AngloAmerican Results Presentation Deck

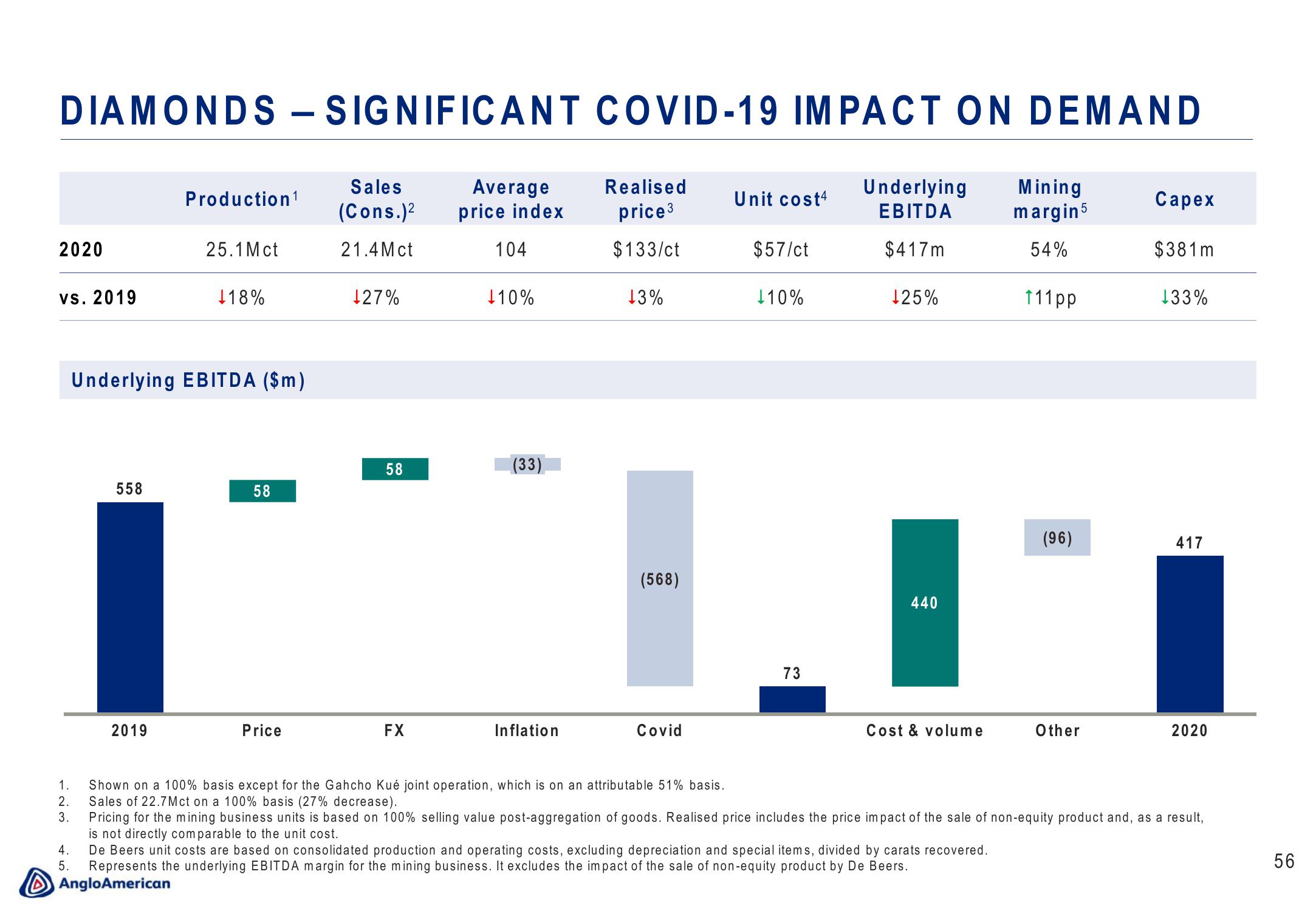

DIAMONDS - SIGNIFICANT COVID-19 IMPACT ON DEMAND

2020

vs. 2019

558

4.

5.

Production¹

2019

25.1 Mct

Underlying EBITDA ($m)

18%

58

Price

Sales

(Cons.)²

21.4Mct

127%

58

FX

Average

price index

104

10%

(33)

Inflation

Realised

price ³

$133/ct

13%

(568)

Covid

1.

Shown on a 100% basis except for the Gahcho Kué joint operation, which is on an attributable 51% basis.

2. Sales of 22.7Mct on a 100% basis (27% decrease).

3.

Unit cost4

$57/ct

10%

73

Underlying

EBITDA

$417m

125%

440

Cost & volume

Mining

margin 5

54%

111pp

(96)

Other

Capex

$381m

¹33%

417

2020

Pricing for the mining business units is based on 100% selling value post-aggregation of goods. Realised price includes the price impact of the sale of non-equity product and, as a result,

is not directly comparable to the unit cost.

De Beers unit costs are based on consolidated production and operating costs, excluding depreciation and special items, divided by carats recovered.

Represents the underlying EBITDA margin for the mining business. It excludes the impact of the sale of non-equity product by De Beers.

AngloAmerican

56View entire presentation