UBS Fixed Income Presentation Deck

Capital requirements and eligibility criteria

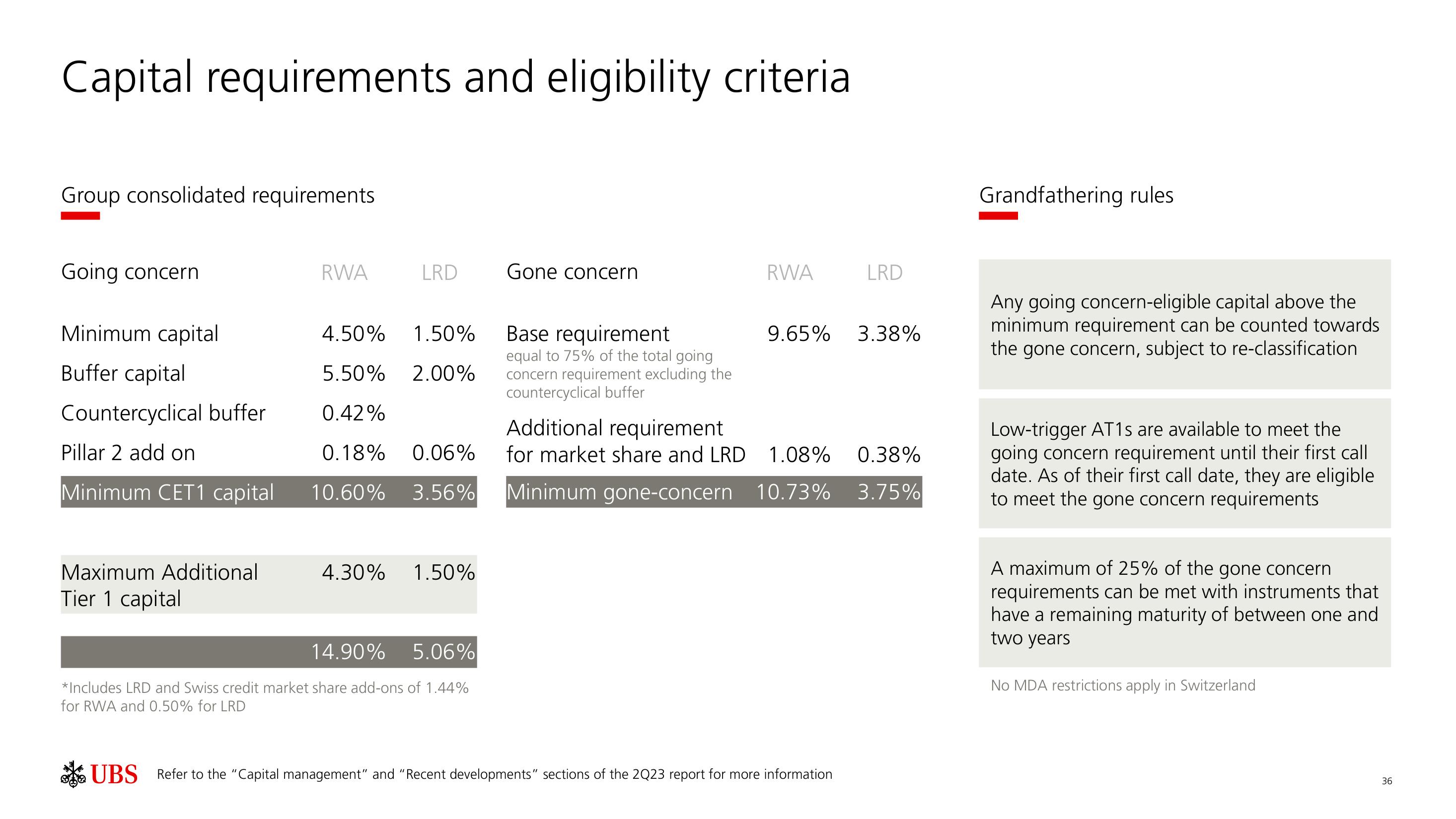

Group consolidated requirements

Going concern

Minimum capital

Buffer capital

Countercyclical buffer

Pillar 2 add on

Minimum CET1 capital

Maximum Additional

Tier 1 capital

RWA

LRD

4.50% 1.50%

5.50% 2.00%

0.42%

0.18% 0.06%

10.60% 3.56%

4.30% 1.50%

14.90% 5.06%

*Includes LRD and Swiss credit market share add-ons of 1.44%

for RWA and 0.50% for LRD

Gone concern

Base requirement

equal to 75% of the total going

concern requirement excluding the

countercyclical buffer

RWA

9.65%

Additional requirement

for market share and LRD 1.08%

Minimum gone-concern 10.73%

UBS Refer to the "Capital management" and "Recent developments" sections of the 2Q23 report for more information

LRD

3.38%

0.38%

3.75%

Grandfathering rules

Any going concern-eligible capital above the

minimum requirement can be counted towards

the gone concern, subject to re-classification.

Low-trigger AT1s are available to meet the

going concern requirement until their first call

date. As of their first call date, they are eligible

to meet the gone concern requirements

A maximum of 25% of the gone concern

requirements can be met with instruments that

have a remaining maturity of between one and

two years

No MDA restrictions apply in Switzerland

36View entire presentation