCP vs. those who see a non-CA

PCP. If we had no CA coverage,

our MCR would be materially

---higher:-

94%

Illustrative 0% CA First 9 Months 2021

Coverage

3.5 Stars =

300bps-500bps

90%

Illustrative at 3.5

Stars

4.0 Stars =

500bps-700bps

84%

Illustrative at 4.0

Stars

Clover has already achieved 3.5 Stars rating for our PPO

plans, which will benefit 2023 financials

Given Clover already offers obvious plan designs, Clover

can take advantage of financial benefits from Stars

improvements even at 3.5 Stars

The illustrative chart shows Clover can support industry-

leading growth with industry level margins via Stars alone,

despite new members tending to have a higher MCR

Clover expects to continue to drive lower MCR via CA

coverage and feature development and other care

management programs, providing further upside above

and beyond this illustrative analysis

(1) A non-GAAP financial measure that excludes from MA MCR the impact of COVID-19 on medical costs and premium revenue and adjusts for the estimate of prior period divergence from estimates.

The impact of COVID-19 on medical costs consists of direct COVID-related costs, prior period development, unrealized 2020 risk adjustment, and Excess (reduced) utilization due to COVID, and the

impact on premium revenue consists of estimates of COVID-19's impact on member risk scores. We believe that this metric, which is used by our management team in the operation of the business,

is helpful to investors and others in assessing the Company's financial performance and operations without the temporary distortion caused by the COVID-19 pandemic. See reconciliation on last

slide of presentation.

12View entire presentation