Lulus IPO Presentation Deck

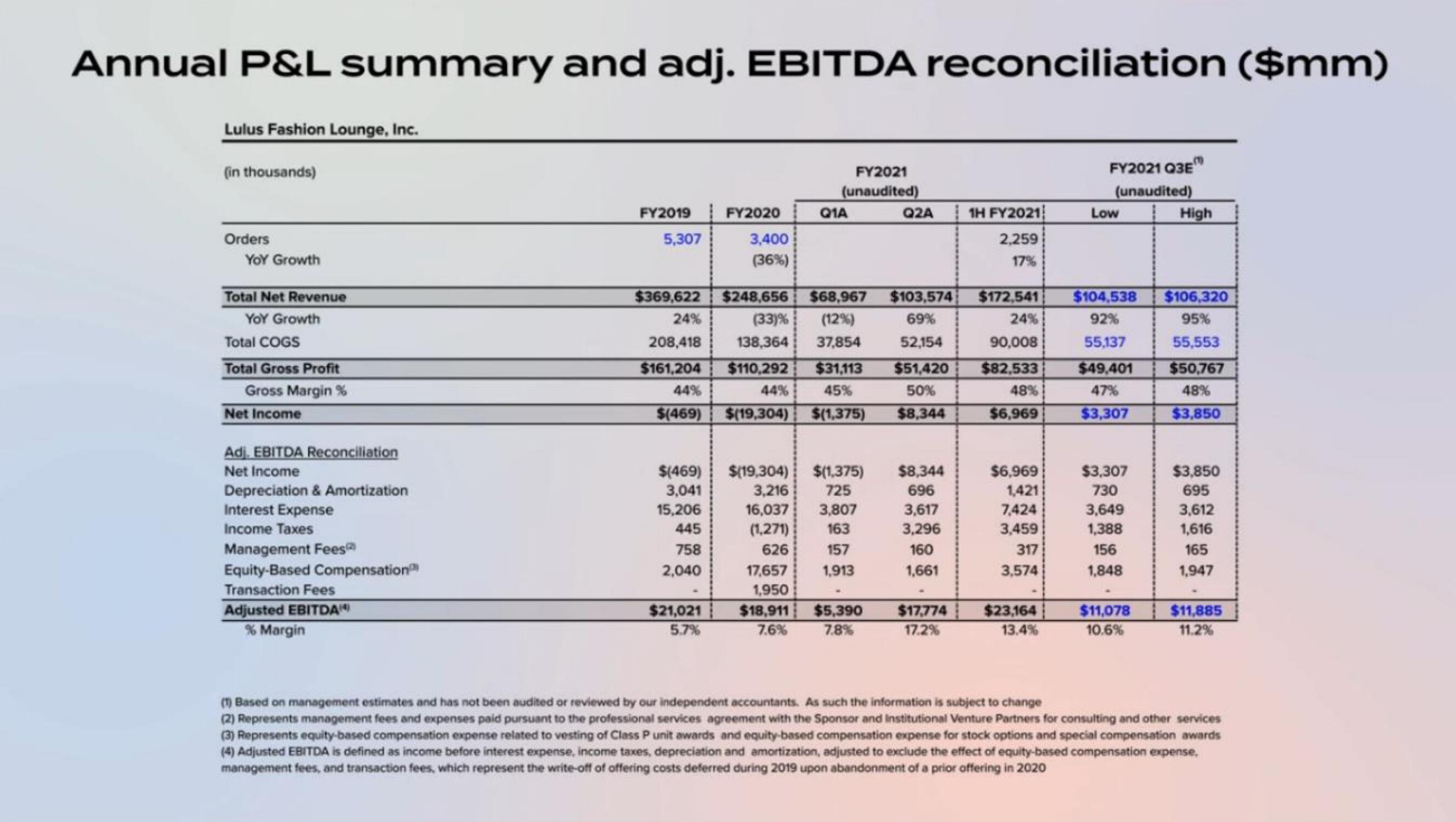

Annual P&L summary and adj. EBITDA reconciliation ($mm)

Lulus Fashion Lounge, Inc.

(in thousands)

Orders

YOY Growth

Total Net Revenue

YOY Growth

Total COGS

Total Gross Profit

Gross Margin%

Net Income

Adj. EBITDA Reconciliation

Net Income

Depreciation & Amortization

Interest Expense

Income Taxes

Management Fees

Equity-Based Compensation

Transaction Fees

Adjusted EBITDA(4)

% Margin

FY2019 FY2020

5,307

3,400

(36%)

$(469)

3,041

15,206

445

758

2,040

$21,021

5.7%

FY2021

(unaudited)

Q1A

$369,622

24%

208,418

$161,204

44%

$248,656 $68,967 $103,574 $172,541

(33) % (12%)

69%

24%

138,364 37,854 52,154

90,008

$110,292 $31,113 $51,420 $82,533

44% 45%

50%

48%

$(469) $(19,304) $(1,375) $8,344 $6,969

17,657

1,950

$18,911

7.6%

$(19,304) $(1,375)

3,216 725

16,037 3,807

(1,271) 163

157

626

1,913

Q2A

$5,390

7.8%

$8,344

696

3,617

3,296

160

1,661

1H FY2021

2,259

17%

$17,774

17.2%

$6,969

1,421

7,424

3,459

317

3,574

$23,164

13.4%

FY2021 Q3E

(unaudited)

Low

$104,538 $106,320

92%

55,137

$49,401

47%

$3,307

95%

55,553

$50,767

48%

$3,850

$3,307

730

3,649

1,388

156

1,848

High

$11,078

10.6%

$3,850

695

3,612

1,616

165

1,947

$11,885

11.2%

(1) Based on management estimates and has not been audited or reviewed by our independent accountants. As such the information is subject to change

(2) Represents management fees and expenses paid pursuant to the professional services agreement with the Sponsor and Institutional Venture Partners for consulting and other services

(3) Represents equity-based compensation expense related to vesting of Class P unit awards and equity-based compensation expense for stock options and special compensation awards

(4) Adjusted EBITDA is defined as income before interest expense, income taxes, depreciation and amortization, adjusted to exclude the effect of equity-based compensation expense,

management fees, and transaction fees, which represent the write-off of offering costs deferred during 2019 upon abandonment of a prior offering in 2020View entire presentation